WTI Extends Losses As EIA Confirms Major Crude Build

WTI extended losses overnight after API reported a massive increase in U.S. crude stockpiles, raising oversupply concerns. Piling on the downside risk, OECD cut its outlook for global economic growth again amid trade tensions and political uncertainty.

“The message is clear: the U.S. remains well-supplied and will continue to do so as oil production inches further into record territory,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

API

- Crude +7.29mm (+1.45mm exp)

- Cushing +1.1mm (+1.63mm exp)

- Gasoline -391k

- Distillates -3.1mm

DOE

- Crude +7.07mm (+1.45mm exp)

- Cushing +873k (+1.63mm exp)

- Gasoline -4.23mm

- Distillates -2.393mm

Confirming API's surprise, DOE reported a much bigger than expected crude build of 7.07mm barrels (+1.45mm exp) but sizable draws on gasoline and distillate stocks offset some pessimism.

(Click on image to enlarge)

Bloomberg Intelligence's Energy Analyst Fernando Valle noted that last week's draws helped ease oversupply worries, but gasoline remains a worry in the short term. A recovery in exports could ease concerns, but with Mexico still struggling with transport disruptions, there is limited scope. We are still constructive on diesel, with domestic demand showing no signs of a slowdown.

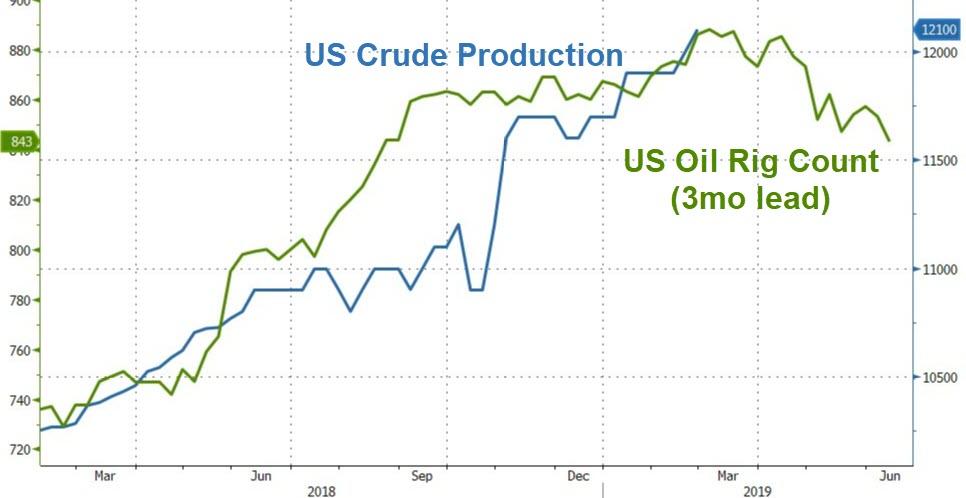

US Crude production looks set to slow if the lagged reaction function of oil rig counts upholds its historical relationship...

(Click on image to enlarge)

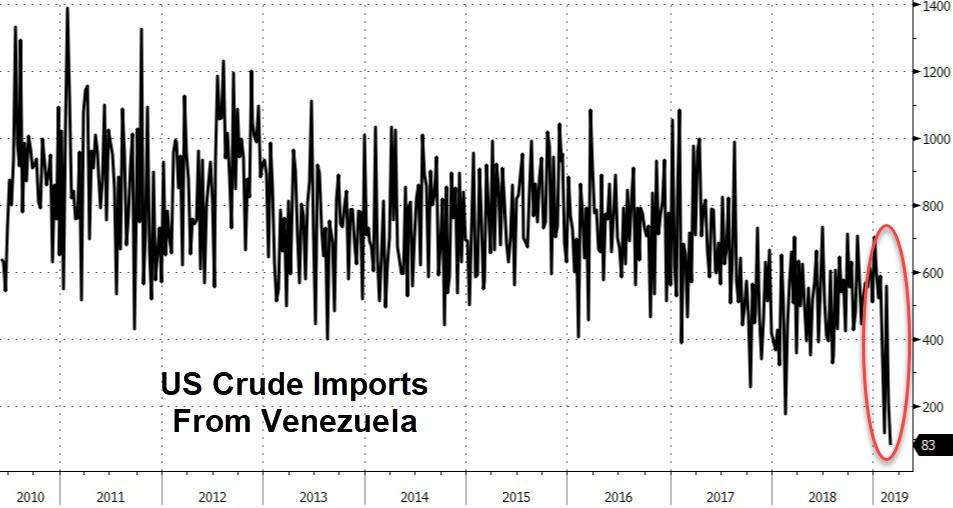

Bloomberg's Sheela Tobben notes that U.S. sanctions on Venezuela continue to take a toll on the country's crude flows to the U.S. Shipments fell to just 83k b/d last week, smallest in data going back to 2010.

(Click on image to enlarge)

WTI was well down from pre-API levels overnight ahead of the official DOE data. After an initial pop - presumably on the product draws - crude prices extended losses...

(Click on image to enlarge)

“The U.S.-China trade talks are a complicated process,” said Michael McCarthy, chief market strategist at CMC Markets in Sydney. “I think it might be dawning on oil traders that a comprehensive agreement might be weeks or even months away, rather than the days they might have been looking at.”