Yahoo Is Screwing Its Shareholders

There are a variety of relatively easy fixes that could unlock tremendous value for Yahoo (YHOO) shareholders (e.g. cost cutting, focus, patience, and realigning the workforce), but the leadership team is so prideful and dysfunctional that they’re going to let “anyone-other-than-shareholders” (e.g. private equity, Verizon, or other) recognize these huge profit opportunities.

Background:

Many articles have been written about the perceived “negative value” of Yahoo’s core business (for example, here and here). If you’re not aware, Yahoo owns large stakes (16.3% and 35%, respectively) in publicly traded companies Alibaba (BABA) and Yahoo Japan with market values of approximately $32.6B and $9.1B, respectfully. And since Yahoo’s current market cap is only $36.4B billion (less than $32.6B + $9.1B) many observers use algebra to conclude Yahoo’s core business is worth less than $0. It’s more complicated when you factor in the potential large tax liabilities related to selling Alibaba (Yahoo’s most recent 10Q records a $12.3B deferred tax liability related to Alibaba, more on this later), but regardless, the market is giving Yahoo very little credit for its core business. For reference, Yahoo’s core business includes things like Yahoo Finance, Yahoo Sports, Internet search, communication and digital content.

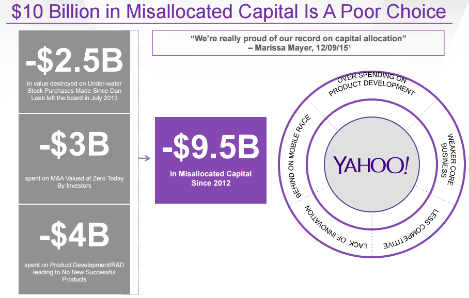

Yahoo has made a lot of mistakes in recent years. For example, the following graphic provides a high level breakdown of roughly $10 billion in “misallocated capital” (destroyed value) since Marissa Mayer took over as CEO in July of 2012.

(source: SpringOwl Investor Presentation, p.36)

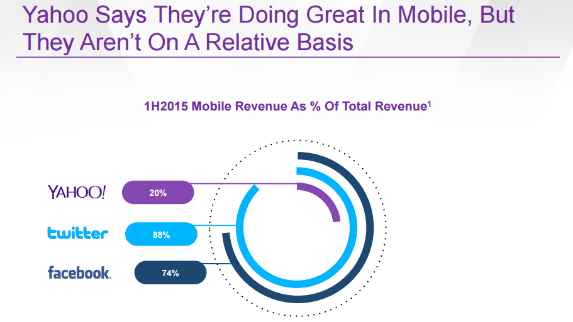

Specifically, Yahoo has tried to invent or acquire new opportunities (unsuccessfully) instead of focusing on the aspects of its core business that already work (more on this later). For example, Yahoo paid over $1 billion for tumblr in 2013 and its value today is arguably closer to zero. And more recently, Yahoo worked hard (and spent heavily) to launch Livetext in 2015 (which was supposed to be a Snapchat and Instagram killer) but it has not lived up to expectations and it’s an example of a failed product development cost (i.e. “misallocated capital”). Additionally, Yahoo has failed to transition to mobile from desktop as shown in the following graphics.

Overall, Yahoo has been swinging for the fences and spending heavily in search of the next big thing instead of working to unlock and maximize the tremendous value opportunities they already have.

Relatively Easy Fixes:

There are a variety of relatively easy fixes that Yahoo can make to dramatically increase value for its shareholders. For example, Yahoo needs to increase its focus. As described previously, Yahoo has wasted billions of dollars in the last several years on “Hail Mary” product development and expensive acquisitions instead of focusing on the aspects of its core business that already can be profitable (i.e. Yahoo needs to milk its core businesses for as long as it can). Had Yahoo simply focused on what already works over the last several years then shareholders would have an extra $10 billion in their pockets (and potentially more because the share repurchases would have been accretive).

Worth noting, Yahoo has been feeling the pressure to increase focus considering this February press release titled “Yahoo To Improve Profitability and Accelerated Growth By Sharpening Focus.” However, they’re not doing nearly enough in our view as the workforce is still bloated and there are many big unnecessary costs that can be cut.

Cost cutting is one of the main easy fixes that Yahoo can make to help maximize shareholder value. For example, Yahoo spent $1.2 billion on research and development in 2015 and they have very little to show for it. And in a related point, Yahoo is overstaffed. The February press release mentioned above describes Yahoo’s plan “reduce our workforce by roughly 15 percent” but that doesn’t go nearly far enough in our view. Yahoo should be focusing on the workforce required to support its most basic core businesses instead of chasing “pie in the sky” opportunities. Yahoo is not the tiny, high-growth, startup company it once was.

Other big cost cutting opportunities for Yahoo include selling unnecessary real estate and cutting unnecessary extravagancies. With regards to real estate, Yahoo could arguably realize $1.8 billion in incremental shareholder value simply by disposing of unnecessary real estate in Sunnyvale California. Specifically, they could sell this very high value real estate (that they currently own outright) and lease back only what they need. Other unnecessary extravagancies include the $100+ million Yahoo spends annually on free meals for its employees, and expensive parties such as the $7 million they spent on a Great Gatsby themed party in December (Investor Presentation,p.85).

Another relatively easy fix, is patience with regards to Alibaba and Yahoo Japan. Yahoo’s management may be able to unlock significant value if they are patient to find a way to sell their Alibaba stake in a tax-efficient (or tax-free) manner. Yahoo has worked on this effort in the past, but seems to have thrown in the towel, and now they want to throw the baby out with the bathwater by breaking up the company and potentially never allowing shareholders to fully recognize the possibility of a tax-efficient transactions. Similarly, Yahoo can work with SoftBank in Japan, the majority owner of Yahoo Japan, to structure a sale of their Yahoo Japan stake in a way to maximize value. If Softbank believes Yahoo Japan is undervalued (which they probably do considering they own such a big stake) then it would be accretive to them to reduce the shares outstanding by buying out Yahoo’s position. Both of these opportunities (Alibaba and Yahoo Japan) require more patience by Yahoo’s leadership.

Valuation Metrics:

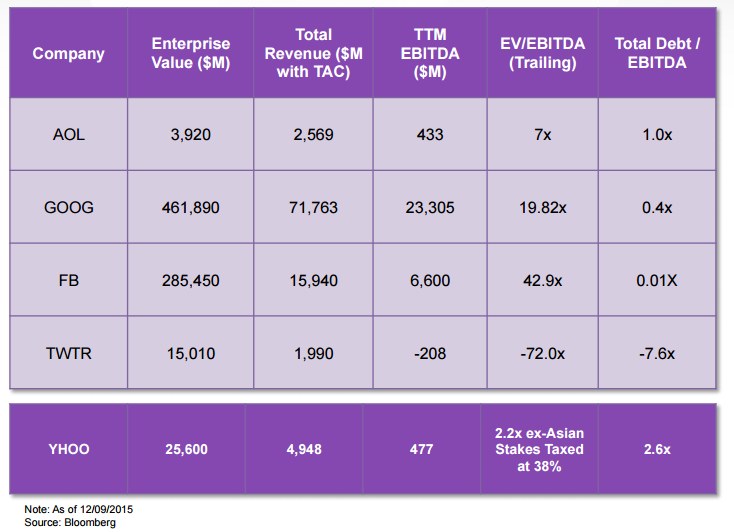

As mentioned previously, the market is giving Yahoo’s core business very little credit after you subtract out the market value of Alibaba and Yahoo Japan. As another example, the following table shows Yahoo’s EV/EBITDA ratio (excluding Alibaba and Yahoo Japan) relative to peers near the end of last year. 1m 2vh7h44

The result (Yahoo’s 2.2 EV/EBITDA ratio) is both ugly and attractive. It’s ugly because it’s so low meaning the company is not being giving much credit for its earning power. But it’s attractive because it suggests there are huge value creation opportunities if Yahoo were to execute on the relatively easy fixes we have described previously.

Another way to think about Yahoo’s value is simply if they cut $2 billion per year (by reducing R&D and reducing headcount) then that’s $2 billion per year in incremental shareholder value. Additionally, if they raise $1.8 billion by selling real estate and another $1 billion selling patents then that’s another $2.8 billion in value for shareholders. The good news is that someone (whether it be a private equity firm or perhaps Verizon (VZ) or AT&T (T)) is going takeover Yahoo, execute the “easy fixes,” and extract these enormous value and profit opportunities. The bad news is that current shareholders will likely miss out on the lion’s share of these profits.

Who Will Fix Yahoo?

Activist investor, Starboard, has expressed much interest in turning around Yahoo, and they’ve recently been successful in obtaining more seats on Yahoo’s board. Relatively speaking, this is a little bit good for shareholders because Starboard is working to sell off Yahoo’s core business at a premium to its current market value. The bad news is that Yahoo is very undervalued right now, and Starboard will be essentially transferring enormous value and wealth away from Yahoo’s shareholders and instead to whoever buys it (because they buyer will ultimately complete the “easy fixes” that Yahoo hasn’t). Starboard seems to not have the patience to maximize Yahoo’s long-term value, and instead just wants a quick small profit.

If a private equity firm buys Yahoo (TPG, Bain Capital and Vista Equity partners have submitted bids) they’ll likely take it private, complete all the “easy fixes” that Yahoo hasn’t, and then recognize huge value in a few years by selling the reformed business at a very big profit. This is really good for them, but bad for shareholders.

Big dividend, widows-and-orphans stock, Verizon Communications, is viewed by many as the leading bidder for Yahoo’s core business. And in reality they are a near perfect match because they have great expertise in managing low cost operations and because they need Yahoo’s cash flow to support their big dividend payments. We’ve written about this before, but essentially Verizon is having a more difficult time covering their big dividend payments, and owning Yahoo’s core business would essentially help them solve this problem by providing lots of potential free cash flow. A Yahoo acquisition would be great for Verizon shareholders (albeit with new risks), but bad for Yahoo shareholders because Verizon would essentially be eating Yahoo’s cake.

In our view, the best solution for Yahoo is simply to replace the current leadership team with people experienced in operationally managing a value company. Yahoo’s current leadership team is living in the past by focusing on unrealistic growth opportunities. Yahoo has lost the search battle to Google, they continue to lose their top talent to the likes of Google, Facebook and Amazon, and they need to shift their focus away from growth and instead to maximizing shareholder value by executing on the “easy fixes” we’ve described previously. Unfortunately, Yahoo’s leadership team is so prideful (they refuse to admit they’re not an innovative high growth company anymore) and so dysfunctional (they can’t execute the easy fixes we’ve described previously) that they’re now willing to throw in the towel by selling the core business and allowing someone else to recognize the tremendous value and profits that rightly belong to current shareholders.

Risks:

Of course there are risks to Yahoo’s business and the easy fixes we’ve described above. For example, there is certainly no guarantee that Yahoo could ever find a tax-efficient way to deal with Alibaba. Also, there is no guarantee that Alibaba and Yahoo Japan will be successful in the future, and they could end up being enormous destroyers of Yahoo’s market value. Additionally, the decline of Yahoo’s core business may accelerate, and there may be far less value extraction opportunities than we are estimating. Further, Yahoo may end up selling its core business for far more than the current bids of ~$5 billion (however, it seems unlikely they’ll ever reach a sale price as high as our perceived value of the company).

Conclusion:

Yahoo is screwing its shareholders. Specifically, management is so dysfunctional and stubbornly committed to growth instead of value that they’ll willing to transfer tremendous value creation opportunities by selling their core business instead of rolling up their sleeves and fixing it in-house. Considering the company’s current activities and market price, it appears management is convicted to selling near the lows. If you’ve been a long-term shareholder, it is understandable that you’d be frustrated. At this point, it seems the best you can hope for is a slightly higher bid from would-be buyers. Because for management to swallow their pride and start acting in shareholders’ best interest would require a small miracle.

Disclosure: None.