With Fed Assets And US Stocks In Lockstep, Yellen Suggests Fed Behind The Curve

Treasury Secretary Janet Yellen pretty much implied on Tuesday that the Fed is behind the curve, although she tried to walk back her comments later. The economy may be “overheating”, but the Fed is not ready to dial back its ultra-accommodative policy.

“It may be that interest rates will have to rise somewhat to make sure that our economy doesn’t overheat.”

The above statement from Treasury Secretary Janet Yellen created a stir on Tuesday. The knee-jerk reaction in the markets was to shoot first and ask questions later. Stocks sold off in that session. The S&P 500 large cap index closed down 0.7 percent and was down 1.5 percent at the session lows. The Nasdaq 100 took it on the chin, down 1.8 percent and was down as much as 2.9 percent.

The prevailing perception is that tech will suffer in a rising rate environment.

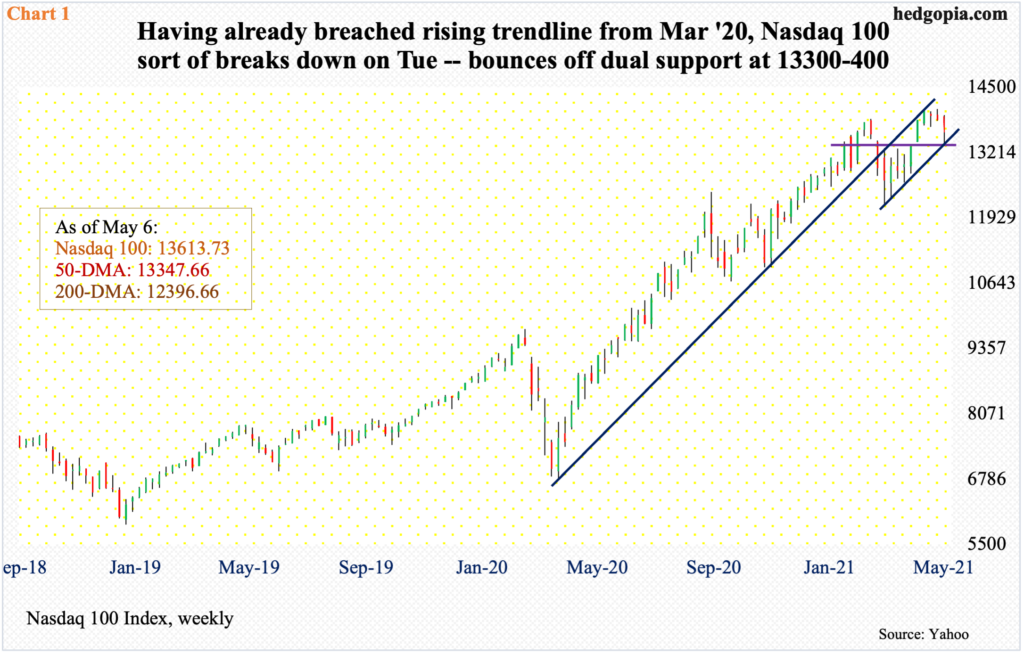

The Nasdaq 100 already breached its rising trend line from the low of March last year, with the underside of that trend line resisting rally attempts. On Tuesday, it gapped lower, with the session low of 13396.11 finding support at a confluence of four-month horizontal support and two-month rising trend line (Chart 1). Plus, the 50-day moving average is at 13348. A decisive breach of this level can expose the index (13613.73) to a drop to 12200s-12400s.

Stocks already struggled to rally on good news last week. Earnings results from five of the top six US companies – Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), alphabet owner Google (GOOG) and Facebook (FB) were very good, with some hitting it out of the park; Tesla (TSLA) slightly missed (more on this here). The FOMC also met last week, and Chair Jerome Powell promised continuation of the firehose of liquidity. And the first print of 1Q21 GDP showed the economy shot up at an annual rate of 6.4 percent.

Later that day, Yellen, speaking at a different event, tried to walk back her comments, saying any price increases would be transitory. But the genie was out of the bottle.

Her comments were of interest not the least because she currently serves as treasury secretary. The US is in debt up to the gills, with national debt north of $28 trillion. Last year alone, this went up by $4.5 trillion.

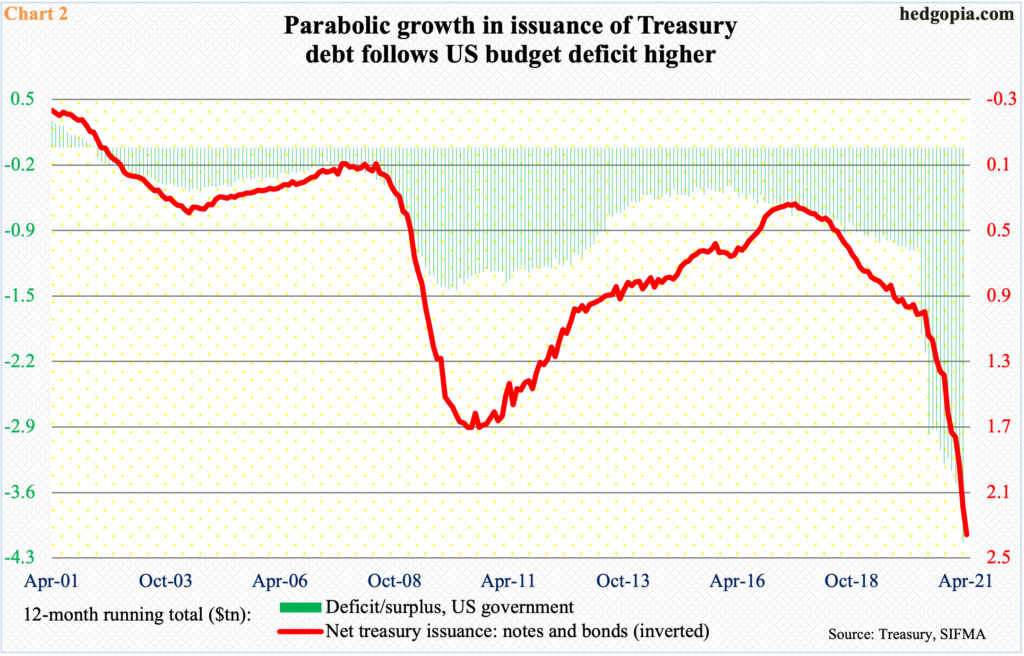

The budget deficit is through the roof, with $4.1 trillion in red ink in the 12 months to March. Treasury issuance has followed. In the 12 months to April, $2.4 trillion was issued in treasury notes and bonds. In March last year, they were just a tad above $1 trillion each (Chart 2).

Low interest rates will obviously help a debtor. So for her to make those comments, (1) it is almost as if she expects rates to rise sooner than the consensus and (2) she is probably channeling Yellen as a central banker; she preceded Chair Powell.

The problem is, too much of this kind of language will be labeled interference – even an attempt to jawbone. To quote Yellen herself: “If anybody appreciates the independence of the Fed, I think that person is me.”

So why bother make the statement on Tuesday?

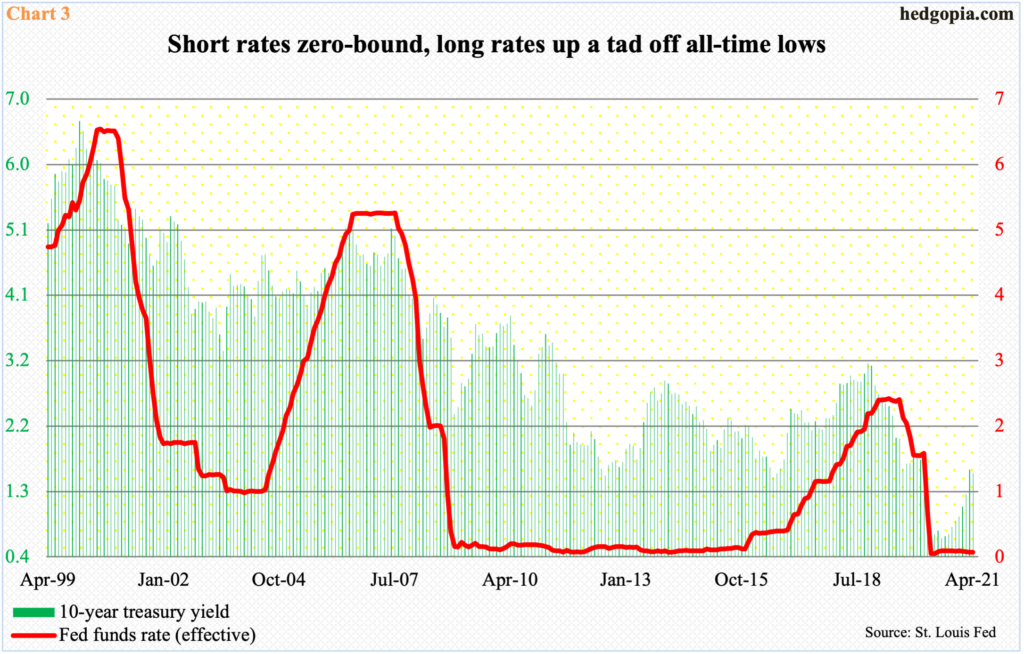

The next sustained move in interest rates is up. No ifs and buts about it. The benchmark fed funds rate is already zero-bound. In last week’s FOMC meeting, rates were left unchanged at a range of zero to 25 basis points. As was monthly purchases of at least $80 billion of treasury notes and bonds and $40 billion of mortgage-backed securities.

In the March meeting, a majority of FOMC members expected a hike in 2024. This is what is at the crux of the matter.

The long end of the treasury yield curve is on the move. The 10-year yield (1.56 percent) broke out of one percent in early June, and by March 30 ticked 1.77 percent. It straddled the 50-day for two weeks before losing it on Wednesday.

But the short end is yet to make a move. Two-year treasury notes are currently yielding 15 to 16 basis points. On Tuesday, the day Yellen spoke, two-year yields were unchanged at 0.16 percent.

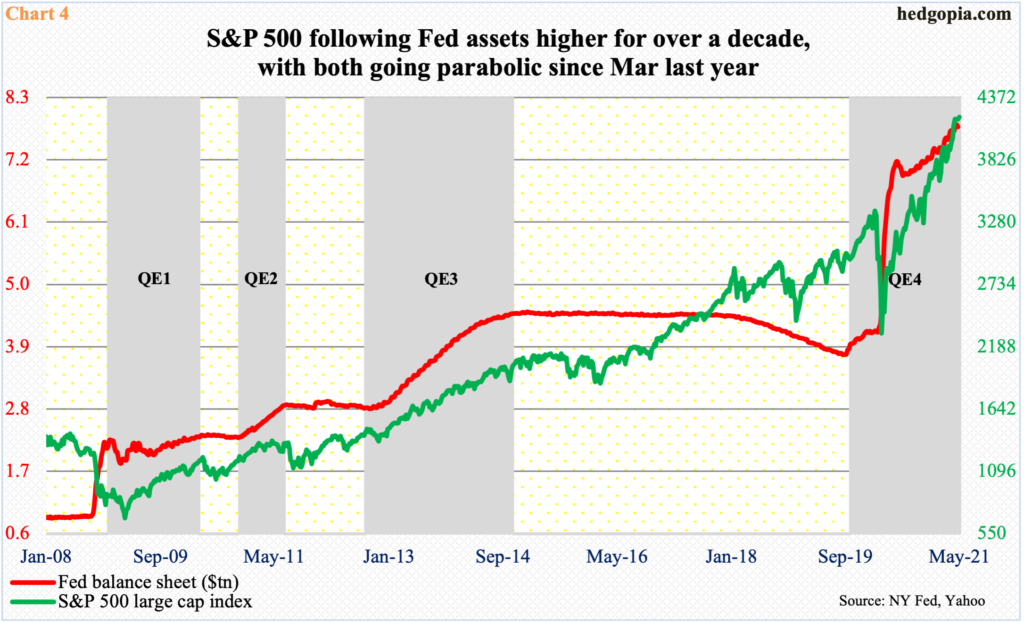

This is important. Two-year yields tend to be the most sensitive to interest rate policy. This is markets’ way of letting the Fed know what they think where things are headed. So far so good. This gives the Fed leeway to continue with its current accommodative policy. Its assets already total $7.8 trillion, up from $4.2 trillion in early March last year. The S&P 500 could not be happier (Chart 4).

As things stand, the Fed is determined to maintain the status quo. The question is, is it painting itself into a corner? Yellen may be saying yes to that.

The issue at hand is if the incipient inflation will prove to be transitory or persistent. If she is right, she is now able to say I told you so. Just the way Alan Greenspan, who preceded Ben Bernanke and Yellen as Fed chair, can say I did warn about the dot-com bubble. In a December 1996 speech, Greenspan talked about escalating asset values, using the phrase “irrational exuberance”, although he was early. The bubble just got bigger and bigger and would not pop until another three years.

Bulls bought Tuesday’s drop on the S&P 500, which, thanks to Thursday’s 0.8 percent rally, is now itching to break out. The Nasdaq 100 is yet to fill Tuesday’s gap, but that session’s low was defended on Thursday just above the 50-day.