Why The Russell 2000 & The Nasdaq 100 Had The Largest Market Impact

(Click on image to enlarge)

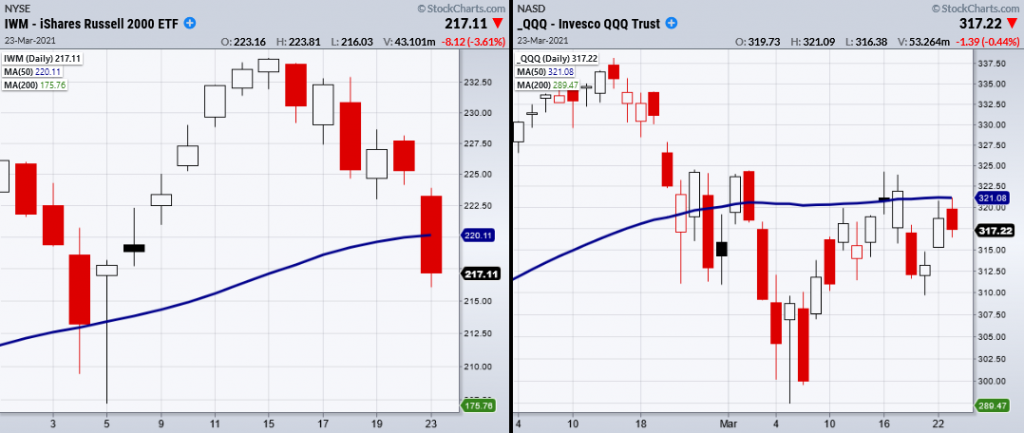

Tuesday, the Nasdaq 100 (QQQ) came close to clearing the 50-day moving average at $321.08.

This was the second attempt to clear this moving average with the first attempt happening last week.

Though the QQQs were unable to hold over the 50-DMA they were able to hold over its short-term 10-DMA.

The next test will be if Nasdaq holds this current price range and makes the 3rd attempt or break lower.

If the price reverses, we could be looking at a retracement to recent lows at around $297-300.

On the other hand, Russell 2000 (IWM) broke under the 50-DMA.

Next, we watch for IWM to confirm its break of the major price level with a second close under.

This means that 2 of the 4 major indices are under their major moving averages.

These caution phases are meant to be exactly what they are-cautionary tales but not necessarily the end of the bull run.

When the major indices are not in alignment, price action tends to get more volatile as traders/investors liquidate positions due to unclear market directions.

Jerome Powell, Chairman of the Federal Reserve has also displayed some indecision when it comes to the future economic outlook.

Recently the Powell stated conflicting views that the economy was “much improved” but yet the economic recovery was “far from complete.”

These vague claims do not help the market’s already uneasy stance.

Some of our recent articles have talked about choppy market environments concluding that if you are not sure what to do from an investing/trading standpoint, often its best to sit on your hands and wait for clarity.

Additionally, if you are already heavily invested, you could decrease risk exposure by cutting down positions sizes or eliminate ones that are not working.

ETF Summary

S&P 500 (SPY) 385.80 next support the 50-DMA

Russell 2000 (IWM) Broke the 50-DMA at 220. Watching for second close underneath.

Dow (DIA) Next support area 320.

Nasdaq (QQQ) Still needs to clear 321 the 50-DMA.

KRE (Regional Banks) 50-DMA at 62.69

SMH (Semiconductors) Filed second close over 50-DMA at 238.17.

IYT (Transportation) If cannot hold 245 area watch 240 next.

IBB (Biotechnology) Next support 148.50 with main support the 200-DMA at 144.54

XRT (Retail) 85.69 support.

Volatility Index (VXX) Would be interesting if VXX clears the 10-DMA at 13.22

Junk Bonds (JNK) Weak hold over the 10-DMA at 107.81. Needs to work its way back to 108.60 area.

LQD (iShs iBoxx $Inv Gd Cor Bd ETF) 130.06 gap to fill.

IYR (Real Estate) Doji day. 90.00 pivotal.

XLU (Utilities) Broke out from support area of 61.22.

GLD (Gold Trust) 161.11 needs to hold.

SLV (Silver) All out.

VBK (Small Cap Growth ETF) Watch 265 as next support area.

UGA (US Gas Fund) Doji Day. 29.53-30.23 support.

TLT (iShares 20+ Year Treasuries) Cleared the 10-DMA at 136.60.

UUP (Dollar) 92.61 Resistance.

EWW (Mexico) 50-DMA at 42.74

MJ (Alternative Harvest ETF) Hovering over the 22.54 the 50-DMA.

WEAT (Teucrium Wheat Fund) Needs to hold 6.

Disclosure: None. If you'd like more information about the additional free trading education mentioned in ...

more