Will A Robot Close Your Next Deal?

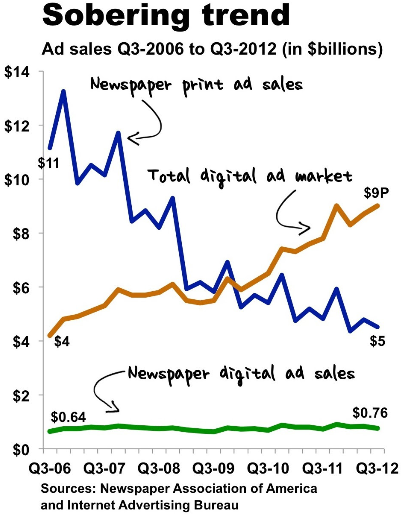

In the next ten years, technology will transform virtually every industry in the world. There will be big winners and big losers. In order to stay competitive, middle market business owners must preempt these changes to their competitive positions and sustainability with smart timely action. Just look at the newspaper publishing industry to see how dramatic the impact can be.

Is the middle market M&A industry exempt from the winds of change? My partners would answer that this is a people business: nothing happens until someone makes a sale. That’s clearly right. Bringing the sale of entrepreneurial business to a successful close involves far more than numbers; human emotions often overrule financial logic. An understanding of psychology is as essential to the success of an intermediary as auctioneering and financial analysis.

The role of the deal professional will not disappear. Nevertheless, the way he or she applies professional skills to reach the ultimate goal of the transaction will be dramatically shaped by the technological revolution now underway in our industry. The successful investment banking firm of the next decade should have access to resources unimaginable to today’s practitioners. In addition to great people skills and financial knowledge, investment bankers will need to be adept at using numerous advanced technologies that will eliminate a great deal of drudgery and that will also accelerate the speed of transaction processes. In that hypercharged environment, the race may well go to the swiftest practitioners with access to the best of data and toolsets.

When I started my investment banking firm in 1985, the most advanced technology was my Compaq luggable (38 pound) computer and a magical program that enabled me to produce both written documents and spreadsheets from a single device. Over time we added desktop computers, a Microsoft network and access to quarterly CD-ROMs with data about thousands of private companies.

Compare that with today. We now have access to incredible information resources like Capital IQ,PitchBook, and GF Data Resources (See previous article), which provide background information on hundreds of thousands of companies worldwide. Virtual data rooms such as Intralinks (See previous interview) cut weeks of logistics out of the due diligence process. The sa le process itself is made more efficient with deal sharing platforms such as Axial and DealNexus.

Compare that with today. We now have access to incredible information resources like Capital IQ,PitchBook, and GF Data Resources (See previous article), which provide background information on hundreds of thousands of companies worldwide. Virtual data rooms such as Intralinks (See previous interview) cut weeks of logistics out of the due diligence process. The sa le process itself is made more efficient with deal sharing platforms such as Axial and DealNexus.

Yet this is only the beginning. We recently interviewed Adley Bowden, Senior Director of Market Development & Analysis at PitchBook. In a wide-ranging discussion, Adley and I discussed the current state of many available technologies including:

- Analysis of social media trends to augment online private company data

- Deal room technology

- Crowd Funding

- Virtual marketplaces

- Use of advanced data to enhance prospecting for clients as well as deal implementation

- Securities compliance

You can access the full twenty-eight minute interview by clicking on Adley’s photo above or a shorter highlighted version at this location.

For Adley and PitchBook the end game is developing a comprehensive PitchBook Ecosystem that serves as a single platform from which his customers can:

- Market their services by targeting prospects more efficiently

- Prepare for the client pitch with in depth information about the prospect’s industry, including the competitive matrix

- Manage the full transaction process in one location

- Identify and target buyers/sellers and investors with investment parameters and industry focus germane to the deal at hand

- Provide regular reporting to clients

- Share deals with a broad universe of potential buyers

- Meet FINRA and other compliance obligations with regard to record-keeping, suitability, etc.

We’ll follow PitchBook’s development with great interest. We’ll also keep close watch on other leading technology providers to get their slant as well. The next few years promise to be an exciting ride and we will report on further developments as they occur.

None.