Why A Defensive Rotation May Not Work So Well This Time

With stocks swooning lately and growing evidence that a new bear market could now be underway, investors seem to be embracing defensive sectors like consumer staples stocks and utilities.

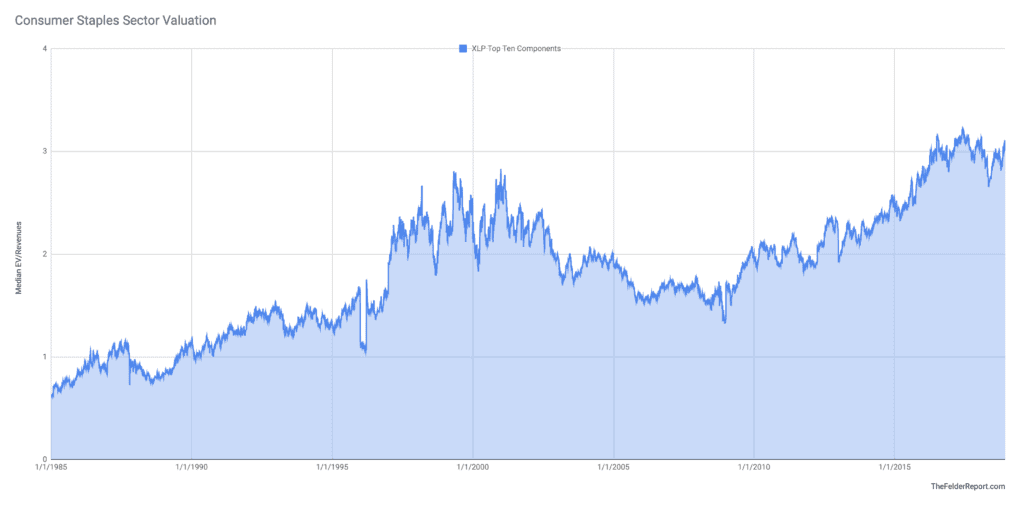

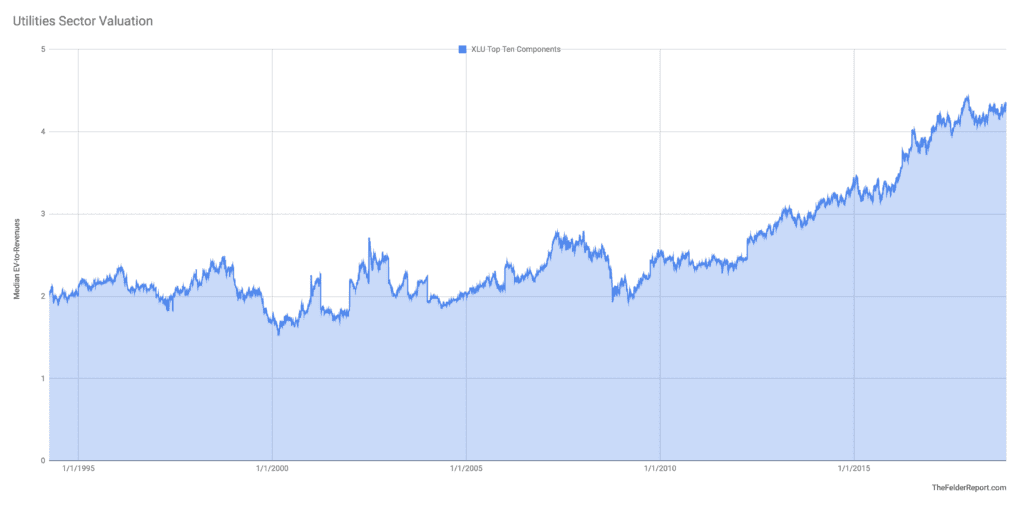

It’s true that these companies are recession-resistant if not recession-proof in many cases. However, both sectors now trade at their highest valuations in over 30 years (perhaps ever).

(Click on image to enlarge)

(Click on image to enlarge)

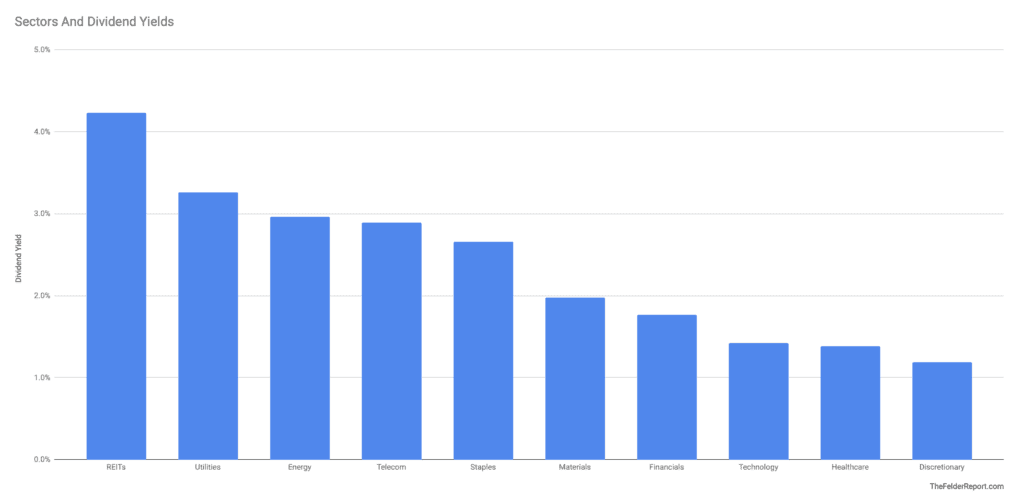

The reason they are so highly valued is that they are two of the highest-paying sectors in the market when it comes to dividend yields. For this reason, they have benefitted greatly from the epic “reach for yield” we have seen over the past decade inspired by ZIRP and QE.

(Click on image to enlarge)

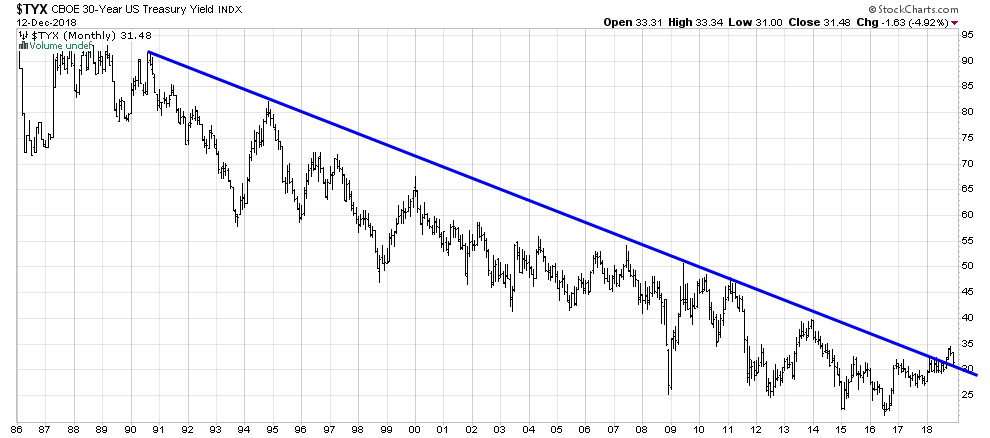

However, if the bull market in bonds did, in fact, come to an end in the summer of 2016 as some have posited then the new trend of rising interest rates could, over time, put a great deal of pressure on these stocks which have benefitted so greatly from the lowest interest rates in history.

(Click on image to enlarge)

Either way, buying anything at a record-high valuation is not normally an effective way of employing a conservative approach to investing. For this reason, investors may need to look elsewhere if they want to truly play defense in the current market environment.

Disclosure: Information in “The Felder Report” (TFR), including all the information on the Felder Report website, comes from independent sources believed reliable but accuracy is not ...

more