Yield Curve Inversion Puts Bull Markets At Risk

THE TRENDING FED

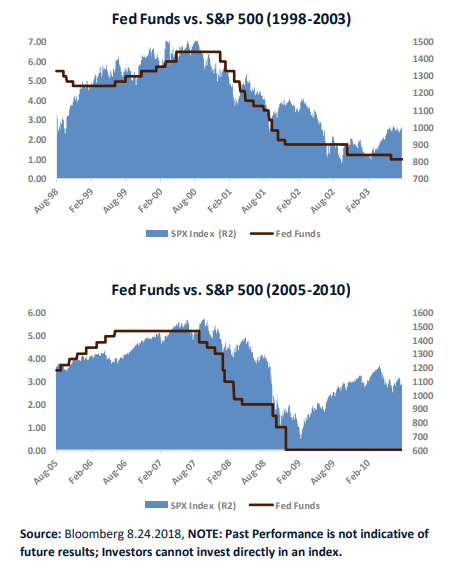

Back in August of 2018, we wrote a perspective piece entitled “The Trending Fed.” We concluded that “trending markets and economies are not held hostage to time limits. Picking tops and recession forecasting is often a recipe for failure. However, the first rate cut by the Fed will likely NOT be the last, and it has historically indicated that the trend in the economy and earnings has changed. In this context, rate cuts by the Fed are NOT bullish for risk assets. I will continue to follow 2Y-3M steepness for signs that a trend change is imminent. If inversion is accompanied by weaker labor markets, my bullishness for the U.S. economy and risk assets will quickly wane. But right now, none of these signals are flashing red.” We included a few charts to illustrate.

DEFENSIVE POSTURING IS WARRANTED

The S&P 500 is within 5% of its all-time high. The Fed has tabled its rate-hikes for 2019 and it is their intent to remove Quantitative Tightening (QT) by the Fall. The “all clear” button has been pushed, has it not? Not so fast. As much as the equity markets salivate over a dovish Fed, history has shown that easy monetary policy often follows deteriorating fundamentals, and that a couple of rate-cuts do little for asset prices as earnings expectations catch down to reality. Not to mention, a change in earnings trend is almost always accompanied with multiple compression as margin calls and fear generally cause markets to overshoot fair value.

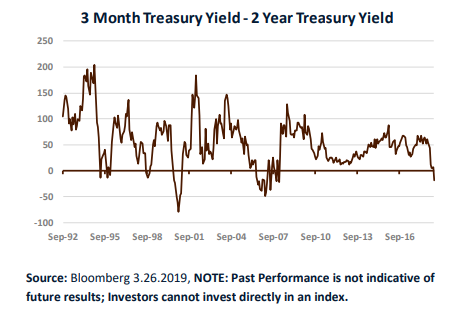

What has changed since August? Well, remember the 3 month – 2 Year portion of the yield curve I mentioned? It’s inverted. We place great importance on this indicator. It represents the difference between current Fed policy and where the bond market projects Fed policy to be over the next couple of years. An inversion signifies that the current hiking cycle is likely over, and that we may be entering an easing regime. I advise those waiting for a 2-10 inversion to be wary. Central Banks have distorted the term premia associated with longer-term bonds, and as a result, this portion of the curve may NOT invert prior to the next recession. Sure, it very well could, but remember, Japan has experienced multiple recessions without 2-10 inversion.

Could the current 3 month – 2-year inversion be a head fake? Could it just be a pause before the Fed resumes hiking into a robust economic environment? This is possible. Anything is possible. However, we are opting to take a defensive posture in the portfolio by shortening the average maturity, upgrading credit quality, and minimizing high yield exposure. For us, yield curve inversion is the most pernicious indicator for risk assets that we have seen during this pro-longed expansion. Now is the time to be defensive.

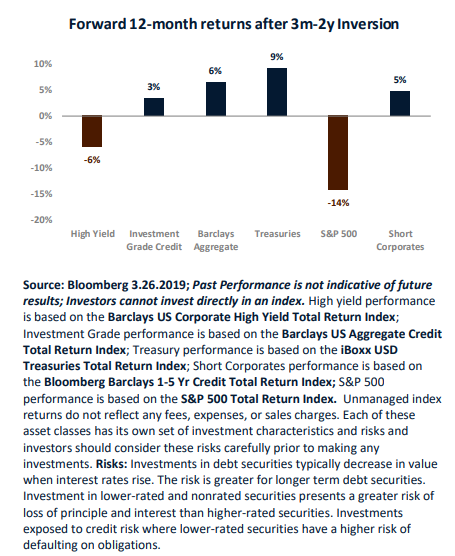

The last few inversions on the front-end of the yield curve have resulted in bifurcated return profiles among different asset classes, as can be seen in the chart below.

Equities and High Yield have typically performed poorly after a front-end inversion. Treasuries and short-duration investment grade credit have outperformed. During the last two recessions, extending duration in treasuries was a profitable strategy. However, we are skeptical that longer-term bonds can replicate such performance. Not only is supply an issue (Federal deficits will continue to grow) but overseas demand for U.S. debt has waned in recent years. We think that during the next easing cycle, negative term premiums, resilient inflation, low foreign demand, and less coupon (prior to the last two recessions 30-year yields were above 6% and 5% respectively) make longer-term bonds a riskier proposition.

CONCLUSION

Ignore yield curve inversion at your own peril.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more