WTI Hits 4-Month Highs, Tops $58 After Surprise Crude Draw, Production Cut

Crude rose for a third day after API reported an unexpected drop in U.S. stockpiles just as planned cuts and disruptions to OPEC output are tightening supply.

While OPEC nations like Saudi Arabia press on with planned production curbs, crises in fellow members Venezuela and Iran are also removing barrels from the market.

Additionally, the EIA in its monthly Short-Term Energy Outlook trimmed American crude output this year to 12.3 million barrels a day -- 110,000 barrels lower than it had forecast previously.

API

-

Crude -2.58mm (+3.00mm exp)

-

Cushing -1.06mm

-

Gasoline -5.85mm

-

Distillates +195k

DOE

-

Crude -3.86mm (+3.00mm exp)

-

Cushing -672k

-

Gasoline -4.62mm

-

Distillates+383k

DOE confirmed API's surprise crude draw (-3.86mm vs +3.00mm exp) and gasoline stocks tumbled further...

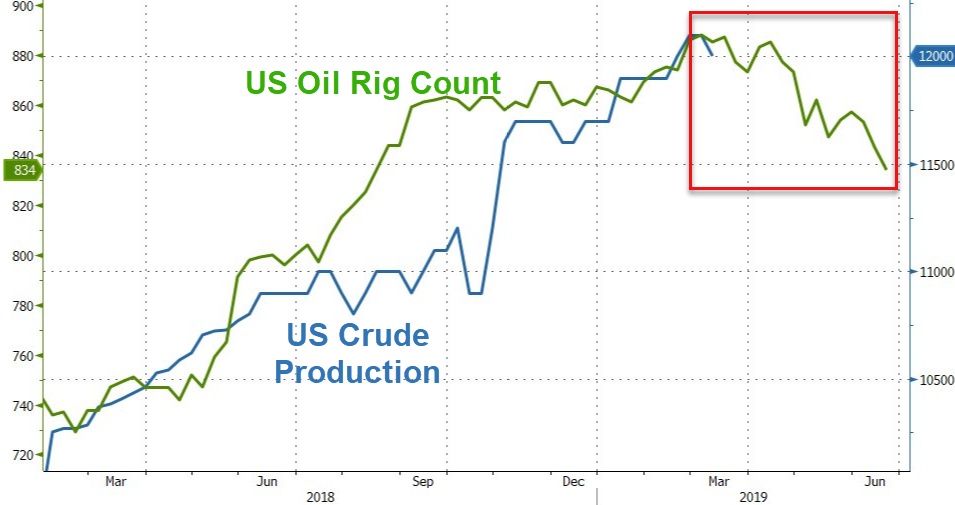

Even more notable, US crude production dropped in the last week, tracking the lagged oil rig count...

WTI surge up to the 2/28 highs - testing towards $58 ahead of the DOE data.

Oil has rallied more than 25 percent this year as the Organization of Petroleum Exporting Countries and its partners show their commitment to restrain production even in the face of criticism by American President Donald Trump. Adding to the market’s upbeat tone, the U.S. government lowered its output forecast for the first time in six months on the back of slowing American drilling activity.

“On the bullish side we have a rapidly deteriorating situation in Venezuela,” said Bjarne Schieldrop, Oslo-based chief commodities analyst at SEB AB. “Further on the bull side, OPEC+ continues to deliver on pledged cuts.”

And on the surprise crude draw, WTI pushed up through $58

Back to 4-month highs...