Will Impeachment Kill The Market?

Last week, House Speaker Nancy Pelosi announced a formal impeachment inquiry into President Trump. According to The New York Times, the inquiry will look at “charging him with betraying his oath of office and the nation’s security by seeking to enlist a foreign power to tarnish a rival for his own political gain.”

I won’t discuss the politics of this—that’s not our department—but instead, let’s look at the ramifications for the stock market. First off, we have to state the obvious. Given the partisan makeup of each house, the odds of impeachment are relatively high, while the odds of conviction in the Senate are very remote. Twenty Republicans would have to cross the aisle to vote to convict.

Putting that aside, here’s the critical point for investors. One of the major fallacies of investors is to think that what’s in the news is of vital importance to the stock market. But for things like impeachment, eh…it’s really not that big a deal.

The stock market is like one giant cyclops. It has just one eye, and it’s always focused on earnings. Neither impeachment nor Trump nor Nancy Pelosi will kill the stock market.

Let’s look at some history. In 1998 and 1999, the market was hardly bothered by the impeachment of Bill Clinton. If anything, it was a great buying opportunity. Shortly after the Senate acquitted the president, we saw a fantastic rise in stock prices, especially in tech stocks. The stock market didn’t turn south until March 2000.

Of course, policy can undoubtedly have an impact on the stock, and the policy agenda is not always closely related to the political agenda. We’re still a long way from seeing a change of direction in D.C.’s economic policies.

While Richard Nixon resigned before he was impeached, the Watergate-era was an unpleasant one for Wall Street. The country suffered a nasty economic downturn. The pain was compounded by the OPEC oil embargo after the 1973 Arab-Israeli war. The stock market fell hard. It was the worst market crash since the Great Depression.

Not long before, Americans had come to believe in universal prosperity. Soon, factories went idle all across the nation. But the downturn can’t fairly be pinned on Watergate. The economy had already started to weaken. American consumers were also facing a new threat, inflation.

The combination of slow growth and inflation, soon called “stagflation” dragged the Dow below 600. For context, in August, we had three single-day drops of more than 800 points.

(Richard Nixon was once asked what he would do if he weren’t president. Nixon said that he’d probably be on Wall Street buying stocks. They asked one old-time Wall Streeter what he thought of that. He said that if Nixon weren’t president, he too would be buying stocks.)

Similar to President Clinton’s troubles, President Nixon’s resignation was probably a better buy signal than it was an omen of more trouble. The market eventually reached its low in late 1974. That’s the lowest point the stock market has been in the last 55 years.

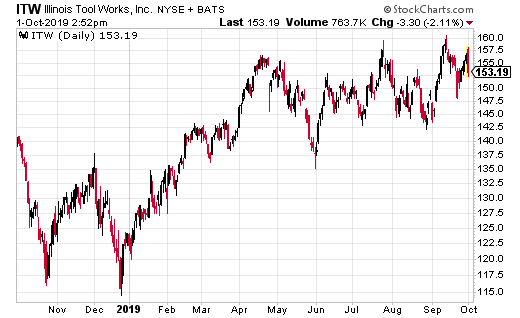

Speaking of 1974, that reminds me of superbly named Illinois Tool Works (ITW). ITW is a diversified industrial conglomerate. Last year, ITW nearly reached $15 billion in revenue.

The company has 48,000 employees, and it’s divided into seven industry-leading segments.

OK…but why does ITW remind me of 1974? That’s easy. A few weeks ago, the company raised its dividend by 7%. This is the 45th year in a row that ITW has increased its dividend payout.

ITW has been a quiet winner for 45 years.

At its low in December 1974, shares of ITW were going for just $16. Today, it’s near $160 per share. But that’s not all. Over that time, the shares have split 2-for-1 five times which works out to 32-for-1. That means that for every one share you owned of ITW at $16 in 1974, today you’d have 32 shares at $160!

On top of that, you’d have the 45 annual dividend increases!

So I guess that’s a long way of saying that ITW wasn’t terribly bothered by political ructions emanating from Washington.

There’s another reason to like ITW at the moment. Goldman Sachs lowered it to a sell. I don’t mean to sound too cynical, but Wall Street doesn’t always have the best track record of such things. (Though the Goldman analyst did concede that ITW is a “high-quality” company.)

My advice is to not let the political grandstanding scare you. To borrow from Macbeth, the Ukraine mess is, from Wall Street’s view,a lot of sound and fury signifying nothing.

Buffett could see this new asset run 2,524% before the end of 2019. And he's not the only one... Mark Cuban says "it's the most exciting thing I've ever seen." Mark Zuckerberg threw down $19 billion to get a piece... Bill Gates wagered $26 billion trying to control it..

What is it?

It's not gold, crypto or any mainstream investment. But these mega-billionaires have bet the farm it's about to be the most valuable asset on Earth. Wall Street and the financial media have no clue what's about to happen... And if you act fast, you could earn as much as 2,524% before the year is up.

Disclosure: None.

If Trump goes, however he goes, maybe we could leave China alone and world prosperity could return.

If we win the #tradewar, we'll have even more prosperity.

But we won't win. We are in the process of losing. The customers are in China. They are upwardly mobile. We can't win.