Will The 10-Year Treasury Yield’s Recent Rebound Continue?

The benchmark rate on the 10-year Treasury has been trending higher since October, suggesting that the sharp slide that unfolded earlier in 2019 has run its course. But the economic outlook is still sufficiently murky to reserve judgment on whether the latest bounce in this key yield is a limited revival after an arguably excessive slide or the start of a sustained rise.

In the realm of what we do know for certain: It’s clear that the strong downside bias that was in force through 2019’s third quarter ran out of steam in October. In the months since, a modest upside trend is conspicuous. Notably, for the first time in 2019 the 10-year yield’s 50-day average rose above the 100-day average in December. That’s a clue for thinking that the rate could continue to increase, especially if the trend survives to lift the 50-day average over the 200-day average at some point in the weeks ahead.

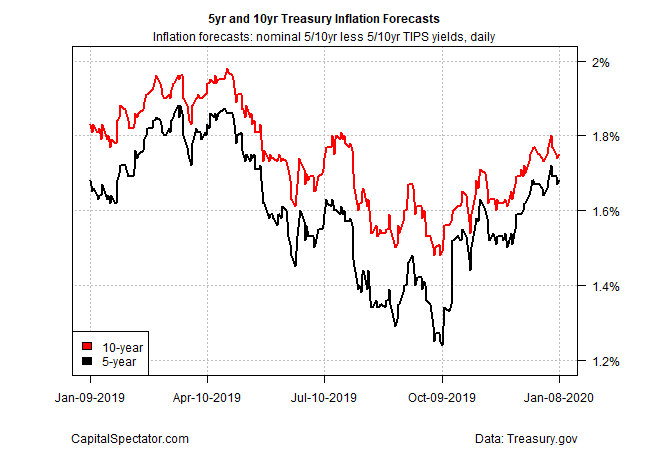

Note, too, that inflation expectations have turned up lately, based on the yield spread between nominal Treasuries rates and their inflation-indexed counterparts. For the 10-year maturities, the market’s current guesstimate is 1.75% (as of Jan. 8), which reflects a modest increase in the inflation outlook vs. the roughly 1.50% forecast that prevailed at one point in October. If the crowd’s mildly firmer reflation expectations roll on, the trend will support higher interest rates generally.

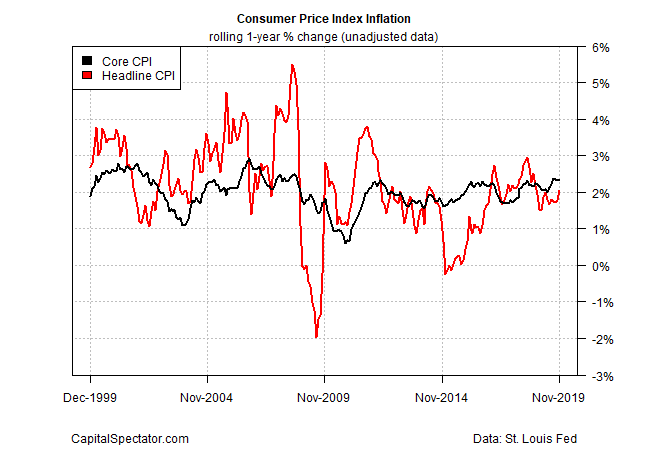

The official inflation data, however, still implies that the 2% inflation trend, give or take, will hold, perhaps with a modest firming in the near term (as suggested by Consumer Price Index numbers of late). With a clear upside bias that lifts core-CPI’s one-year change closer to 3%, it’s reasonable to assume that the Treasury market’s rebounding inflation expectations will moderate. But it’s not yet obvious that CPI is headed to 3% any time soon.

On the other hand, the technical profile for the 10-year yield suggests that there’s more upside ahead. Yet the question is whether the economic data will play along? On this front the outlook has turned a bit cloudy. Although the US economy is on track to report a moderate expansion in the upcoming fourth-quarter GDP report, the slowdown in last year’s second-half remains intact.

That’s a sign that further upside in the 10-year rate may be limited without a material acceleration in economic growth in 2020. But current nowcasts for this year’s Q1 reflect more of the same: moderate growth that’s effectively in line with the recent 2% trend. Now-casting.com’s current estimate for the first three months of this year, for instance, is +1.8%.

Perhaps, then, it’s no surprise that the Federal Reserve is expected to remain on hold with monetary policy for the foreseeable future. Fed funds futures continue to price in a high probability that the central bank will leave interest rates unchanged through the first half of the year, based on CME data.

Some analysts note that the weak manufacturing data, based on the widely followed ISM survey data, suggest that the economy faces stronger headwinds in 2020. But a competing index (Manufacturing PMI) paints a brighter profile. In any case, veteran Fed watcher Tim Duy (an economics professor at the University of Oregon) advises that “a manufacturing recession no longer guarantees an economy-wide downturn, a lesson learned in 2015-16.”

Instead, Duy recommends focusing on the much-larger services sector as a barometer of economic risk. “As far as recessions are concerned, we should be on the lookout for economy-wide shocks that pull down the services sector along with manufacturing,” he notes. “So far though the services sector remains resilient as seen in this week’s ISM services report.”

Nonetheless, the combination of a weak/sluggish manufacturing sector and a moderately expanding services sector doesn’t leaves room for doubt that US growth is about to accelerate in a meaningful degree. In turn, the 10-year yield’s upside run of late may soon run out of road without a general improvement in the economic outlook.

New growth estimates published by the World Bank yesterday offer a reason to keep expectations in check for now. US economic growth is expected to slow in 2020 to 1.8%, down from an estimated 2.3% rise in 2019. On both fronts, the bank trimmed its projections by 0.2 percentage points from the previous estimate. If the World Bank’s forecasts are reasonable, it follows that the recent rise in the 10-year yield isn’t the start of an extended rise.

Disclosure: None.