Why Wall Street Forecasts Always Fail

Wall Street Loves to Make Predictions.

Warren Buffett famously said that forecasts don’t tell you much about the future, but they do tell you a lot about the forecaster.

That’s certainly true. Imagine if you had told someone on January 1, 2019, all the raucous headlines we’d see in the coming 12 months. After learning all that news, I very much doubt they’d predict a booming market for the year. But that’s what we got.

Wall Street loves to make predictions. I’ll give you an example. Each year, Wall Street strategists predict where the S&P 500 will close by the end of the year. For 2020, the consensus is that the S&P 500 will finish up at 3,327. Going by Friday’s close, that’s less than 2% away.

Are they right? Beats me.

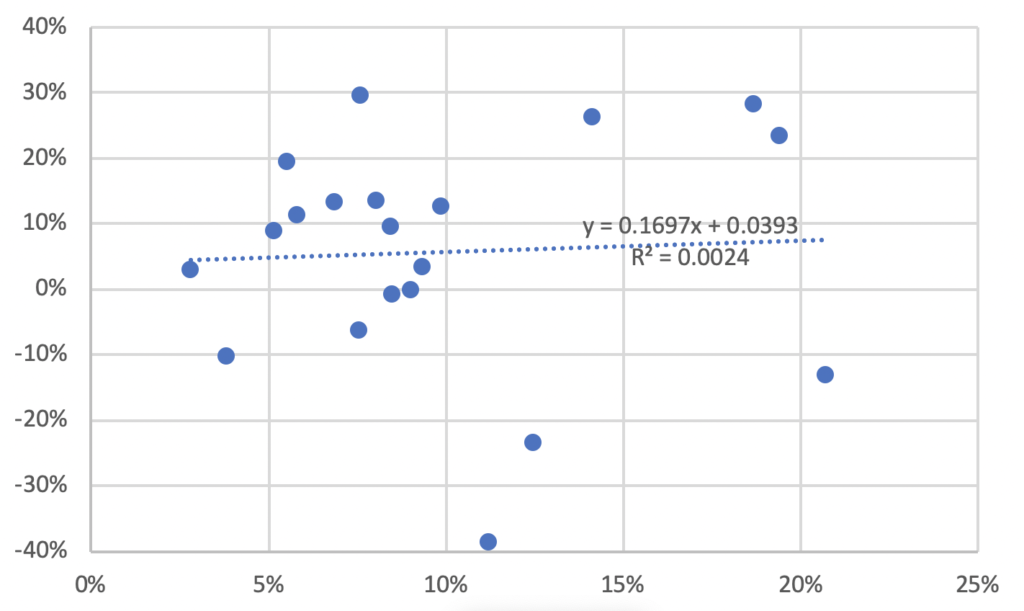

But let’s look into those numbers. I took the consensus estimate of Wall Street strategists for the coming year. I then made a scatterplot to see how well those forecasts worked.

There’s almost zero correlation. Basically, the experts are shooting into the dark.

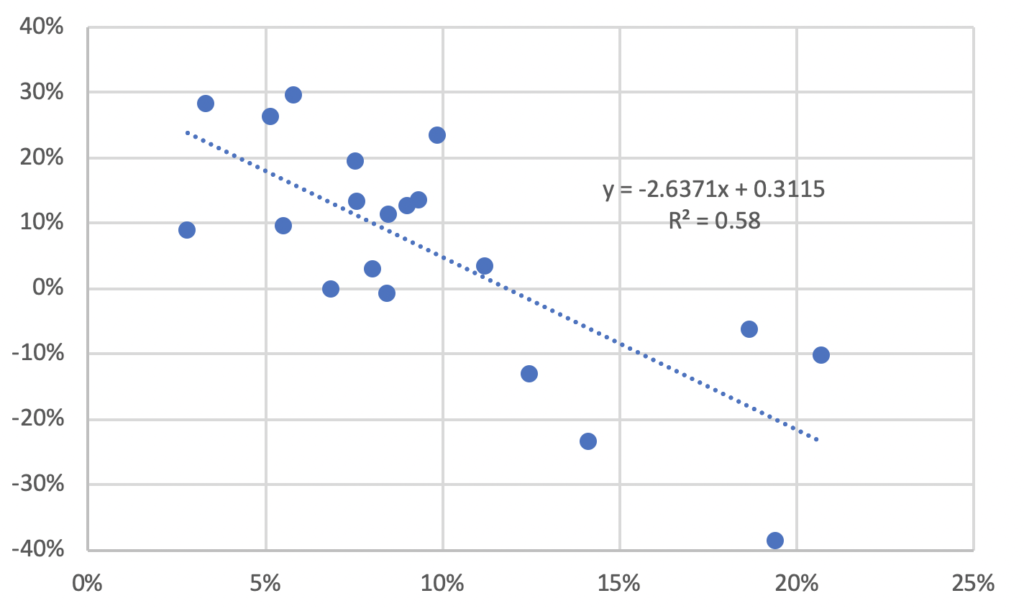

I then made a small but important change. I reran the scatterplot, but this time I compared the coming year’s estimate with the previous year’s result. I found a fairly decent correlation. Except it was a negative correlation.

What does this mean in simple terms? The fancy Wall Street strategists are merely predicting the opposite of the year that just happened. They just water it down some. So if we had a strong year one year, then the strategists will predict a mildly weak one next year. If we have a down year one year, then they’ll predict a mildly strong one next year. It’s just that simple—and they get paid a lot of money to do this.

The December Jobs Report

On Friday, the government released the jobs report for December. The U.S. economy created 145,000 net new jobs. That was below expectations of 160,000. The unemployment rate fell to its lowest level since June 1969.

The government also tracks a broader measure of employment called the U-6 rate. For December, that rate fell to 6.7%, which is the lowest rate since it was first tracked in 1994.

The weak spot, however, is wages. To be fair, we’ve seen some improvement here, but we need to see more. Over the past year, average hourly earnings are up by 2.9%. That’s more than inflation, but not by much. Bear in mind that higher wages will eventually translate into higher sales and profits for companies.

We may be seeing evidence that workers are in demand. There was a recent story that Taco Bell is willing to pay general managers $100,000 per year. The company will also start paying employees 24 hours of sick time each year.

Here’s a remarkable look at how the U.S. economy has changed. If we were to have the same jobs-to-population ratio that we had 20 years ago, we’d need 8.8 million more jobs. We could also achieve it if we had 13 million fewer people. What’s changed is that there are many more retirees.

RPM International Beats Earnings

Last week, we got good earnings results from RPM International (RPM). This is one of my favorite little-known stocks. It’s a diversified industrial that’s raised its dividend every year since 1973. Still, many people have never heard of RPM.

For its fiscal Q2, RPM earned 76 cents per share. Wall Street had been expecting 73 cents per share. Net sales rose 2.8% to $1.40 billion. RPM had record cash flow and EBIT margin improved by 180 basis points.

For fiscal 2020 (ending in May), RPM sees earnings ranging between $3.30 and $3.42 per share. Wall Street expects full-year earnings of $3.35 per share.

This is from the earnings report:

“Our very strong bottom-line growth in the quarter was primarily driven by our 2020 MAP to Growth, which is enabling us to grow earnings at a faster rate than those of our peers. Actions taken included delayering management, consolidating manufacturing, and shedding low-margin product lines to free up capacity for more value-added, EBIT-accretive volume. Pricing and moderating raw material inflation also positively impacted results,” stated Frank C. Sullivan, RPM chairman, and chief executive officer. “In spite of a challenging macroeconomic environment, we were pleased with our solid organic-sales growth in the quarter of 3.5%, which resulted from market-share gains and pricing. Acquisitions contributed 0.6% to the quarter’s top-line growth, while foreign currency translation was a 1.3% headwind.”

For Q3, RPM expects sales to be up 2.5% to 4.0%, and 25% to 30% in adjusted growth in earnings before interest and taxes. RPM sees earnings-per-share in the “high-teens to the low-20-cent range.” RPM is a good stock for the long term.

Disclosure: None.

$RPM is a good find!