Will Japan Also Lead The Way On Phony Recessions?

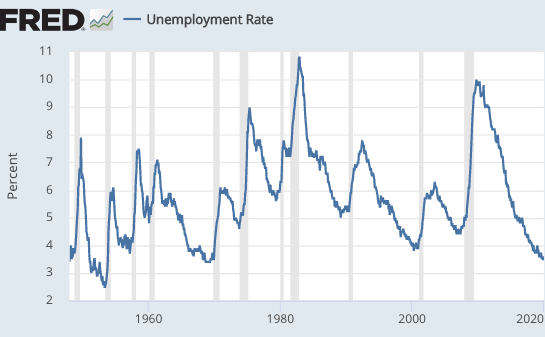

In recent decades, Japan has been a pathbreaker for the rest of the world. It led the way on slowing population growth (and then falling population), secular stagnation, and zero interest rates. Will Japan’s frequent “phony recessions” also begin to occur in the US? I suspect the answer is yes.

As you can see from this graph, the US hasn’t had any phony recessions. Each time there is an official recession, unemployment rises by at least 2%:

(Click on image to enlarge)

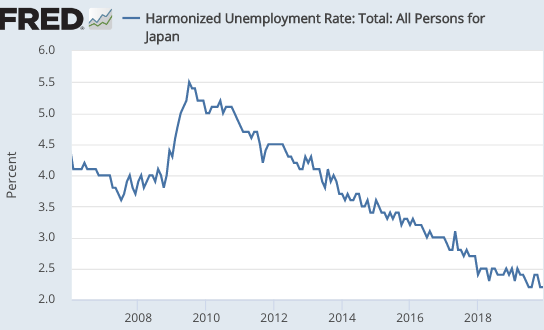

In contrast, Japan has lots of phony recessions. After a big actual recession in 2008-09, Japan has had three phony recessions (maybe 4, if they are in one now), defined as brief periods of falling RGDP and a booming labor market:

(Click on image to enlarge)

I’m not certain that the US will begin having phony recessions. But given that we’ve adopted so many other recent Japanese trends, I think it’s fairly likely that it will happen in the US before too long.

It’s certainly something to keep an eye out for.

PS. If the Fed wants a V-shaped recovery from Covid-19, consider level targeting. That’s what it’s for.