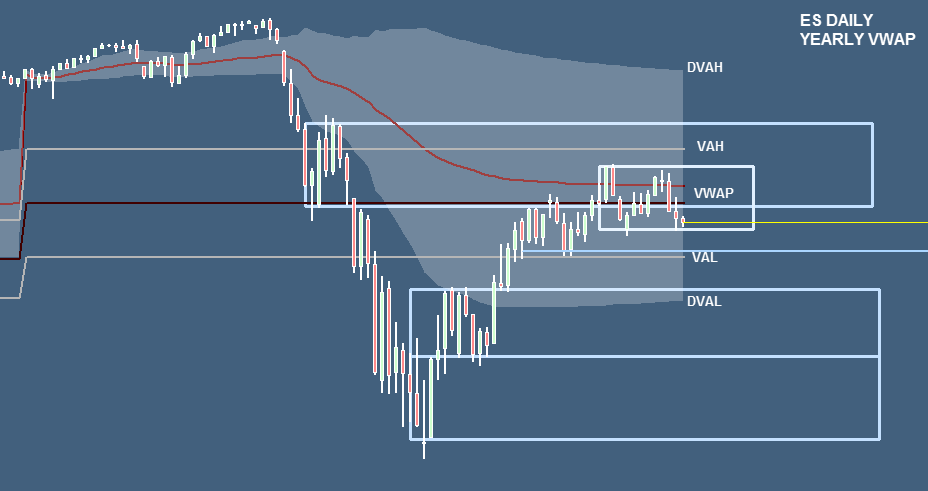

Yearly VWAP Update On E-Mini S&P 500 (SPX)

The E-mini S&P 500 Futures contract is quite rotational currently and trades inside of the Yearly VWAP value. To the detail, the market trades around the developing VWAP and the Previous Year's VWAP close level in a balanced behavior. Currently, we testing the bracket low for support and a break could lead us to the next bracket low which is confluent with the previous VAL close level. A dip into the swing low to find buyers is probable as well.

On the higher timeframe perspective, we can name the current bullish trend as a pullback to the developing VWAP which should react with resistance. A rotational and a retest of the DVAL is probable in this case. However, the market trades rotational inside of the Yearly value close area, therefore we can lean us on the value or balance extremes to conclude a trading scenario. Also to be noted is bearish to the flat slope of the developing value area - DVAH and DVAL area levels of interest for sure.

For now, the expectation is to find a supportive pattern around the current bracket low.

(Click on image to enlarge)

Visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint chart.

Disclosure: ...

more