Will Iron Ore Be Able To Sustain Its Gains?

The short term bull case of supply tightness, coupled with strong Chinese demand, has pushed iron ore prices to multi-year highs, which may continue into early next year. However, as supply improves over the course of 2021 and demand growth slows, we expect prices to come under pressure.

Supply makes a comeback

Iron ore has seen a remarkable rally this year, with prices gaining more than 40% year-to-date, largely on the back of robust demand from China, which has tightened the market. The first half of the year also saw large supply disruptions once again. Australia was affected by cyclone activity, whilst in Brazil, COVID-19 related disruptions weighed on output. Some smaller producers, such as South Africa and Peru also faced issues. These various disruptions coincided with relatively low inventory levels in China.

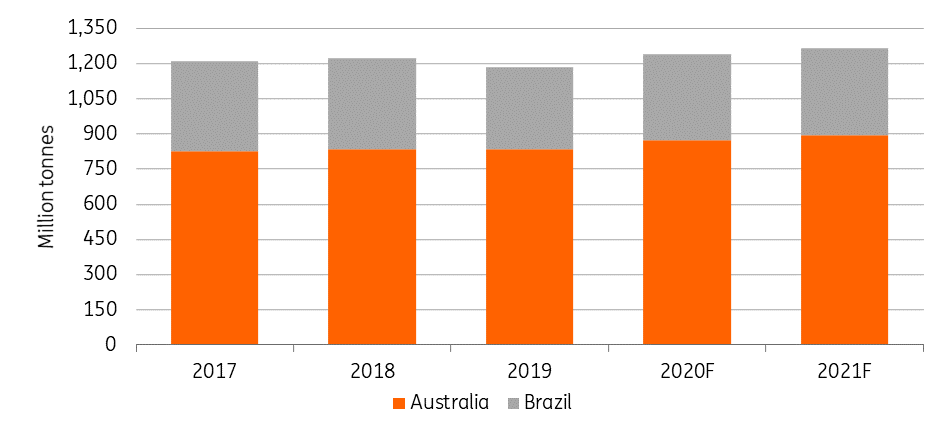

However, over the second half of the year, supply appears to have recovered. In 3Q20, Brazilian miner, Vale, produced a record quarterly amount from its Northern system. Brazilian iron ore supply overall has returned to pre-pandemic levels over the last few months, with September shipments hitting a five-year high of 37.9mt, though exports over the first 10 months of the year are still down 6% YoY to total 278.9mt, given the poorer flows over the first half of 2020. In 2021, Brazilian iron ore exports are likely to recover to around 372mt, compared to around 366mt of shipments this year and 336mt in 2019.

Following a similar path, after weak supply earlier this year due to the cyclone season (January-March), Australia has managed to boost its total shipments by 3% YoY during the first nine months. Total iron ore exports from Australia are expected to increase to 896mt in 2021 compared to 874mt of exports this year, according to data by the Department of Industry, Innovation and Science. Current iron ore prices are significantly above the marginal production cost for the majority of mining companies in Australia, and we believe that mining utilisation rates are likely to improve next year.

Australia and Brazil iron ore exports

Source: MDIC, Department of Industry, Science, Energy and Resources (Australia), ING

China boosts iron ore imports

China has seen an astonishingly strong recovery since the country emerged from lockdown earlier this year.

The country has imported 975mt of seaborne iron ore (+11.2% YoY) in the first 10 months of the year, and full-year volumes are expected to grow 10% YoY. Driven by government-led stimulus post lockdown, steel product inventories were drawn down quickly over 2Q20, pushing steel prices higher, and boosting margins for steel mills. As a result, blast furnaces have been operating at record levels for much of the year. In 3Q20, unexpected port congestion in China temporarily led to reduced accessibility for steelmakers, and this, compounded with a seasonal lull of fines from Australia, was a further catalyst for the price surge.

Chinese steel demand is expected to grow by 8% YoY to 980mt in 2020, following the post-COVID-19 stimulus. We expect that consumption will continue to grow in 2021, although at a slightly slower pace compared to this year. Meanwhile, Europe and the US continue to tighten measures against imports from China and other Asian countries, which could weigh on external demand for Chinese steel next year. For the rest of the world, if vaccines are rolled out from 1H20 it would bring hopes for a quick revival in industrial activity.

Price Outlook

Global steel demand is expected to see a tepid recovery of around 2-3% next year, after falling around 2.4% this year according to the World Steel Association, leaving 2021 consumption roughly around 2019 levels.

On balance, we expect an increase of around 80-100mt in iron ore supply next year, while there is still plenty of uncertainty over the demand outlook. Quick rollouts of vaccines could see a more robust recovery in demand, which would likely keep prices well supported above US$100/t. However, a gradual rollout means we would probably see more lacklustre demand growth, which could push the iron ore market back into surplus, weighing on prices.

ING forecasts

MDIC, Department of Industry, Science, Energy and Resources (Australia), ING

China boosts iron ore imports

China has seen an astonishingly strong recovery since the country emerged from lockdown earlier this year.

The country has imported 975mt of seaborne iron ore (+11.2% YoY) in the first 10 months of the year, and full-year volumes are expected to grow 10% YoY. Driven by government-led stimulus post lockdown, steel product inventories were drawn down quickly over 2Q20, pushing steel prices higher, and boosting margins for steel mills. As a result, blast furnaces have been operating at record levels for much of the year. In 3Q20, unexpected port congestion in China temporarily led to reduced accessibility for steelmakers, and this, compounded with a seasonal lull of fines from Australia, was a further catalyst for the price surge.

Chinese steel demand is expected to grow by 8% YoY to 980mt in 2020, following the post-COVID-19 stimulus. We expect that consumption will continue to grow in 2021, although at a slightly slower pace compared to this year. Meanwhile, Europe and the US continue to tighten measures against imports from China and other Asian countries, which could weigh on external demand for Chinese steel next year. For the rest of the world, if vaccines are rolled out from 1H20 it would bring hopes for a quick revival in industrial activity.

Price Outlook

Global steel demand is expected to see a tepid recovery of around 2-3% next year, after falling around 2.4% this year according to the World Steel Association, leaving 2021 consumption roughly around 2019 levels.

On balance, we expect an increase of around 80-100mt in iron ore supply next year, while there is still plenty of uncertainty over the demand outlook. Quick rollouts of vaccines could see a more robust recovery in demand, which would likely keep prices well supported above US$100/t. However, a gradual rollout means we would probably see more lacklustre demand growth, which could push the iron ore market back into surplus, weighing on prices.

ING forecasts

Source: ING Research

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more