Who In Their Right Mind Would Lend Money To Chicago?

When you see that Italy’s debt is rising, the logical question is, who the hell is dumping good money after bad into such an obviously failed state? The answer is that by lending money to Italy (or Greece, Portugal, Spain, or France) you’re really lending money to Germany, since the latter will have to bail those other countries out shortly.

Keep that in mind as you read this, from yesterday’s Wall Street Journal:

Cash-Strapped Illinois, Chicago Seek Billions From Investors

Illinois and its biggest city kick off hundreds of millions of dollars in borrowings this week, a test of investors’ willingness to lend to stressed governments prone to spending more money than they bring in.

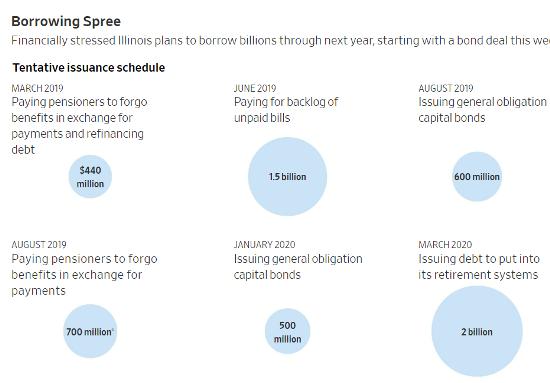

The state launched borrowings with about a $440 million bond deal on Tuesday, followed by a sale topping $700 million by Chicago. Analysts expect what could be billions more especially from the state, as it puts together funds to do everything from paying retirees’ pensions to launching capital projects.

(Click on image to enlarge)

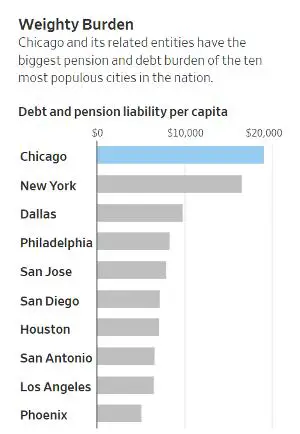

Before buying bonds from the nation’s lowest-rated state and its biggest city, investors have to assess their continuing mismatches between expenses and revenues along with pension burdens, which are slated to eat up a growing share of both budgets in coming years. Municipalities nationwide are grappling with how to pay bondholders while also meeting the rising costs of retirement benefits, but few are as financially strained as the nation’s third-largest city and the state.

(Click on image to enlarge)

Illinois leaders have floated borrowing at least $4.5 billion more through next year, according to its financials. Rather than using most funds to build bridges or improve infrastructure, the Prairie State plans to use many of its bonds to pay off outstanding debts or put money toward pension benefits that have already been earned. For example, a proposed $1.5 billion borrowing tentatively scheduled for June would help pay for a pile of unpaid bills the state still owes. Lawmakers failed to pass a budget for two years under the former governor, worsening this backlog.

Rahm Emanuel’s last bond deal as Chicago’s mayor will be used to pay off previous short-term borrowing alongside projects including sidewalk improvements and traffic signal installation. He considered selling $10 billion of debt to fund pensions, but it will be up to his successor—elected this April—to decide whether to move forward.

Illinois’s rating sits just above junk level. Chicago holds a speculative grade from Moody’s Corp. and investment-grade scores from S&P Global Inc. and other firms. Chicago didn’t hire Moody’s for its latest bond deal.

Despite their precarious finances, the city and state’s leaders have turned to the bond market at what some analysts say is an opportune time. Investors have poured money into municipal bonds in recent weeks, vying for a relatively limited supply of debt, analysts say, and lifting prices while pushing down the yields of even some existing Illinois and Chicago bonds.

That background helps ensure demand for the new bonds, analysts said, in the latest example of how investors’ voracious appetite for debt can help governments find willing lenders despite fiscal stress.

Here’s the key passage that ties Illinois/Chicago back to Italy:

“Despite their precarious finances, the city and state’s leaders have turned to the bond market at what some analysts say is an opportune time. Investors have poured money into municipal bonds in recent weeks, vying for a relatively limited supply of debt, analysts say, and lifting prices while pushing down the yields of even some existing Illinois and Chicago bonds.”

Why would such obviously crappy paper be such an easy sell? Because investors are looking ahead to the next Great Reflation, in which the Fed and other major central banks are forced to unleash a tidal wave of new credit to bail out the bad debts incurred in the previous round of monetary experimentation.

If the express goal is to keep bad debts from blowing up the global financial system, then by definition Illinois/Chicago will be bailed out, since they personify the concept of “bad debt”. So today’s junk munis are tomorrow’s Fed balance sheet assets. Which is another way of saying they’re taxpayers’ responsibility, not Chicago’s.