Will Market Volatility Return This Year?

2020 is in the rearview mirror, and I think we can all agree that it’s a good thing. While last year was certainly interesting for investors, I don’t think anyone wants to relive the other parts of 2020. The year is, of course, marked by the start of the COVID-19 pandemic. But let’s not forget massive forest fires, tireless political drama, and a host of other negative headlines.

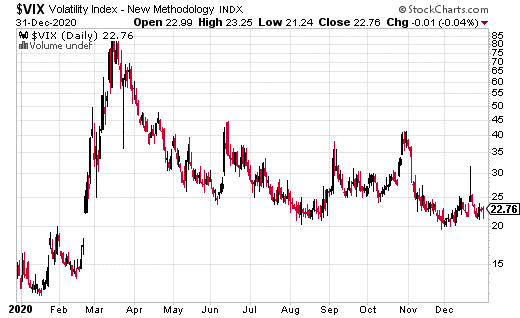

For the stock market, one defining feature of 2020 was persistent high volatility. Volatility spiked to record-high levels during the March COVID-19 crash. It remained elevated for the remainder of the year.

To put it in perspective, let’s look at the VIX – the S&P 500 Implied Volatility index – the most popular measure of market volatility. In a “normal” year, the VIX will rarely reach 20, much less spend weeks or months above that level. In 2020, the VIX climbed above 20 in February and has yet to close below it as we head into 2021.

The sustained elevation in the VIX really shouldn’t be that much of a surprise given the pandemic’s scope and severity. COVID-19 has taken a substantial toll on the global economy (to say nothing of the awful loss of human lives). The economy will continue to suffer as the world waits for the slow rollout of the COVID vaccine.

The multiple vaccines available or becoming available give reason for hope. There may be something akin to normalcy in 2021. Nevertheless, volatility hasn’t shown much inclination to return to more modest levels. Does that mean we can expect higher volatility for the foreseeable future?

The thing is, volatility tends to cluster at higher levels after a significant market dislocation, as we had in March. The aftereffect of a crash can be quite severe. What’s more, there are a lot fewer volatility sellers these days. 2020 was not kind to systematic volatility selling strategies.

Eventually, especially as the vaccine becomes more available, volatility is likely to drift lower. However, it may take longer than expected. There are even some short-term bets that volatility could spike again in January.

At least one strategist is using iPath VIX Short-Tem Futures ETN (VXX) as a way to hedge against (or bet on) a big spike in the VIX over the next month. VXX is one of the most popular methods for trading the VIX. It covers the first two futures in the VIX term structure, so it’s a proxy of short-term volatility.

Short-volatility (as seen through VXX) has faded quite a bit since the presidential election. However, perhaps due to the Senate runoff in January or a spike in COVID-19 cases, the aforementioned strategist purchased 8,000 January 29th 25-35 calls spreads for $0.39 with VXX at $16.97. A call spread simply means the 25 call was purchased while the 35 call was sold. A call spread is used to reduce the cost of the trade.

It would take a major spike in short-term volatility for this trade to payoff, which is likely why it’s a hedge and not a speculative trade. The most the position can lose is the 39 cents per spread if VXX remains below $25. However, in a crash-like scenario where VXX goes to $35 or above, the trade can pay off for $9.61.

Again, this is not a likely scenario by any stretch. However, if there is a substantial selloff in stocks and a volatility spike, a VXX call spread like the one described above can be a cheap hedge and offer peace of mind.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more