Xactly Corporation: Huge IPO Lockup Expiration Merits Your Attention

Xactly Corporation (NYSE:XTLY) - Sell or Short Recommendation - $8.25 PT

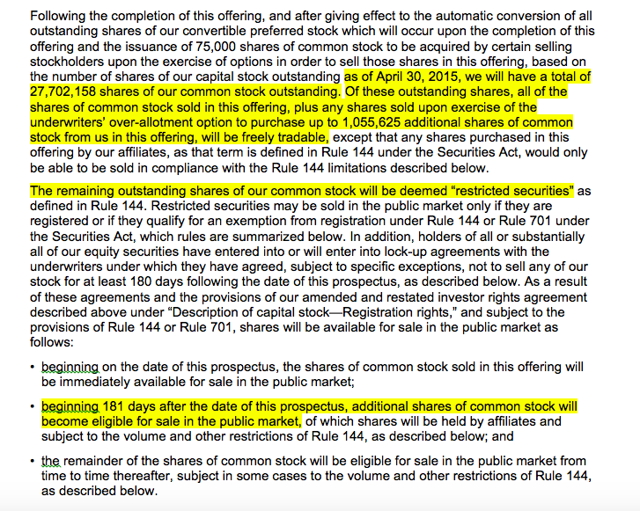

December 23, 2015 concludes the 180-day lockup period on Xactly Corporation. We previewed IPO lockup expiration events and opportunities on our IPO Insights platform.

When the lockup period ends for XTLY, its pre-IPO shareholders, directors and executives will have the chance to sell their ~20 million shares. (This was calculated by subtracting the 7 million shares initially offered from the total~27 million outstanding.)

(Click on image to enlarge)

(Source)

The potential for a sudden increase in stock available in the open market may cause a significant decrease in XTLY shares, opening a short opportunity.

Business Summary: Provider of Cloud-based Incentive Compensation Solutions

(Click on image to enlarge)

(Source)

Xactly Corporation offers cloud-based incentive compensation solutions for sales and employee performance management in the Unites States and the United Kingdom. Its product portfolio includes Xactly Incent Enterprise, which manages critical elements of incentive compensation for mid-sized to large enterprise organizations; Xactly Objectives, which offers solutions for sales and non-sales employees and managers to track and achieve objectives through collaboration; and Xactly Incent Express, which offers incentive compensation solutions for smaller companies with fewer than 350 employees.

In addition, the company offers Xactly Insights, which uses aggregated and anonymous data to help motivate employees and improve performance; and Xactly Incent Enterprise, which offers analytics, automated workflows and approvals, modeling and credit assignment.

The company markets its products through a direct sales force that focuses on high-tech manufacturing, media and Internet, life sciences, communications, business and financial services, and Software-as-a-Service and conventional software.

Through January 2015, Xactly had approximately 194,000 subscribers versus 140,000 subscribers a year prior for an increase of 39 percent.

Corporations that use Xactly software include DHL, Hyatt (NYSE:H), DocuSign, Rosetta Stone, Service Max, Cascade, Rackspace, Honeywell (NYSE:HON), American Express Travel (NYSE:AXP), and LinkedIn (NYSE:LNKD).

Financial Highlights: Q3 2015

For the third quarter ended October 31, Xactly reported the following financial highlights:

- Total revenue increased 27% from the same period last year to $19.1 million.

- Breaking this down: Subscription revenue increased 25% from the same period last year to $15.2 million.

- At the same time, GAAP net loss was ($10.4) million versus a loss of ($4.8) million in Q3 FY2015.

Xactly insiders could still be ready to take initial profits, following growth.

Competition: Cognos, Oracle and Callidus

Xactly competes primarily with other companies that offer similar incentive compensation and performance management software. In addition, they compete with internal systems and tools built to specification for existing infrastructure. Their direct competitors include Cognos, Oracle (NYSE:ORCL), and Callidus (NASDAQ:CALD).

Early Market Performance: Sitting Above IPO Price

Xactly Corporation priced its IPO at $8 per share, at the low end of its expected price range of $8 to $10. The stock opened on the first day of trading at $8 and closed at $8.70, for an increase of 9 percent. Since then the stock reached a low of $6.56 on July 28 and a high of $10.31 on October 20. Currently, the stock is priced at $9.14.

(Click on image to enlarge)

(Nasdaq.com)

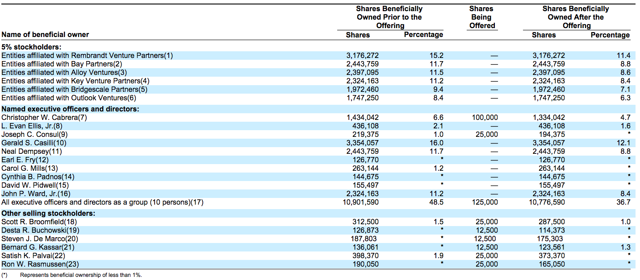

Conclusion: Sell XTLY Prior To Dec. 23rd

On December 23rd, six firms and 10+ individuals (see below) will be able to sell their previously restricted shares.

(Click on image to enlarge)

(Source)

As XTLY has performed well post-IPO, sitting well above its initial price, at least some may be ready to take profits, which could lead to a flood of new shares available for public sale, and a decrease in XTLY stock price.

We suggest selling or shorting XTLY ahead of the event on Dec. 23rd to take full advantage of potential declines, often further exacerbated by savvy investors selling ahead, as well.

Disclosure: None.