Yin And Yang

The good beat the bad headlines today driving another rally up in risk with hope for a US/China trade deal continuing in the background and a tentative US political deal for funding the border security, thus keeping the government open. Avoiding trouble isn’t the same as doing good and that is the point of risk for today. Hope overlays against greed as positions remain moderate in a world still filled with fear. Here are some bad stories that stand out from the overnight:

- China warns on reduced consumption demand in 2019: “The medium- to long-term accumulated contradictions and risks throughout economic development are going to become more prominent in 2019,” Wang Bin, a commerce ministry official told reporters during a briefing. “The pressure facing the consumer market will increase and consumption growth is very likely to slow further.”

- North Korea may have made even more nuclear bombs. According to Standford University’s Center for International Security report, North Korea has continued to produce bomb fuel while in denuclearization talks with the United States and may have produced enough in the past year to add as many as seven nuclear weapons to its arsenal.

- China debt defaults rising. The debt guarantees for private companies are under scrutiny. “There is a severe imbalance between private companies’ contribution to the Chinese economy and the financing that they get. They account for 50 percent of taxes, 60 percent of GDP, 80 percent of urban jobs and 90 percent of new hires, but only receive 25 percent of loans disbursed,” Yang, a former Chinese banking regulatory official, told Reuters. “If private companies don’t have other sources of funds to repay their debts or collateral, they have to find guarantees, which will add 2 to 3 percentage points to their financing costs,” he said.

Later today we get the UK May Brexit talk update and noise with all its risk for GBP and EUR. Then we get the RBNZ decision, where most expect a similar dovish tilt from Governor Orr to keep up with RBA Lowe. But most of all, markets are paying attention to the CNY and USD today as they are the barometers to risk even if the correlation has faulty causality. The USD index isn’t collapsing even as equities hold bid. Perhaps that is a warning signal, or perhaps its just another noisy indicator lost in the turn of Yin and Yang news flow with the real story about CNY and EUR weakness.

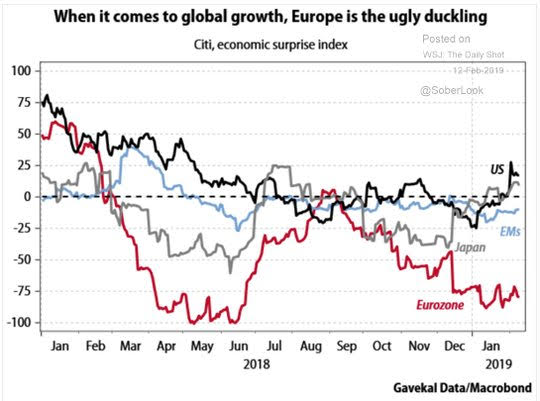

Question for the Day: Is Europe the problem for 2019? The hope for a US/China deal and the open expectations that Beijing will do whatever it takes to keep the economy stable puts the pressure on Europe. With little to no data from Europe today it’s a good time to consider the connections to the US and China. The speech from ECB Weidmann is worth considering given its clear warning that Europe is not crisis-proof. The drop in the EUR today below 1.13 opens up plenty of issues for both and it’s clear that growth shocks in Europe are behind much of the FX noise.

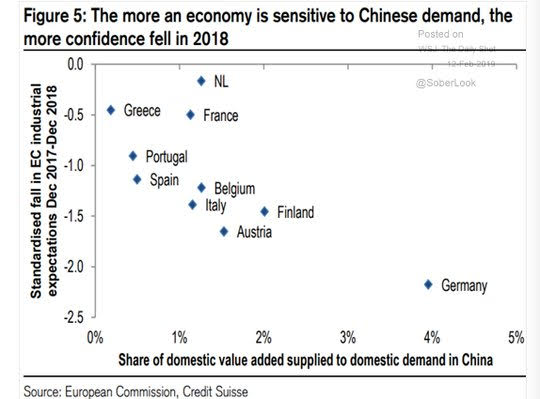

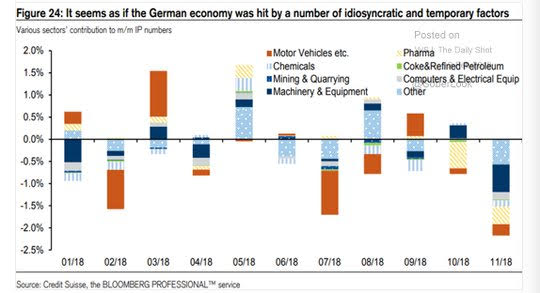

Consumption in China matters but it is not a broad-based issue for the EU – as the Credit Suisse chart shows. Rather, the pain trade for Europe is in Germany as it sees its trade to Asia dwindle and it’s hit with a set of temporary issues for growth for autos, oil, and computers. Blame US trade worries, Brexit and the Paris accord.

What Happened?

- Australia January NAB business confidence 4 from 3 – better than 3 expected. Conditions rebound to 7 from 3. Employment rose to 5 from 4 while profitability rose to 5 from 1. Orders rose to 2 from -1. Across sectors conditions improved but for retail.

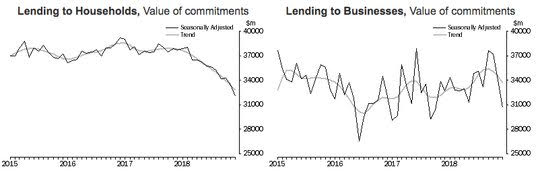

- Australia December home loans -6.1% m/m after-0.9% m/m - weaker than -2% m/m expected. Lending for investment housing fell 4.6%. Overall household lending fell 4.4% after a 2.4% m/m drop. n seasonally adjusted terms, the value of new lending commitments for owner occupier dwellings is down 16.2% from December 2017, and the value of new lending commitments for investment dwellings is down 27.8% from December 2017.

- Japan December tertiary industry index -0.3% m/m after -0.4% m/m – weaker than +0.4% m/m expected. By sector, restaurants and sports -1.2% m/m, wholesale trade -0.9% m/m, technical services -1.6% m/m, real estate -1% m/m, transport -0.5% m/m, leasing -0.3% m/m while electricity and gas rose 3.8% m/m, retail trade rose 0.9% m/m, finance rose 0.3% and health care rose 0.2% m/m.

Market Recap:

Equities: The S&P 500 futures are up 0.7% after a 0.07% gain yesterday. The Stoxx Europe 600 is up 0.65% with focus on autos, while the MSCI Asia Pacific index jump 1% with Japan returning to markets.

- Japan Nikkei up 2.61% to 20,864.21

- Korea Kospi up 0.45% to 2,190.47

- Hong Kong Hang Seng up 0.10% to 28.171.33

- China Shanghai Composite up 0.68% to 2,671.89

- Australia ASX up 0.33% to 6.148.70

- India NSE50 off 0.53% to 10,831.40

- UK FTSE so far up 0.3% to 7,150

- German DAX so far up 1.2% to 11,145

- French CAC40 so far up 1.15% to 5,071

- Italian FTSE so far up 1.00% to 19,782

Fixed Income: Risk on drives bonds off. The focus is on US debt and growth with CPI looming and Fed speeches. The EU open was all about periphery gains. German 10-year Bund yields up 1bps to 0.13% - with 0.15% key still. French OATS flat at 0.56%, UK Gilts flat at 1.19% while periphery rallies with Italy off 3bps to 2.86%, Portugal off 2bps to 1.65%, Spain off 1bps to 1.24% and Greece off 5pbs to 3.95%.

- Spain sold 6M Letras at -0.372%up from -0.428% previously and 12M Letras at -0.307% up from -0.333% previously.

- US Bonds lower across the curve with focus on Fed speakers, datawatch– 2Y up 2bps to 2.51%, 5Y up 3bps to 2.50%, 10Y up 3bps to 2.68%, 30Y up 4bps to 3.02%.

- Japan JGBs see curve steeper with BOJ focus, equities driving– 2Y up 1bps to -0.16%, 5Y up 1bps to -0.15%, 10Y up 2bps to -0.01%, 30Y up 3bps to 0.61%.

- Australian bonds see profit taking with focus on US/China talks, not weaker home lending– 3Y up 4bps to 1.68%, 10Y up 3bps to 2.13%.

- China bonds holding gains despite equities/US talks– 2Y up 1bps to 2.64%, 5Y flat at 2.87%, 10Y flat at 3.09%.

Foreign Exchange: The US dollar index off 0.05% to 97.01. In EM FX USD mostly lower– EMEA: RUB up 0.2% to 65.606, ZAR flat at 13.797, TRY up 0.3% to 5.26; ASIA: INR 70.709 up 0.6%, KRW up 0.3% to 1121.75.

- EUR: 1.1285 up 0.05%. Range 1.1258-1.1290 with focus on 1.1320 resistance and 1.1215 first target.

- JPY: 110.55 up 0.15%. Range 110.34-110.65 with EUR/JPY 124.70 up 0.2%. Rates matter and risk on driving with 110.20-40 base for 112 again.

- GBP: 1.2850 flat. Range 1.2833-1.2885 with EUR/GBP .8775 up 0.1%. Focus is on the Brexit May speech again. 1.28-1.30 keys.

- AUD: .7085 up 0.35%. Range .7054-.7088 with China and risk on mood driving with .7050 base intact. RBNZ key for NZD flat at .6730 with China tourism problem in background.

- CAD: 1.3265 off 0.3%. Range 1.3261-1.3315 with A$ leading and oil helping 1.3250 pivot for 1.3080 again.

- CHF: 1.0080 up 0.45%. Range 1.0036-1.0091 with EUR/CHF 1.1375 up 0.5%. Risk-on, CHF off – 1.00 holding opens 1.02 test.

- CNY: 6.7720 up 0.3%. Range 6.768-6.7940. PBOC set fixe 6.7765 from 6.7495.

Commodities: Oil up, Gold up, Copper off 0.5% to $2.7720.

- Oil: $53.35 up 1.8%. Range $52.29-$53.45. All about growth hopes and US sanctions on Iran/Venezuela but US inventories still key. $52 base for $55 still in WTI while Brent up 2% to $62.72 with $62 base for $64.

- Gold: $1317 up 0.4%. Range $1310-$1317.50 with focus on $1305 holding for $1320 again – USD/rates/risk mood key. Silver up 0.75% to $15.81. Platinum up 0.6% to $791.60 and Palladium up 0.65% to $1365.70.

Conclusions: Is Iron the new Copper for markets? There has been little written about the 4 ½ year highs for Chinese iron ore prices touched last week. Today, prices fell 0.5%. But the correlation of iron to stocks maybe something to pay attention to going forward as the metal represents all that is connected to the old Chinese infrastructure spending games to support growth. Some of the gains in iron were Vale related and that also matters as the connection of LATAM to China growth maybe more important than that of Germany but just as overlooked.

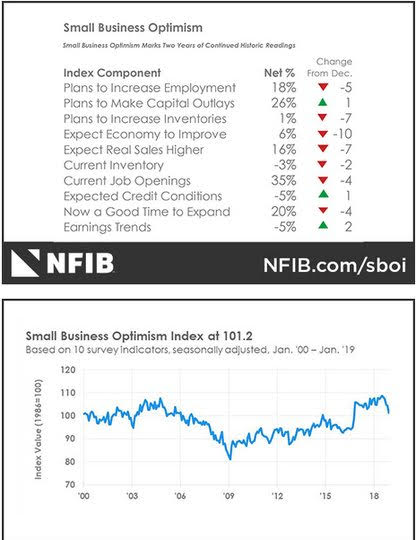

The US January NFIB small business optimism index fell to 101.2 from 104.4 – weaker than 103.2 expected– back to pre-election 2016 levels. “Business operations are still very strong, but small business owners’ expectations about the future are shaky,” said NFIB President and CEO Juanita D. Duggan.“One thing small businesses make clear to us is their dislike for uncertainty, and while they are continuing to create jobs and increase compensation at a frenetic pace, the political climate is affecting how they view the future.”

Economic Calendar:

- 1000 am US Dec JOLTS job openings 6.888m p 6.96m e

- 1245 pm FOMC Chair Powell speech

- 0430 pm US weekly API oil inventory 2.514mb p 1mb e

- 0530 pm Kansas City Fed George Speech

- 0630 pm Cleveland Fed Mester Speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.