Xerox: More Outperformance In 2015

A) Introduction

Xerox (NYSE:XRX) is one of the most shareholder friendly companies in the market, evidenced by management's goal to return $1.3 billion - just under 10% of market cap - to shareholders through share buybacks and dividends. As we'll discuss in this article, we agree with company management in that Xerox represents a great investment at these prices.

The report will start with a breakdown of Xerox's valuation profile, followed by an analysis of price & profit growth, and concluding with some qualitative analysis and conclusions. We take a quantitative approach to investing, preferring to focus our analysis on metrics that have strong predictive ability. Thus, we tend to analyze academic papers and perform historical back tests on different metrics before including them in our analysis. We will provide links to the academic papers we draw inspiration from as we progress through our breakdown of the stock so readers can see for themselves what we base our conclusions on.

B) Valuation Breakdown

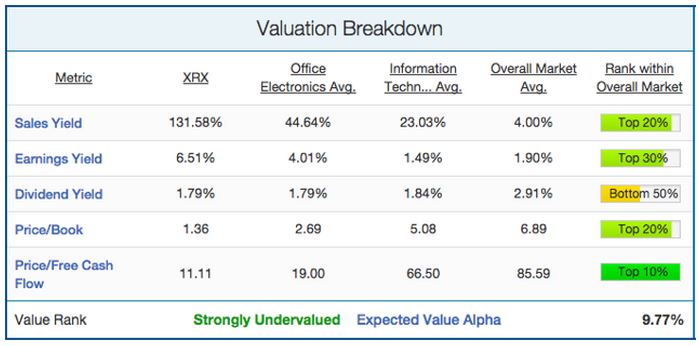

We'll start by analyzing Xerox's value profile. This is important to look at as "Value stocks (with low ratios of price to book value) have higher average returns than growth stocks (high price-to-book ratios)". Xerox's valuation profile is shown below:

On four of the five value metrics shown above, Xerox resides within the top 30% of the entire market. Xerox is unique in that its cash flow yield (Free cash flow/Price) of 9.2% (1/11.1) is actually higher than its earnings yield of 6.5%. This means the company actually generates more free cash flow than earnings. Free cash flow is a more indicative and practical measure of both operating performance and value, as it less easily manipulated than earnings. On a free cash flow basis, Xerox looks very undervalued compared to its peers with its price/free cash flow of 11.1 being much lower than the industry group (19), sector (67), and overall market (86) averages. While Xerox's dividend yield is below average at 1.8%, the company has announced $1 billion in share buybacks in 2015, leading to a relatively high "shareholder" yield. Xerox also sports an attractive sales yield (132%) and price/book (1.36) relative to the office electronics (45% & 2.69) and technology sector (23% & 5.08) averages. Overall, our model rates Xerox as "Strongly Undervalued" and we expect the stock to generate 9.77% of outperformance over the market in the next 12 months due to its relative undervaluation.

C) Growth Breakdown

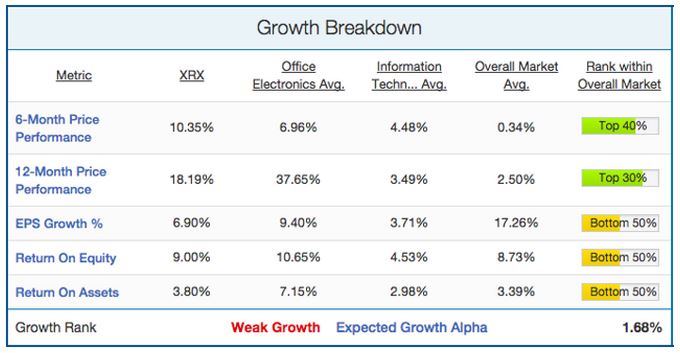

There are a variety of different growth metrics that have been shown to predict stock returns. Most important among them is price momentum. Winning stocks keep winning, and losing stocks tend to keep losing. Xerox's growth profile is shown below:

While Xerox inherently seems more of a value than momentum play, the stock's six-month price performance (+10.4%) is better than its industry group (+7%), sector (+4.5%), and overall market (+0.34%) averages. The stock outperformed over 2014, gaining 18.2% over the last twelve months versus 2.5% for the overall market average. As shown in the link to the academic paper above, on average, strong momentum leads to future strong momentum. Thus, we actually interpret Xerox's strong price performance as a good sign. Besides momentum, Xerox has had average profit growth (+7% annual EPS) and profit efficiency (9% ROE). Overall, our model rates Xerox as a "Weak Growth" company and expects them to outperform the market averages by 1.68% over the next twelve months due to their growth profile.

D) Qualitative Analysis & Conclusion

As always, we will finish our quantitative breakdown of Xerox with a qualitative discussion of potential growth catalysts and business risks. First off, Xerox's massive share buybacks have arguably the biggest driving force behind the stock's outperformance over the last 2 years. Share buybacks effectively increase the amount of ownership of each shareholder and drive the stock price upwards in the interim with increased demand for shares. Xerox is a cash flow machine, having generated almost $600 million last quarter alone (as per the earnings transcript). This has allowed Xerox to increase their share buybacks guidance from $700 million to $1 billion. As mentioned in the last quarter earnings call, Xerox management knows that their stock is undervalued and they intend to use their cash flow to capitalize. Xerox has maintained a significant share buyback program for a number of years, and we don't see this program ending anytime. Xerox has also made a successful shift from their low margin hardware business to the high margin business services segment (now 55% of revenues). This shift is expected to continue to 2017 when management expects 67% of revenue to be generated by the services segment.

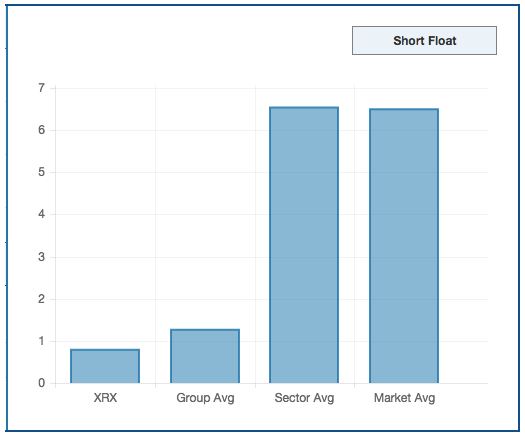

Before beginning with our conclusions, we'd also like to point the incredibly low level of short interest in Xerox's stock:

High short interest tends to be a precursor to lower future returns, as short sellers tend to be very sophisticated investors. The fact that short interest is so low is a good sign that shorts don't see much downside in the stock.

Overall, we feel Xerox combines a very attractive valuation with solid price momentum and an extremely shareholder friendly management team. Their significant and increasing share buyback plan and continued transition to higher margin service segments will continue to provide tailwinds to the stock price. We recommend Xerox as a "Strong Buy", and expect continued outperformance from the stock in 2015. Investors looking to learn more about our analytical style can do so here.

Disclosure: The author has no positions in any stocks mentioned. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. ...

more