Yields Rocked By Surprise Apple Bond Issuance

Last Friday, JPM's Nick Panigirtzoglou asked a question: just how illiquid is the Treasury market - still viewed by many as deepest, most liquid market on the planet - and whether the recent rollercoaster in bond yields was first and foremost a function of growing Treasury lack of liquidity (spoiler alert: a lot).

Fast forward to today when we got the latest stark example of this illiquidity, when in the unofficial launch to buyback season, shortly after the disappointing GDP report which sent yields sliding, Apple announced a four-part, back-end loaded debt issuance offering of paper due 2028, 2031, 2051, and 2061 which clearly took the bond market by surprise today, with the result a sharp re-steepening of the Treasury curve and 10Y yield spiking by 2bps to session highs.

Bloomberg confirms that this move was largely rate-locks (i.e., buyers hedging rate exposure) with payers at the back-end of the curve in the U.S. swaps market in London linked to the slog of corporate issuance.

How big is the offering? Therein lies the rub: according to Bloomberg's Alyce Anders, market chatter is that the Apple deal could be in the $6 billion to $8 billion range. In other words, as little as $8 billion in offsetting TSY hedging (i.e., shorting) can move the most liquid benchmark paper by 2bps. This is a striking collapse in liquidity in a market that clearly can barely absorb any volume without moving the entire market!

Some statistics: the last time Apple issued a benchmark deal was Feb. 1, 2021, with a $14 billion six-part offering, the technology behemoth’s largest bond offering since it brought $17 billion in 2013. The February order book peaked at $33.7 billion, 2.4 times the deal size.

In any case, with a TSY market this illiquid, and only set to get worse as traders hit the beach, beware any sudden reversals should the market be hit with any unexpected developments which see a sharp move in yields.

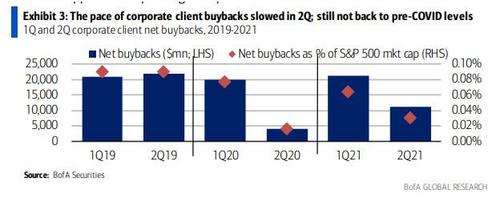

And speaking of buybacks which the proceeds from Apple's bond offering will most likely be used for, earlier this week BofA noted that while corporate client buybacks have picked up over the last three weeks amid the start of earnings season, buybacks this year still haven’t returned to ‘normal’ (preCOVID run-rate):

- Despite a strong start in 1Q21 (4Q20 earnings season) as many corporates reinitiated buybacks, the pace slowed last quarter in 2Q (1Q results season), with buybacks ~50% below 2Q19 levels and nearly 70% below those levels when normalized by S&P 500 market cap (cover chart). Companies doing the largest buyback programs have recently been outperforming, perhaps amid greater scarcity vs. the pre-COVID years when buybacks largely underperformed.

- Three sectors have dominated buyback activity this year: Tech, Financials, and Consumer Discretionary. But Discretionary is the only one of the 11 sectors where buybacks have eclipsed 2Q19 levels.

And now that Apple has given the all-clear, expect the next push higher in stocks to come not from retail investors but from companies themselves.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more