Why I Own Arista Networks Stock

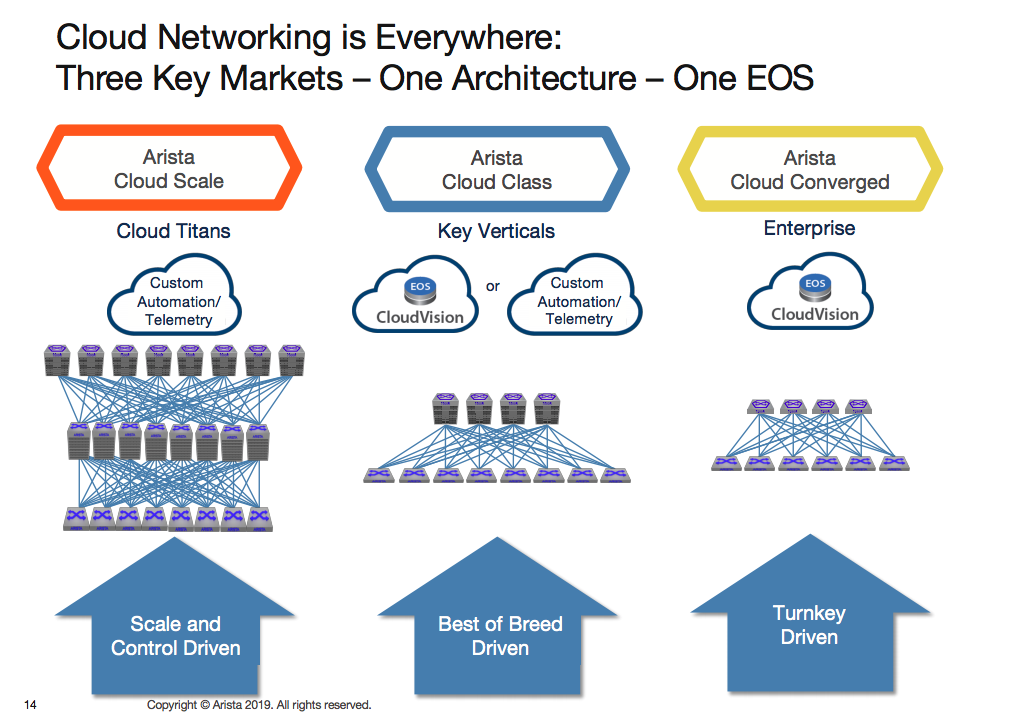

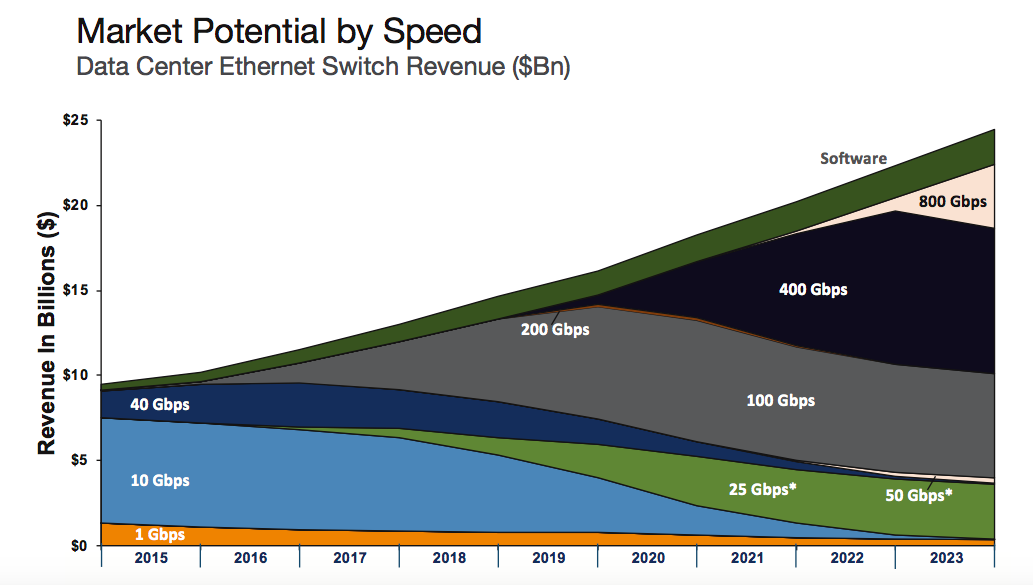

Arista Networks (NYSE: ANET) is a market leader in software-driven cloud networking solutions for large data center and cloud computing companies. The company offers a wide variety of Gigabit Ethernet switches that significantly improve the price and performance equation of data center networks.

(Click on image to enlarge)

Source: Investor Presentation

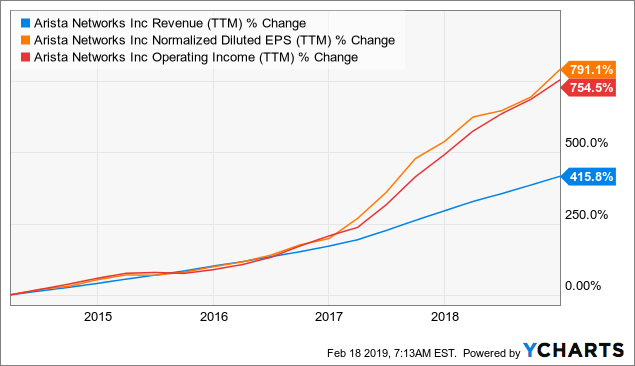

Demand for cloud connectivity is booming, and Arista is doing a sound job in terms of translating its growth opportunities into growing sales and earnings for investors. In the past five years alone, the company has increased revenue by more than 400%, with both operating income and earnings per share increasing well above 700%.

(Click on image to enlarge)

Data by YCharts

Arista Is Driven By Strong Momentum

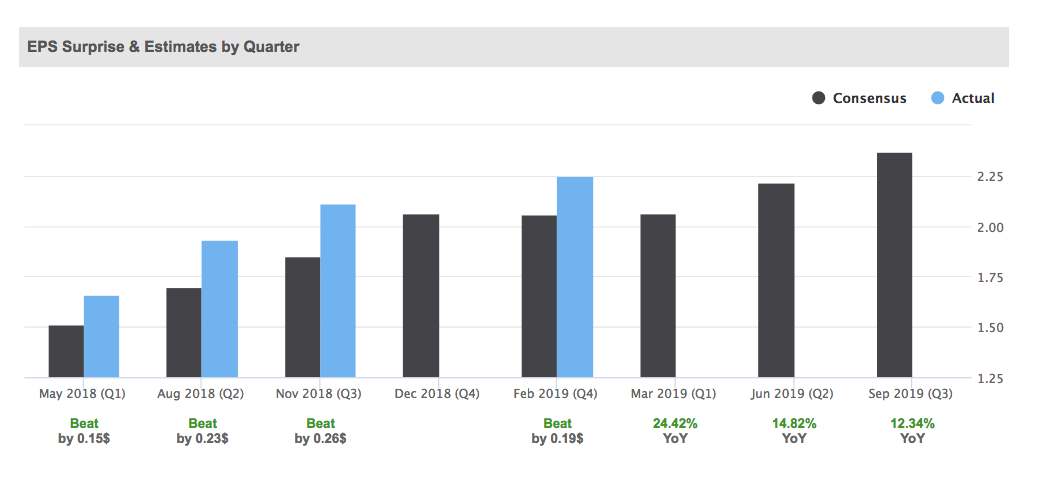

Arista reported earnings for the fourth quarter of 2018 on February 14, and performance was quite solid across the board. Market's reaction to the earnings announcement was clearly strong, with the stock jumping by 9.6% after the news hit the wires.

Revenue during the full-year 2018 amounted to $2.15 billion, an increase of 30.7% versus 2017. Adjusted earnings per share reached $7.96 during the period, a vigorous increase of 35% year over year. Both revenue and earnings surpassed expectations in the fourth quarter, and this is a major positive for investors in Arista Networks.

The company tends to consistently deliver financial performance above expectations, which can be a powerful upside fuel for the stock. Successful investing is not just about investing in companies that are doing well, but those companies that are doing better than expected can be the most profitable ideas in the market.

In other words, current market prices are reflecting a particular set of expectations for a company. When the company delivers earnings numbers above expectations, chances are that the stock price will tend to rise in order to reflect the upward adjustment in expectations going forward.

(Click on image to enlarge)

Source: Seeking Alpha

Arista has a spectacular trajectory over the long term. The company has delivered both revenue and earnings numbers above Wall Street's expectations in each and every quarter since the second quarter of 2014. This level of consistency in fundamental momentum is quite exceptional.

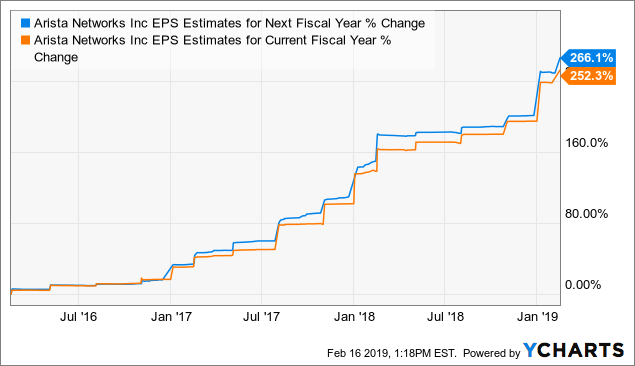

If the company performs better than expected, this generally means that Wall Street analysts are running from behind and increasing earnings forecasts for it in the future. Unsurprisingly, stock prices and earnings expectations tend to move in the same direction over time.

The chart below shows how earnings forecasts for Arista Networks in both the current year and next fiscal year have evolved over time. An image is worth a thousand words, and Arista Networks has an outstanding track record in terms of outperforming expectations and driving increased expectations about future performance.

(Click on image to enlarge)

Data by YCharts

Moving forward, Arista is launching its 400-gigabit fixed switches named the 7060X4 Series with game-changing improvements in terms of routing and buffering in the middle term. This market looks like a huge opportunity for Arista in 2019 and beyond.

(Click on image to enlarge)

Source: Arista Networks

Arista Is Priced For Growth, But Not Overvalued

The market is expecting vigorous growth from Arista in the years ahead, and these expectations are incorporated into valuation levels to a good degree. But the stock is not overvalued at all, especially if the company keeps crushing expectations in the future.

Wall Street analysts are on average expecting Arista to make $8.89 and $10.31 in earnings per share for 2019 and 2020 respectively. If the company meets those numbers, then the stock would be trading at a forward PE ratio of 29.7 for the current year and 25.6 for next year.

These valuation levels are clearly demanding, but not excessive at all for a company that is delivering revenue growth well above 25% year over year and expanding profitability.

Besides, valuation is a dynamic as opposed to a static concept. Arista has an exceptional track record in terms of delivering earnings numbers above expectations over the long term. If the company continues exceeding expectations in the future, this would make the stock much cheaper than what current numbers are showing.

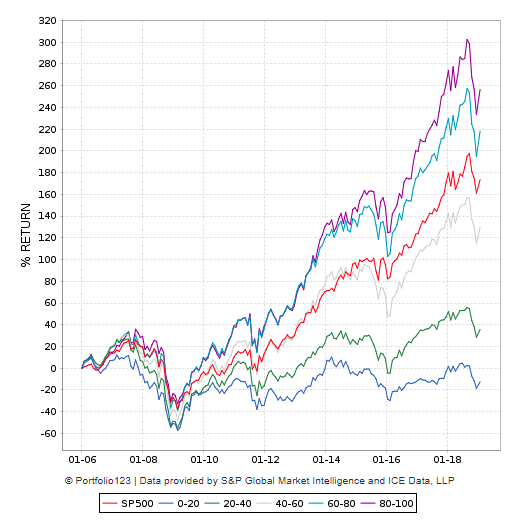

The PowerFactors system is a quantitative algorithm available to members in my research service, "The Data-Driven Investor." This algorithm ranks companies in the market according to a combination of quantitative factors that include: financial quality, valuation, fundamental momentum, and relative strength.

In simple terms, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

The algorithm has delivered market-beating performance over the long term. The chart below shows backtested performance numbers for companies in 5 different PowerFactors buckets over the years.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Companies with higher rankings tend to produce superior returns, and stocks in the strongest bucket materially outperform the market in the long term.

Arista is currently in the top decile, with a PowerFactors ranking of 97.78. The company has solid numbers across the four quantitative drivers: quality (99.39), value (85.57), fundamental momentum (98.9), and relative strength (60.65). This means that the big picture in Arista Networks looks clearly attractive from a quantitative perspective.

Only because the numbers look strong, this does not guarantee that Arista will outperform the market going forward. On average, companies with strong quantitative metrics tend to outperform the market more often than not. However, this does not tell us much about how a single stock will perform over a particular year.

Arista needs to continue reinvesting for growth in order to sustain its technological advantage, and the company is facing tough competition from bigger players with deep pockets such as Cisco (Nasdaq: CSCO). If the company fails to continue gaining market share versus the competition, this could be quite problematic for the stock.

That risk being acknowledged, it's good to know that Arista Networks is still offering attractive upside potential from current price levels if the company plays its cards well in the years ahead.

Disclosure: I am/we are long ANET. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business ...

more