Winners And Losers During Trump's Presidency

With Election Day upon us, below we take a look at the biggest winners and losers across financial markets during the Trump Presidency from Election Day 2016 through today. First off, below is a chart of the market cap of the Russell 3,000 since Election Day 2000 which George W. Bush eventually won. The Russell 3,000 makes up more than 98% of the total US equity market cap, so it's a good gauge to use for measuring the overall change in market cap levels. The current market cap of the Russell 1000 is just north of $35 trillion, which is up $11.5 trillion since Election Day 2016. President Obama oversaw US market cap growth of $12.3 trillion over his two terms, while President Bush actually saw market cap decline by $4.1 trillion after his two terms.

Below is a look at the total return of various asset classes since Election Day 2016 using key ETFs listed on US exchanges. The S&P 500 (SPY) is up 70.6% since Trump was elected, while the Nasdaq 100 (QQQ) more than doubled that at +144.3%. Of the broad index ETFs in the matrix, the Smallcap Value ETF (IJS) is up the least since Election Day 2016 at just +17.2%.

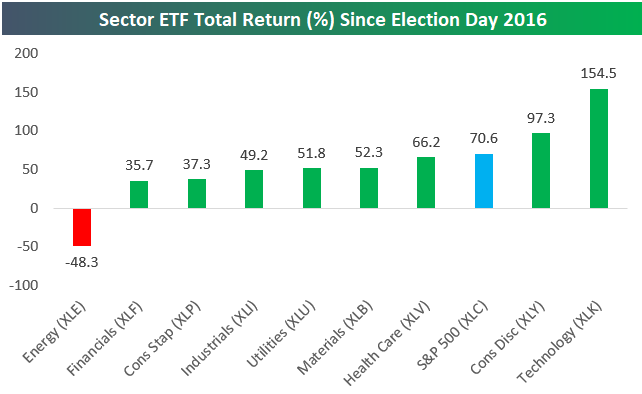

Looking at US sector ETFs, the Energy sector (XLE) is a huge outlier with a decline of 48.3% since Trump was elected. Technology (XLK) and Consumer Discretionary (XLY) are up the most with gains of 154% and 97%, respectively.

Along with Energy stocks, the oil (USO) and natural gas (UNG) ETFs have been more than cut in half since 11/8/16, while gold (GLD) is up 47% and silver is up 29.5%.

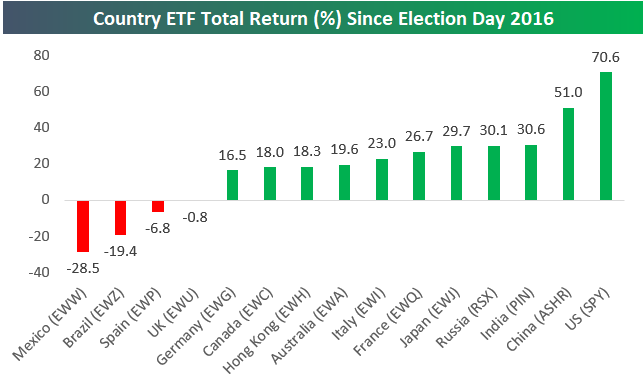

Not every country has seen stock market gains since Trump was elected. As shown below, Mexico (EWW) is down 28.5%, Brazil (EWZ) is down 19.4%, Spain (EWP) is down 6.8%, and the UK (EWU) is just slightly in the red.

The US (SPY) is up more than any other country with a gain of 70.6%, while China (ASHR) is up the second most at +51%. Whatever happened with the trade war certainly didn't hurt the US and China versus the rest of the world on a relative basis.

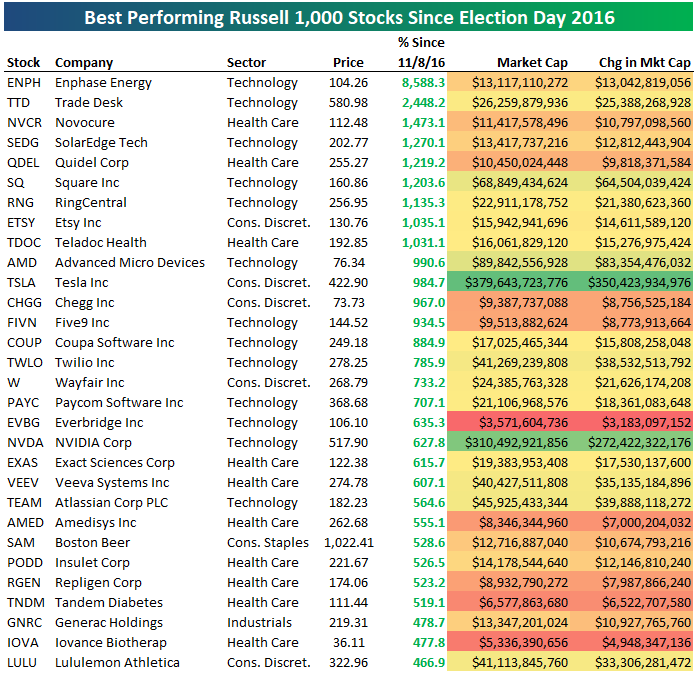

Within the Russell 1,000 in its current form, there are nine stocks that are up 1,000% or more since Election Day 2016, with Enphase Energy (ENPH) at the top with a gain of 8,590%. Trade Desk (TTD) is up the second most at +2,448%, followed by Novocure (NVCR), SolarEdge Tech (SEDG), and Quidel (QDEL). Square (SQ) ranks sixth with a gain of 1,203%. Other notables on the list of big winners since Trump was elected include Etsy (ETSY), Teladoc (TDOC), Tesla (TSLA), NVIDIA (NVDA), Atlassian (TEAM), Boston Beer (SAM), and Lululemon (LULU).

In terms of market cap gains for individual stocks, the numbers below are quite eye-popping. Apple (AAPL) has gained the most in market cap since Trump was elected with an increase of $1.257 trillion! Amazingly, both Amazon (AMZN) and Microsoft (MSFT) have added more than $1 trillion in market cap as well. Prior to the last few years, no company was even close to having a $1 trillion market cap, but at this point, AAPL, AMZN, and MSFT have gained that much in the last four years.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more