Why Oil Is Likely Headed Much Higher From Here

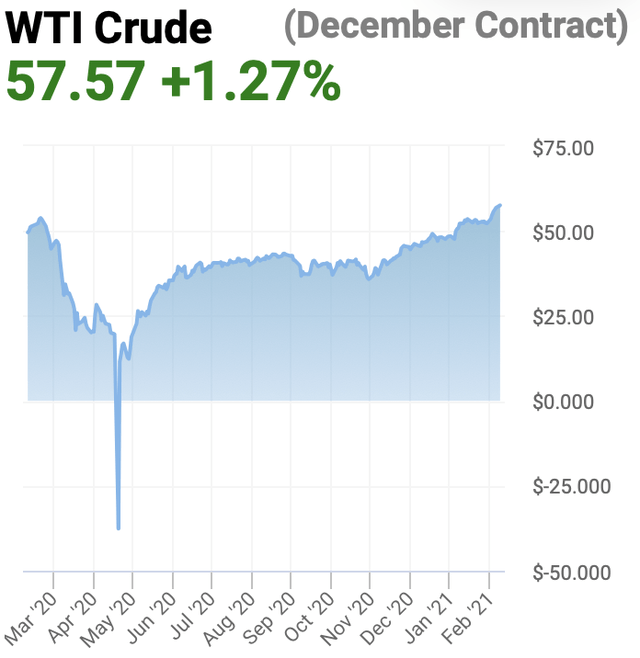

Oil - WTI Crude has come a long way since dipping into negative territory during the height of the coronavirus panic. At roughly -$40 a barrel it was quite surreal. Oil stocks were melting, traders were unloading barrels at sub-zero prices, this was an unprecedented time indeed. Nevertheless, fast forward less than 1-year, and oil is closing in on $60 again.

OPEC + oil producers are likely to stick to their production cuts. This should limit the supply of oil coming to market. Moreover, oil demand is likely to rise, as the coronavirus pandemic begins to ease into the second half of this year and into 2022. Furthermore, inflation is likely to rise as well going into year-end and next year. Therefore, oil is likely headed higher from here, possibly into the $70-80 range by the end of this year.

The Supply Demand Dynamic

Oil's supply and demand dynamic is likely the single most important driver for oil prices. We saw oil prices crash into negative territory during the height of the coronavirus meltdown. This was in part due to an extremely strong shock to the global demand side of the equation. However, on the other side, while demand fell off a cliff, major oil producers kept pumping, essentially overflowing the market with oil.

However, things are much different now. Saudi Arabia and Russia agreed to extend their oil cut outputs. This move puts pressure on other OPEC + nations to comply with their output cuts as well. Also, we are seeing the supply demand dynamic play out in markets, as we see larger than expected declines in U.S. oil inventories in much of the recent economic data.

An important factor to consider is that many of the top oil producers in OPEC + like Saudi Arabia, Russia, as well as many other nations are developing, or are essentially third world countries. Thus, oil revenues account for large portions of these countries' GDPs, as well as their budgets. For the sake of stability, and a certain level of prosperity, it is essential to keep oil at "an acceptable" price for these nations.

An acceptable price is around $55-65, in my view, however, a preferable price is notably higher. Naturally, the higher the price the better (within reason), but a likely lower range for a "preferable oil price" is probably around $70-80, and I think the this is where oil is headed by the end of 2021.

As the Coronavirus Weakens

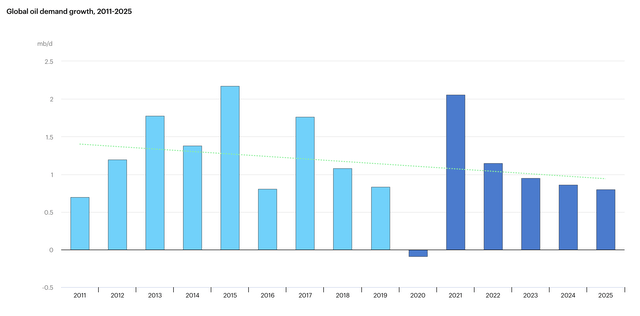

As the coronavirus loosens its grip on the global economy, oil demand is likely to rise. We see that 2020's demand fell off a bit, but growth seems to have dipped just marginally into negative territory. In fact, I was expecting a larger decline due to the coronavirus pandemic.

Now, the good news is that we are likely to see robust growth this year, and possibly in future years as well. Global oil demand is expected to jump by around 2% this year, illustrating one of the best growth years for oil over the last decade. Also, despite future years' growth declining slightly, I don't expect this to impact price negatively.

The Key Word is Inflation Here

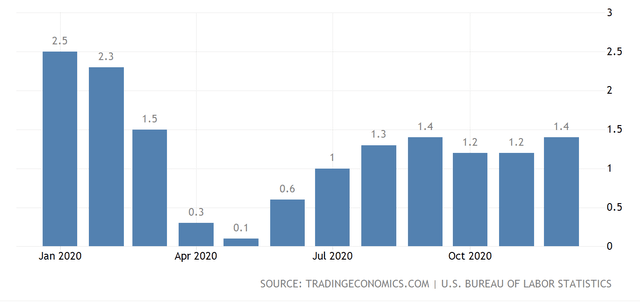

Yes inflation, which seems to be rather tame right now is not likely to remain so for long. So, CPI inflation has been running at about 1.2-1.4% in recent months.

Some may say "wow, that is pretty low". Indeed, it is not very high, but let us put this in context. So, CPI inflation is essentially telling us that a lot of the prices surrounding us are higher now than they were a year ago. In fact, this has been constant throughout the coronavirus pandemic.

This is astounding. Portions of global economies were shut down, some parts came to a halt, countless people lost their jobs, GDP fell off a cliff for a while, and all this time we see prices around us increasing. In a "normal" scenario we would likely see deflation occur, but we are seeing the opposite instead.

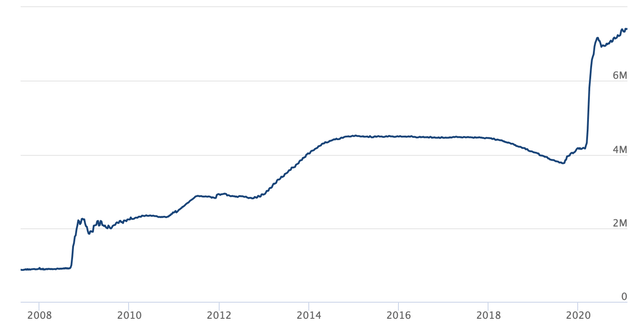

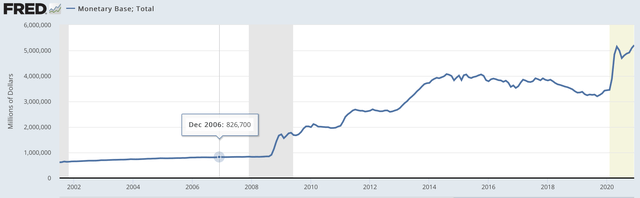

Well, this is largely due to the Fed and other major central banks around the globe. For the sake of simplicity, let's focus on the Fed, the most influential central bank in the world. Perpetual zero rate policy, multi-trillion dollar backstops and bailouts, coupled with "QE unlimited" are causing the Fed's balance sheet to explode. We see that the Fed's balance sheet is nearly 10 times higher than where it was before the financial crisis of 2008, and it has nearly doubled just over the past 18-months alone.

This is unprecedented, and it makes 2008's easing look like a blip in comparison to what is going on now. Furthermore, while there were expectations that the Fed could eventually "normalize" rates and unload its balance sheet post the 2008 crisis, this was proved to be wishful thinking in late 2018. The economy was not able to function effectively and grow in a rising rate and quantitative tightening/QT environment.

Therefore, I expect the Fed's balance sheet to continue to expand further from here. Moreover, I don't believe that the Fed will be able to shrink its balance sheet notably in the future, nor will the U.S. economy be able to withstand noticeably higher interest rates going forward.

Here we see the Fed's balance sheet expansion translating into the expansion of the U.S.'s monetary base. The underlying phenomenon creates a perfect storm for inflation to materialize going forward. If we are seeing inflation when we should normally see deflation, what is going to happen when the economy starts to expand notably in the H2 2021, and in 2022?

I think it is clear, inflation is likely to run quite hot, and I don't think that the Fed is going to be able to implement its usual tools to cool it down any time soon. If easy money stops flowing the economy could stall again. If interest rates tick higher economic activity will slow. Additionally, the enormous debt loads in every segment of the economy, consumer, and government may become unmanageable, and too costly to service.

The Bottom Line

There really is not much that the Fed can do to cool down inflation going forward without damaging the economy in my view. Thus, inflation is likely to run hot in future years. This is very bullish for oil and other real assets. Furthermore, once we consider the stronger demand picture coupled with constrained supply, oil is likely headed notably higher from here. I expect that we can see oil prices in the $70-80 range by the end of this year, and possibly in the $100 plus range sometime in 2022.

Some Companies We Like:

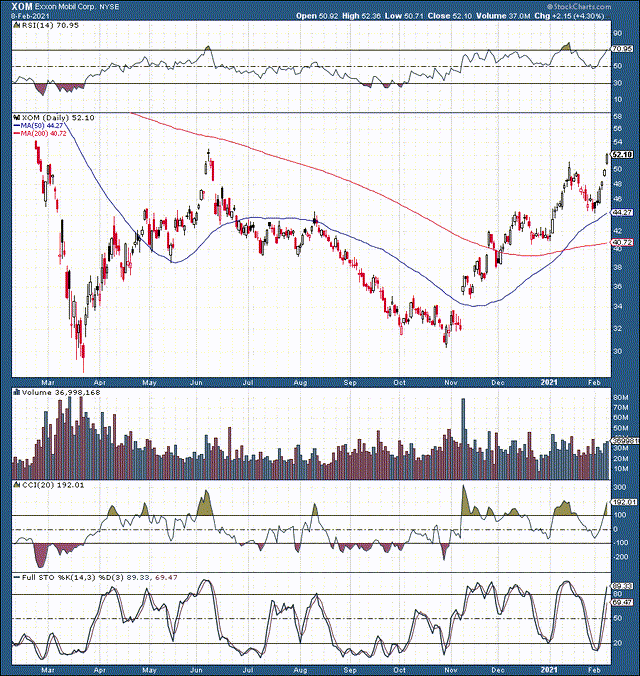

Exxon (XOM)

Exxon is one of the best and most stable names in the business. The stock can probably use a mild pullback, but the overall uptrend is very bullish. We like Exxon for its stability, and very strong profitability. The stock trades at 16 times consensus 2022 P/E estimates, the company is projected to deliver revenue growth of about 24% this year and 12% next year, and Exxon pays out a very healthy 7.2% dividend.

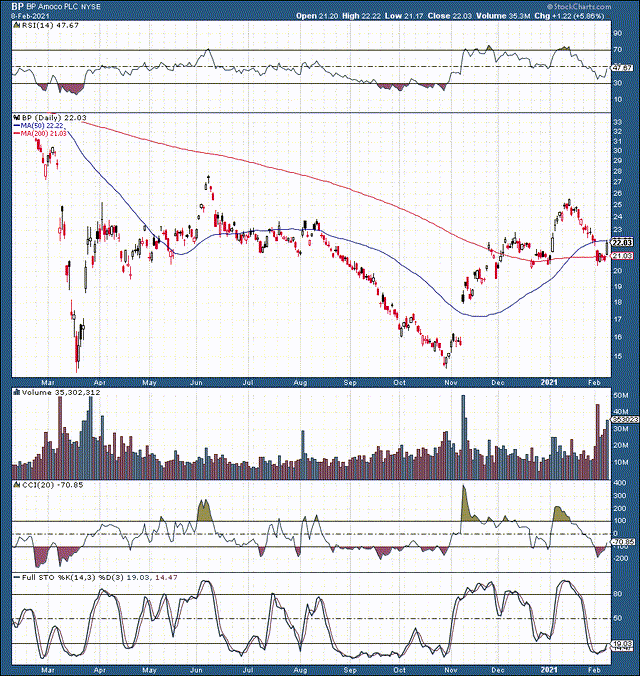

BP p.l.c. (BP)

BP is another oil major that we like. We see that the stock was likely building a base in recent sessions before making a notable move higher yesterday. This company's earnings may not be as stable as Exxon's, but it is cheap. BP trades at only around 8.8 times its 2022 consensus EPS estimates, is projected to grow revenues by around 30% this year and roughly 10% next year, and pays out a dividend of around 6%.

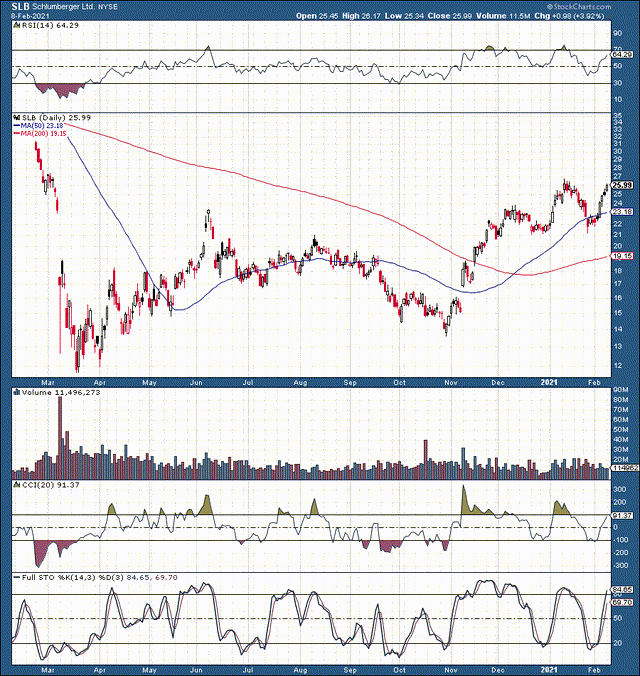

Schlumberger (SLB)

SLB also has a strong looking chart, and this is one of our favorite oil services providers. This industry leader trades at about 17.5 times next year's consensus EPS estimates, is expected to grow revenues by about 12% next year, and pays out a dividend of about 2%. While the dividend is not high now it is likely to grow as the company becomes more profitable going forward.

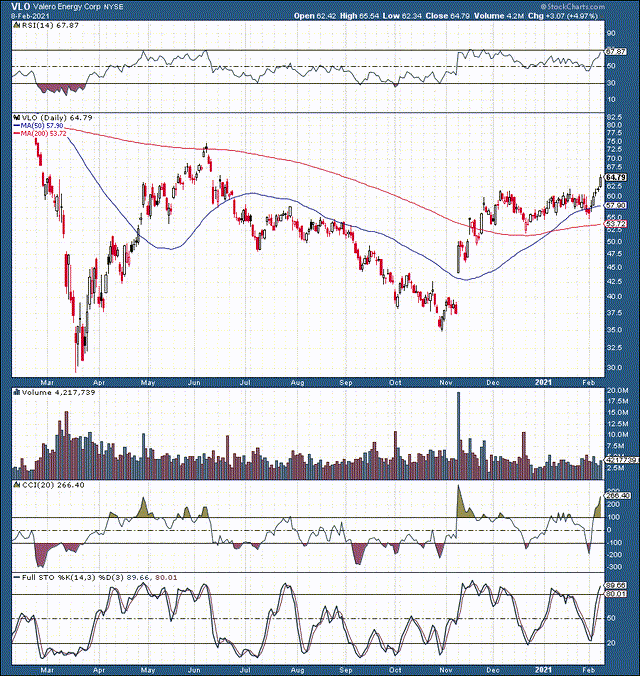

Valero (VLO)

VLO is a refinery name that we like. The chart is also very bullish here. VLO trades at about 14 times 2022 consensus EPS estimates, is projected to grow revenues by around 15% next year, and pays out a dividend of over 6%.

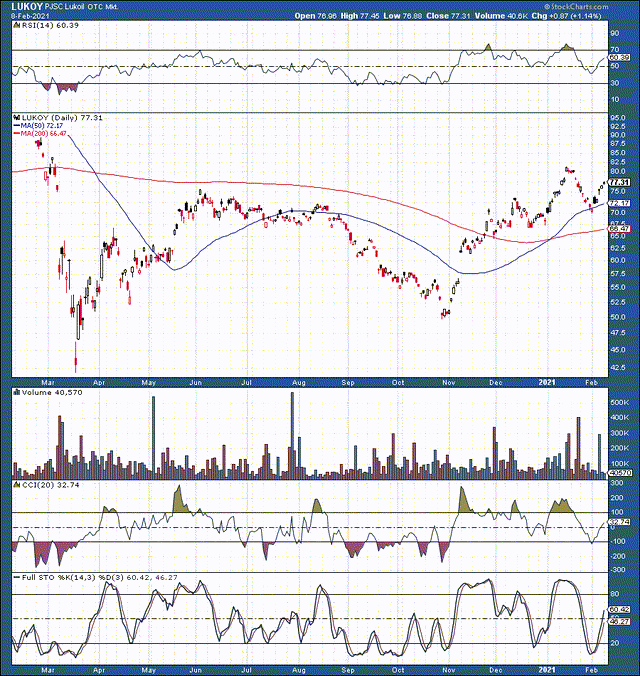

Lukoil (OTCPK: LUKOY)

Lukoil is a Russian oil giant. This company is extremely profitable and is quite cheap right now. Lukoil trades at only around 10 times next year's EPS estimates, and pays out a dividend of about 7%.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in XOM, LUKOY, VLO, SLB, BP over the next 72 hours. I wrote this article myself, and it ...

more