Will Weatherford's Debacle Destroy The Halliburton - Baker Hughes Merger?

The merger between Halliburton HAL and Baker Hughes BHI once seemed like a forgone conclusion. Halliburton would divest certain assets to appease the DOJ and arbitrageurs would gain a windfall from the "Buy BHI, Short HAL" trade. Heading into its second year, the deal is beginning to look more uncertain. After the DOJ ruled Halliburton's divestiture package was insufficient, the oil services giants extended their deadline to April in order to consummate the merger.

The Situation

Halliburton is practically groveling to get approval for the merger, offering to divest assets beyond what was initially required. However, regulators have not been convinced the deal would not hurt competition. Brazil's anti-trust regulator is concerned about higher prices for oilfield services post-transaction. Meanwhile, Jefferies believes the EU is concerned the deal could facilitate coordinated behavior. My previous article explained why Halliburton's divested assets may not be enough to assuage regulators:

If Halliburton has to sell divested assets piecemeal, it may not be able to convince regulators that the buyers (GE or others) of those assets will be large enough to prevent "coordinated behavior" or a dislocation in the oilfield services market.

If the asset divestitures are not enough to convince regulators that the demand/supply dynamics of the marketplace will not be disrupted, a strong number three firm must emerge.

Weatherford's Financial Debacle Could Kill The Merger

Schlumberger SLB, Halliburton and Baker Hughes are considered the top three oil services firms. Weatherford International WFT is ranked number four, particularly for firms with high exposure to land drillers. Post-deal it may be logical to assume that Weatherford could be strong enough to maintain a competitive landscape. However, in my opinion, Weatherford may not survive much longer amid a free fall in oil prices and $7.7 billion of debt.

In Q3 Weatherford experienced a 6% sequential decline in revenue and incurred a $98 million pretax loss. Its North America operations (37% of revenue) are particularly concerning. Loss from operations were $54 million; this followed a $92 million loss in Q2. The competition is so cut throat that in Q3 Weatherford had to scale back two product lines -- rentals and pressure pumping -- due to "punitive economics."

$7.7 Billion Debt Load Appears Untenable

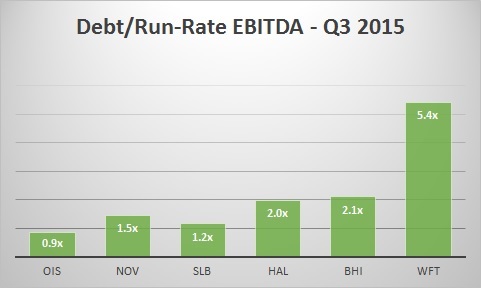

Weatherford built its number four position in the sector via acquisitions when oil prices were much higher. In the process, it also amassed $7.7 billion debt which is at junk levels. It has nearly the same amount of debt as Halliburton ($7.7 billion versus $7.8 billion), though its run-rate EBITDA is nearly one-third less ($1.4 billion versus $4.0 billion). With debt/run-rate EBITDA at over 5x Weatherford has the worst balance sheet amongst its peers, including National Oilwell Varco NOV and Oil States International OIS.

Source: Shock Exchange

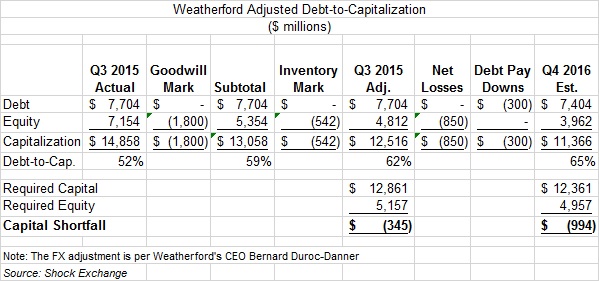

While oil prices and E&P have declined, Weatherford's debt service requirements have not. Its covenant with short-term lender, JP Morgan Chase JPM, requires it to maintain a debt-to-capitalization of less than 60%. I believe it has potential asset impairments (goodwill and inventory) exceeding $2 billion. Such impairments could [i] cause a breach of its debt covenant and/or [ii] prompt lenders to accelerate its short-term debt ($1.7 billion).

With only $519 million of cash on hand and a $350 million principal payment due in Q1 2016, Weatherford may need about $1 billion to avoid bankruptcy. Coincidentally, Weatherford attempted to raise $1 billion in September to "pre-fund acquisitions."

I am short WFT, NOV and OIS

I would hate to see a great company, Baker Hughes, swallowed up by a company once run by Richard Cheney. I hope the merger fails. I know business is business, but...

The Halliburton-Baker Hughes saga is interesting. It's hard to predict whether the merger will be approved or not. SE