Who's Buying?

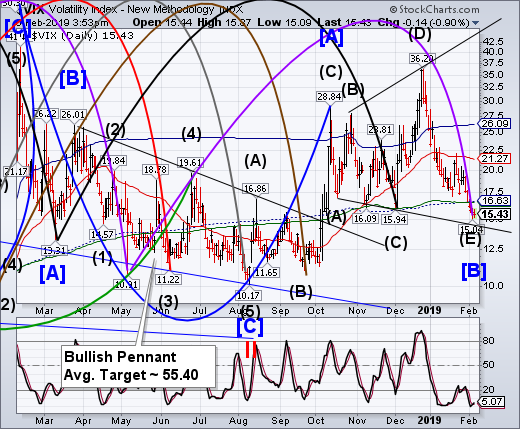

VIX has spent the past week beneath mid-Cycle support/resistance and the 200-day Moving Average at 16.63. Volatility shorts are having a field day again. However, VIX may have just made its Master Cycle low yesterday. It’s time to exercise due care.

-- The NYSE Hi-Lo Index made an inverted Master Cycle high not seen since last July on February 1. The Cycles Model suggests that it is stretched and overdue for a strong reversal.

(ZeroHedge) Stock markets are flying. Credit spreads are tightening in a parabolic fashion. It makes no difference whether it’s investment grade credits or high yield. Presumably, there isn’t a risk to be found in the world. Gold prices are showing definite signs of stalling without even testing the next area of resistance the metal was widely expected to blow through. Who can be bothered with safety? The most negative thing you will read is someone saying this is a tactical rather than strategic opportunity to ride carry to the first-half glory.

And then have a look at yields on global sovereign debt to sober you up.

There isn’t any way to explain the prevailing level of rates, other than people are scared amid all these upbeat prints on their screens. This has nothing to do with risk parity. Bond buyers aren’t hedging their equity longs. There is simply a presumption out there that the rate-hiking cycle is over.

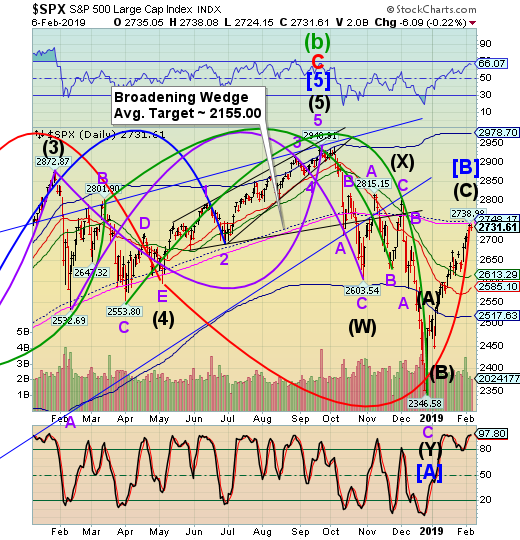

-- The SPX rally surged into its (inverted) Master Cycle high on Tuesday, stopping short of its 200-day Moving Average at 2742.08. Cycles require meeting both time and price targets. In this case, the time was extended to accommodate the price target. The next agenda item is a retest of the December low.

(Bloomberg) U.S. stocks fell in thin trading as investors weighed corporate earnings against persistent concerns over trade and another government shutdown. The dollar extended its rally to a fifth day.

The S&P 500 declined for the first time in six sessions with volumes below the 30-day average. President Donald Trump’s speech to Congress did little to remove trade and shutdown concerns, putting the focus on earnings-related moves. The Nasdaq composite slid along with Alphabet, while Electronic Arts and Take-Two plunged after disappointing numbers. Microchip Technology’s call for a bottom in the chip cycle boosted semiconductor makers.

Investors remained on edge with the deadline for Congress to reach a deal on keeping the government open fast approaching with little sign of compromise. There are also looming meetings in Beijing next week between U.S. trade representatives and their Chinese counterparts.

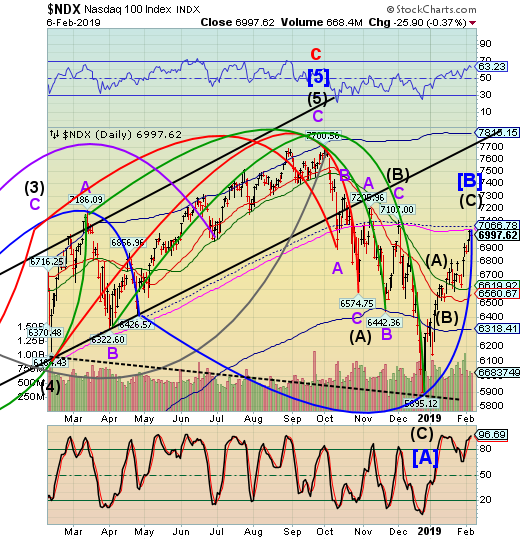

-- NDX may have completed its rally this morning by edging up to the 200-day Moving Average at 7040.62. Some analysts are predicting that it may go above that level. However, a major Pivot is overdue. Should it reverse, it will have completed the right shoulder of a new Head & Shoulders formation. If valid, new downside lows may be made. I will publish the target at the break of the neckline.

(ZeroHedge) With sales of its signature iPhone slumping and CEO Tim Cook shifting the emphasis to Apple's booming services business, the company announced on Tuesday that long-time retail head Angela Ahrendt will be leaving the company after a five-year stint at the consumer tech giant.

And on Wednesday morning, the company revealed that Ahrendt - who joined Apple from British fashion house Burberry - will be replaced by Deirdre O’Brien, currently the company's head of HR, who will now enjoy a new (if unorthodox) dual role as head of retail and people.

Analysts greeted the news of O'Brien's appointment with enthusiasm, though some noted that her combined role could be a source of confusion.

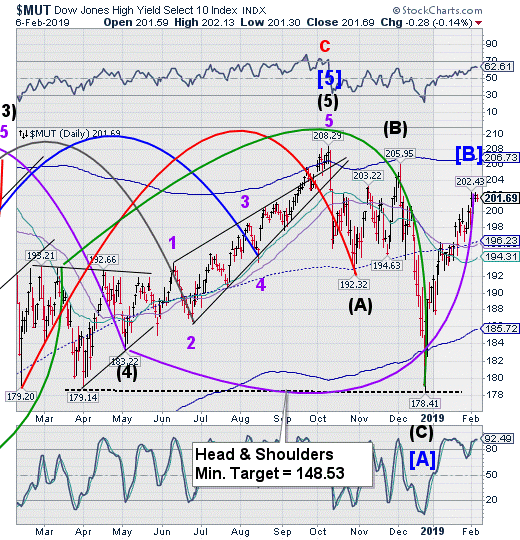

The High Yield Bond Index may have peaked at round number resistance at 200.00 on Monday. Since then it has consolidated near the high as it awaits the other indexes making their pivot.

(Reuters) - While stocks hog the limelight with their best January in three decades, another corner of the risk assets marketplace sprang back to life last month after having taken a pounding at the end of last year, though some investors question whether the recovery has legs.

Junk bonds in January delivered their strongest monthly performance in more than seven years with a total return of nearly 4.6 percent, according to ICE BofAML index data, retracing almost all of the fourth quarter’s losses. Issuance of new debt rebounded after a near-complete shutdown in December.

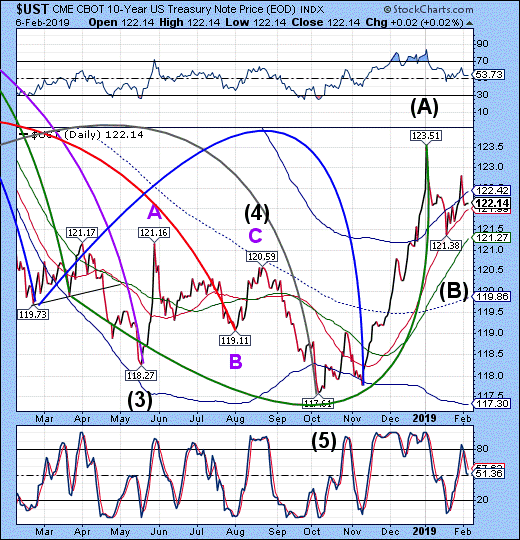

10-Year Treasury Notes pulled back from Thursday’s high at 122.80, consolidating near Intermediate-term support at 121.99. The Cycles Model calls for a possible over the next week or longer which, in all probability, may find support near the mid-Cycle area.

(ZeroHedge) One day after a surprisingly strong 3Y auction priced, stopping through the When Issued for the first time after 10 consecutive tails, moments ago the US Treasury sold $27BN in 10Y paper in what can only be described as a poor, sloppy auction, which stopped at 2.689%, which while the lowest yield for a 10Y issue since January 2018, tailed the When Issued 2.681% by 0.8bps.

The internals confirmed the weak nature of today's auction, with the Bid to Cover sliding from 2.51 in January to only 2.35, which was tied with the lowest since February 2018; it was also well below the 6 month average of 2.49.

Finally, looking at the buy side, there was a distinct lack of enthusiasm by foreign buyers, with the Indirects taking down just 59.5, which while above last month's weak 56.9%, was below the recent average of 63.9%. At the same time, the Direct bid tumbled from 20.8% to 12.2%, the lowest since December if above the 10.5% average, which however was dragged down by November's surprisingly low 1.2% takedown. Dealers were left with 28.4% of the final allotment, the highest since October.

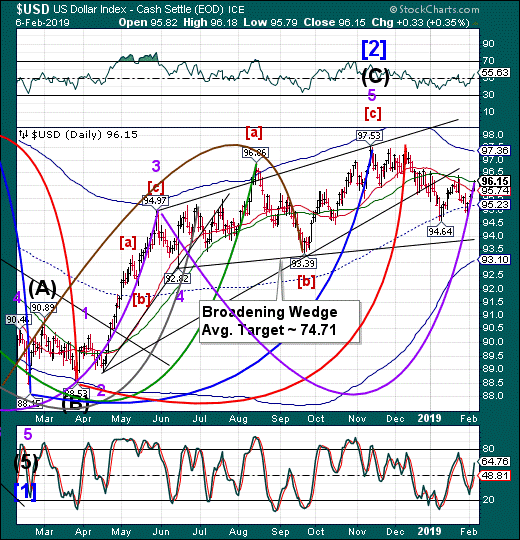

The U.S. Dollar may be just days away from another Master Cycle inversion (high). The Cycles Model suggests a substantial pivot may occur within the next week. Today appears to be the last day of strength for this Cycle, so incremental new highs, if any, may be small.

(Investing.com) - The greenback rose to an almost one-and-a-half-week high Tuesday even as services sector data slowed to a five-month low in January.

The Institute of Supply Management said its non-manufacturing purchasing managers’ index (PMI) fell to 56.7 from 58.0 in December, as worry over the impact of the government shutdown weighed on businesses.

But Friday’s upbeat jobs numbers, along with ISM manufacturing data, helped ease concerns of a slowing economy.

The U.S. dollar index, which measures the greenback’s strength against a basket of six major currencies, increased 0.23% to 95.79 as of 10:58 AM ET (15:58 GMT).

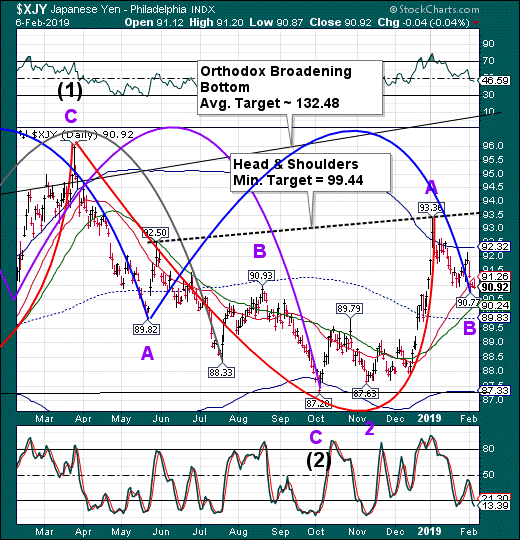

--The Yen declined to a Master Cycle low on February 4. The next move appears to be a rally to the Head & Shoulders neckline near 93.50 and its subsequent target. If the Cycles are correct, there may be an extended rally that could last up to 6 weeks.

(Bloomberg) As investors adjust to the prospect of a slowing global economy, JPMorgan Asset Management is turning to the yen for protection from an uncertain outlook.

“The yen has the attraction that it’s still very cheap versus its history,” Olivia Mayell, managing director, multi-asset solutions, at the $1.7 trillion investment firm, said in Sydney. “Our fundamental view is that it does get a little bit stronger from where it’s been regardless of market stress. It’s one of the cheaper hedges you can put in the portfolio today.”

The Nikkei appears to have completed its retracement on Tuesday. A breakdown Intermediate-term support at 20616.21 puts the Nikkei on a sell signal. The Cycles Model calls for the decline to last up to two months.

(Reuters) - Japan’s Nikkei edged up on Wednesday with markets barely reacting to U.S. President Donald Trump’s State of the Union address, while attention remained on corporate earnings.

Toyota Motor Corp slipped into negative territory after the automaker cut its annual net profit outlook during afternoon trade. The stock ended 0.7 percent lower.

The Nikkei share average rose 0.1 percent to 20,874.06.

In an 82-minute speech that began at 0200 GMT, Trump said he wanted a U.S. immigration system that was “safe, lawful, modern and secure” as he continued to seek funding for a border wall rejected by Democrats.

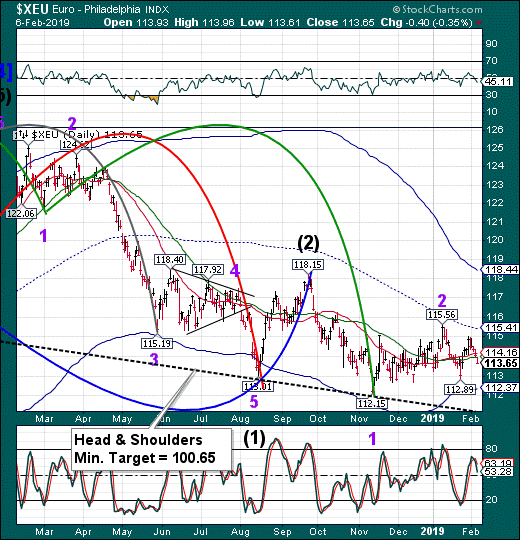

The Euro declined back through the 50-day Moving Average, putting it on a sell signal. The Cycles Model suggests another week or more of decline ahead. A likely target for the decline may be the Head & Shoulders neckline.

(CCN) With newly released data showing slower growth in the euro-zone, the struggle of Deutsche Bank, and BNP Paribas cutting $683 million in expenses, the euro may be in deep trouble.

In the last quarter of 2018, a period in which even U.S. banks underperformed, the global markets division of BNP Paribas recorded a $256 million loss.

BNP Paribas, the largest bank in France, ended 2018 with a staggering 40 percent loss in trading according to FT.

EuroStoxx 50 Index continues to extend its inverted Master Cycle to new highs. While it appeared to be topping early last week, it is now time for a reversal. The Cycles Model may turn bearish with a Master Cycle low due in March.

(Reuters) - European shares inched up to touch 12-week highs on Wednesday, fueled by strong gains in Italian banks and tech stocks, while Ubisoft sank following a revenue warning from U.S. videogame maker Electronic Arts.

Europe’s STOXX 600 managed a 0.2 percent gain by the close, having oscillated in and out of negative territory during the day.

The regional benchmark hid wide variations at country level: Germany’s trade-sensitive DAX was down 0.4 percent and France’s CAC 40 fell 0.1 percent while Italy’s FTSE MIB jumped 0.8 percent.

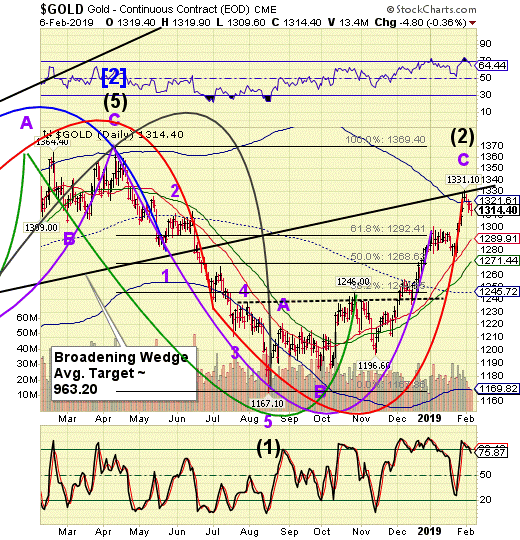

-- Gold tested the trendline of the Broadening Wedge formation last Thursday, simultaneously making an Inverted Master Cycle high. It has since reversed down and is now on a sell signal beneath the Cycle Top resistance at 1321.61. The resulting decline may last up to 6 weeks.

(CNBC) Gold eased on Wednesday on a firmer dollar but held in a $5 range as investors waited for signs of resolution in U.S.-China trade talks, while keeping an eye on the Federal Reserve’s monetary policy.

Spot gold was 0.41 percent lower at $1,309.55 per ounce at 1:50 p.m. EST.

U.S. gold futures settled down $4.80 at $1,314.4

“For gold prices to firm further, we need to see signs of easing trade tensions,” which could stem safe-haven flows into the dollar, said Suki Cooper, precious metals analyst at Standard Chartered Bank.

“Gold is likely to consolidate above $1,300 before we see the next move higher.”

West Texas Intermediate Crude reversed from its Master Cycle high on Monday and may have completed a reversal pattern. A decline beneath the trendline at 50.71 activates the larger Broadening Wedge formation and a sell signal. This signal may be just as strong as the signal given on October 3.

(OilPrice) A day after the American Petroleum Institute disappointed oil bulls by reporting an estimated inventory build across the board, the Energy Information Administration deepened the mood by saying U.S. crude oil inventories added 1.3 million barrels in the week to February 1.

At 447.2 million barrels, the EIA said, U.S. crude oil inventories are still above the seasonal average but not by much.

In gasoline, the authority reported a build of 500,000 barrels, with daily production at a little less than 9.9 million barrels. A week earlier, gasoline inventories fell by 2.2 million barrels after four weekly builds, and hefty ones, at that, with production averaging 9.9 million bpd.

The Shanghai Index went on sabbatical as of last Friday. It closed just above the 50-day Moving Average at 2577.55, leaving it short-term neutral-to-positive. The Cycles Model indicates weakness may resume, lasting through mid-March. But first, Spring Festival has begun and will continue until Sunday. The Chinese market resumes on Monday, February 11.

(ZeroHedge) The Chinese New Year begins today, and the year of the dog will cede its place to the pig, a zodiac sign that is supposed to attract luck and success.

Chinese New Year is one of the largest holidays for travel. During the New Year, hundreds of millions of people take planes, trains, and automobiles to celebrate the event with their friends and families.

This year, more than 400 million people celebrating Chinese New Year are expected to travel, including nearly 7 million abroad mainly in Thailand, Japan and Indonesia, according to Ctrip estimates.

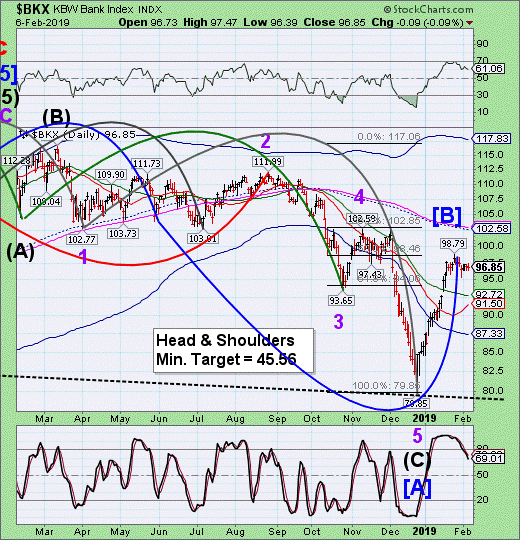

-- BKX has been consolidating near the Master Cycle high since January 25. The Cycles Model suggests a decline to develop through late February. However, the next Master Cycle low may not be due until late March.

(Bloomberg) Major U.S. banks shaved about $21 billion from their tax bills last year -- almost double the IRS’s annual budget -- as the industry benefited more than many others from the Republican tax overhaul.

By year-end, most of the nation’s largest lenders met or exceeded their initial predictions for tax savings. On average, the banks saw their effective tax rates fall below 19 percent from the roughly 28 percent they paid in 2016. And while the breaks set off a gusher of payouts to shareholders, firms cut thousands of jobs and saw their lending growth slow.

The tally is based on a review of financial results and commentary from the 23 U.S. banks the Federal Reserve deems most important to the nation’s economy in annual stress tests. Banks stood to benefit more from lower tax rates because their effective rates were typically higher than those paid by non-financial companies. In other words, their bills had more room to fall. They’re also among the first industries to post annual results.

(ZeroHedge) In a report that elicited chuckles from some corners of Wall Street, the Washington Post reported late Monday that President Trump planned to nominate Treasury Undersecretary for International Affairs David Malpass - who, in addition to serving as the chief economist at Bear Stearns as the investment bank spiraled into bankruptcy, also worked in the Reagan and Bush the elder administrations - to be the next president of the World Bank.

Due to a decades-old agreement with European nations, Washington picks the head of the World Bank while Europe chooses the head of the IMF. Since 1944, the World Bank's 12-member board has never refused to confirm Washington's pick, meaning that Malpass's confirmation is virtually assured - barring an unforeseen and unprecedented break with unprecedented.

One "person close to Malpass," told WaPo that he would seek to be a "constructive" World Bank president, though he declined to comment on Malpass's agenda beyond saying he would seek to protect US interests and raise incomes in developing nations.

(ZeroHedge) The latest alarm signal that the US economy is on collision course with a recession came after today's release of the latest Senior Loan Officer Opinion Survey (SLOOS) by the Federal Reserve, which was conducted for bank lending activity during the fourth quarter of last year, and which reported a double whammy of tightening lending standards and terms for commercial and industrial loans on one hand, and weaker demand for those loans on the other. Even more concerning is that banks also reported weaker demand for both commercial and residential real estate loans, echoing the softer housing data in recent months.

Disclaimer: Nothing in this article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more