Yields In Recovery, S&P 500 Closes Above 2,800 And Nonfarm Payrolls Ahead

It's not often that you see a market aimed at crushing the options on Friday, but "manalamancha" was that fun to watch with the major indices rising sharply prior to the ISM manufacturing data being released.

The Institute for Supply Management said its survey of top manufacturing executives fell to 54.2% last month from 56.6% in January. Economists surveyed by MarketWatch had forecast the index to total 55.5%.

The index for new orders dropped 2.7 points to 55.5%, with production falling a steeper 5.7 points to 54.8%. Employment slipped 3.2 points to 52.3%, also the lowest in two years.

With the negatives out of the way, on a more positive note, the prices companies pay for raw materials and other supplies continued to drop in line with a gradual decline in inflation. What’s more, 16 of the 18 industries tracked by the ISM reported growth. There's actually another really important way of reviewing the latest ISM data, but that's for another day.

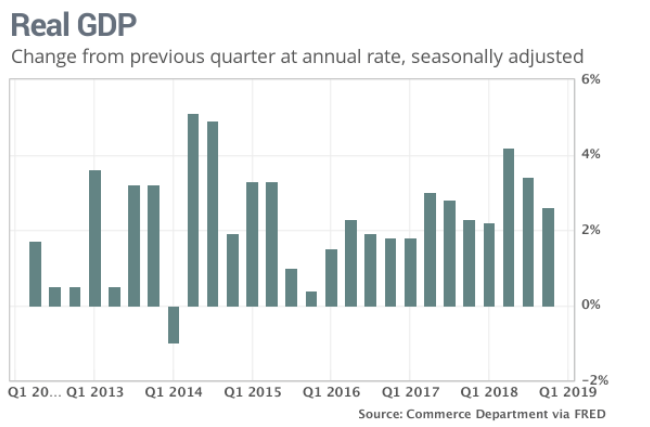

Probably the biggest data point released on Friday was the Q4 2018 GDP data that surprised to the upside. GDP rose 2.6% in Q4 2018 against the average estimate of 2%. Finom Group (for whom I am employed) would be of the opinion that this GDP print gets revised lower and possibly finishes with a 2.3% growth rate when it's all said and done in the next couple of months.

Consumer spending, the main engine of the economy, increased a healthy 2.8% in the fourth quarter. Americans spent more on new cars and trucks, health care and financial help, among other things. Businesses investment, meanwhile, was stronger than expected. Companies invested more in equipment and product research, offsetting another decline in spending on structures such as drilling rigs or office buildings.

In a big surprise, firms also increased the value inventories by $97.1 billion, even more than in the third quarter. Other reports had suggested inventories would shrink.

The rate of inflation tapered off in the 4th quarter of 2018. The PCE index rose at a 1.5% pace in the quarter, with the core rate that excludes food and energy up 1.7 percent. Inflation ran about 2% for the entire year, right at the Federal Reserve’s target.

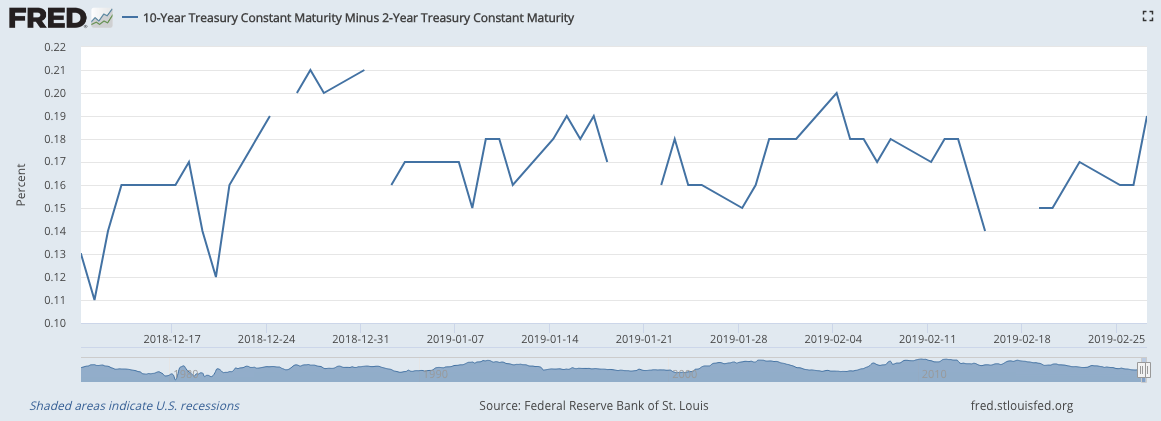

Speaking of inflation, well not really but in terms of the bond market and rising yields Friday also proved eventful. Friday found the spread between the 2-yr. Treasury yield and the 10-yr. Treasury yield above 20 bps for the first time in 2019 as depicted in the chart below.

With the latest GDP results for Q4 2018 out of the way it will prove time to focus on Q1 2019 GDP. The estimates are already widely distributed and they are looking rather unfavorable. Of course, next week's big data point will come from the monthly Nonfarm Payrolls report that also includes wage inflation data. This was the precise data point that served to plunge the market in February of 2018. So be aware and be prepared.

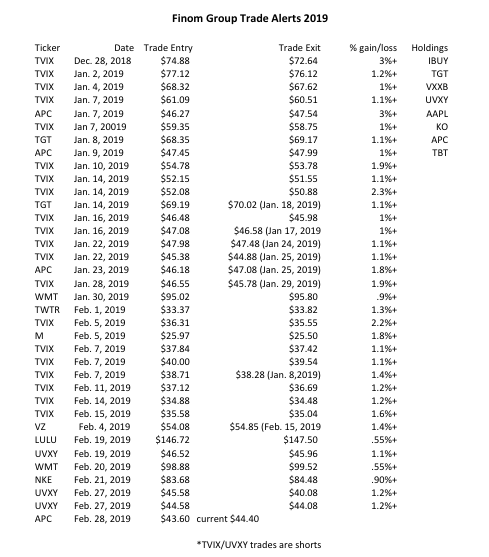

With all that being said and done, the S&P 500 managed to close the week positively once again and above 2,800 for the first time since October 2018. Finom Group rode the wave of volatility since the market sell-off in 2018 and through its rebound in 2019, issuing trade alerts along the way. In 2019, the table below denotes the YTD Trade Alerts for subscribers.

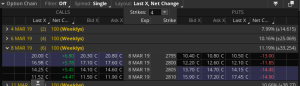

Looking ahead to the trading week, the S&P 500 weekly expected move has bumped up a little bit when compared to the previous week. The weekly expected move is now $33/points.

Last week and for the last several weeks, the S&P 500 has managed to finish the trading week within the weekly expected move. As volatility has been extrapolated from the markets in 2019, option pricing has become more efficient.

The coming week will be highlighted with the concluding portion of earnings season, also featuring quarterly reports from the likes of Target (TGT) and C.