Will Americans Use Their Stimulus Checks To Pay Down Debt?

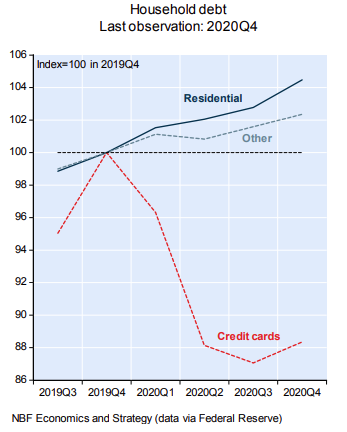

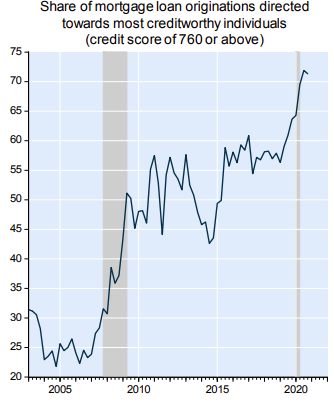

“Are American households using the money they receive from the federal government to pay down debt? The general idea that this is the case seems at least partially wrong judging from the most recent data released by the Federal Reserve. Indeed, total household debt increased 1.4% in the last quarter of the year (the fastest pace recorded since 2018Q3), capping a year in which total borrowing rose 3.3%, a number roughly in line with the average for the 2014-2019 period (+3.5%). These figures contrast with the sizeable deleveraging process that took place following the Great Recession.” (National Bank Financial, Feb. 17, 2021)

In the US, there was a dramatic increase in American household savings after the financial crisis of 2008-09.

The deleveraging that took place was reflected in a decline in total household credit at an average annual rate of 2.2% between 2009 and 2013.

Of course, deleveraging at that time made the weak economic recovery from the Great Recession a very painful experience.

The question is, will we see a return of the same kind of deleveraging after the US economy rebounds away from the pandemic recession?

Thus far, and it is incredibly early days, the early evidence suggests that Americans may not deleverage to the same degree this time around as what happened after 2009. Nonetheless, there is fragmentary evidence that Americans are choosing to save some a large share of their government windfall payment and pay down their debts rather than spend the funds on consumer goods and services.

Indeed, personal surveys suggest that many Americans plan to save their stimulus checks or pay down debt, rather than spend directly into the economy.

Currently, consumer confidence surveys are quite optimistic about the year ahead. Bear in mind that the confidence surveys and actual consumer spending are rarely very consistent.

But the University of Michigan's consumer sentiment index soared to 83 in March of 2021 from 76.8 in February. The survey’s improvement is the highest reading since March of 2020, clearly influenced by the growing number of vaccinations in the US as well as the passage of Biden's $1.9 trillion relief measures.

In other words, the confidence survey implies a strong rebound in consumer spending during the year ahead, with the largest percentage gains centered on services, including travel and restaurants, and the smallest increases for vehicles and homes.

In sum, while the evidence of future deleveraging and consumer spending is somewhat murky, my own view is that extreme optimists have to rethink their rosy view of post-pandemic recovery.

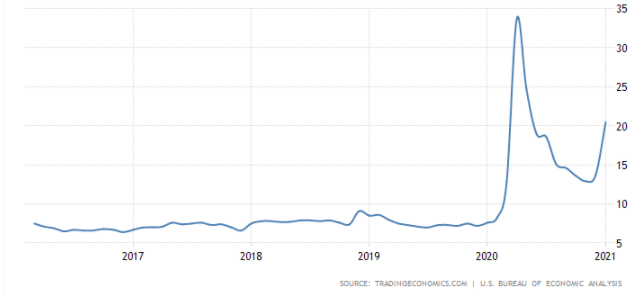

That is, it will not be easy to restore the US economy to where it left off over a year ago. For example, as the following charts highlight, the household saving rate in the United States increased to 20.5% in January from 13.7% in December of 2020.

The US Household Savings Rate

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The source of the problem is that the fools handing out the money are giving most of it to the people who are not suffering hardships at all. Certainly there are some folks who do desperately need help, But the INCREDIBLY STUPID choice was "to be fair" and give lots of money to everybody. ( That is so very California). The result i an incredible amount of debt created without delivering the intended benefit. In addition, a secondary result was much less money for those folks with actual hardships. And the third result is that a whole lot of money, many millions at least, was given to criminals stealing it by means of fraud. Thus future generations are now saddled with trillions of dollars of debt before they are born, AND the poor folks are having the purchasing power of whatever they have eaten away by the inflation caused by all of that free money.

So the biggest problem presently is that the financial people are purposely doing the wrong things every time. I assert that it is intentional because nobody could possibly be that stupid that they would believe it was the correct choice. Thus I conclude that they have an entirely different agenda.