Which Message Is The Right Message?

There can be little argument that the stock market is a slave to the news at the present time. Friday's surprise pronouncement that the President plans to use tariffs in a new way is exhibited A in this argument. Tweets go out. Threats are made. Uncertainty increases. Stocks are sold. Bonds are bought. Rinse and repeat. Such has been the routine since the beginning of May.

The bears are quick to point out that this is just the beginning. A warm-up act, if you will, for what is sure to come. The glass-is-half-empty gang contends that the "message" from the bond market is a dire one and that stock market investors should (a) pay attention to what the bond market is saying and (b) expect a retest (or worse) of the December debacle.

The Dance To The Downside

In case you missed it, bond yields continued their vigorous dance to the downside last week. The yield on the U.S. 10-Year finished at 2.142%, which was the lowest level since the fall of 2017. And the fact that the yield curve (as defined by the spread between the yields of the 10-year Treasury bond and the 3-month T-bill) has inverted, is also getting a lot of attention. You know, because such an event is generally viewed as a warning of recession.

US 10-Year T-Note Yield - Daily

(Click on image to enlarge)

It is also worth noting that the ginormous move in yields isn't limited to our shores. No, European yields are diving as well with a host of benchmarks moving into negative territory again. Heck, even Greek bonds hit their lowest levels in ages last week.

Now toss in the news that the odds (as determined by the futures market) of at least one rate cut this year have spiked and the "message" from the bond market seems to be that the economy is heading in the wrong direction.

There have been numerous reports on the anticipated impact the current trade spat with China will have on the economy. Now analysts are busy calculating the potential damage that could be inflicted from the Mexico thing. The key seems to be that economic uncertainty is on the rise and the risk of recession would appear to be real. Or so the pouting pundits contend.

Mixed Messages

However, I found some interesting research over the weekend from Jim Paulsen, Chief Investment Strategist at the Leuthold Group. As reported in Barron's, Paulsen's work suggests that the "message" from the bond market is at odds from that of the real economy. And based on his historical review, such mixed messages tend to be resolved bullishly in the stock market.

Paulsen went back to 1967 and constructed a model to compare consumer confidence (i.e. the real economy) to the 10-year Treasury yield. He looked for periods when consumer confidence was high, and yields were falling. The thinking is to look at what happens when the real economy is doing well and yet yields were "warning" of problems.

What Paulsen found is that stock market investors should stick with what is actually happening in the economy, as opposed to what bond investors think might happen next.

Specifically, Paulsen found that when his so-called "confidence gap" (the spread between consumer confidence and the 10-year) has been in the highest quartile, the ensuing 6-month return for the S&P 500 averaged 14.3%, which is well above the historical mean - and only 6.7% when the confidence gap was in the lowest quartile.

Paulsen's work also found that the odds of a decline in stocks over the next six months were also much lower when consumer confidence diverged from the "message" of the bond market. When the confidence gap is in the upper quartile, the chances of a loss for the S&P over the next six months was 20.4%. And when the confidence gap is in the lower quartile, the odds of a loss in stocks was almost double at 38%.

Oh, and Paulsen's model is currently in the 93rd percentile of all readings since 1967. So, the odds would seem to suggest that stocks should fare well in the coming six months.

Which Message?

To be sure, there are mixed messages in this market. The bond market message, as told by diving yields and an inverted curve, suggests that the economy is heading for a recession. The message from consumer confidence and the labor market would seem to be that everything is just fine, thank you. The message from the stock market is that it's time to worry. The message from the Fed Funds futures suggests that the Fed may have to get even more dovish and take action later this year. And the message from the White House is, well, good luck with that one. Let's just say, it's complicated.

The bottom line is that the mixed messages create, at the very least, uncertainty. And as we all know, the stock market hates uncertainty. So, what do stock traders and their computers do when uncertainty increases? They sell first and as questions later. Of course, this causes millisecond trend-following algos to jump on board the bear train. Which, naturally, leads to a "whoosh" down in the indices and creates additional uncertainty. Again, rinse and repeat.

My Take

For now, at least, my view is that we've got another emotional, news-driven market on our hands. In my experience, this is the type of market where it pays to either "panic early or not at all." As we learned from the December/January-April experience, the news can and often does change quickly. Currently, all the news is bad. Uncertainty reigns supreme. And the expectation is the economy's growth is at risk.

Yet we must keep in mind that we are seeing the sausage being made, so to speak, in terms of ongoing negotiations. And given that it's election season, we can probably expect some good news to occur at some point.

On that note, it would seem to make sense that a trade deal with China might "play" better in the spring of 2020. But then again, the stock market game and to a large degree, the state of the economy, is about confidence. So, something to build a little confidence about the future should probably be expected.

Disclosures

At the time of publication, Mr. Moenning held long positions in the following securities mentioned: None - Note that positions may change at any time.

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

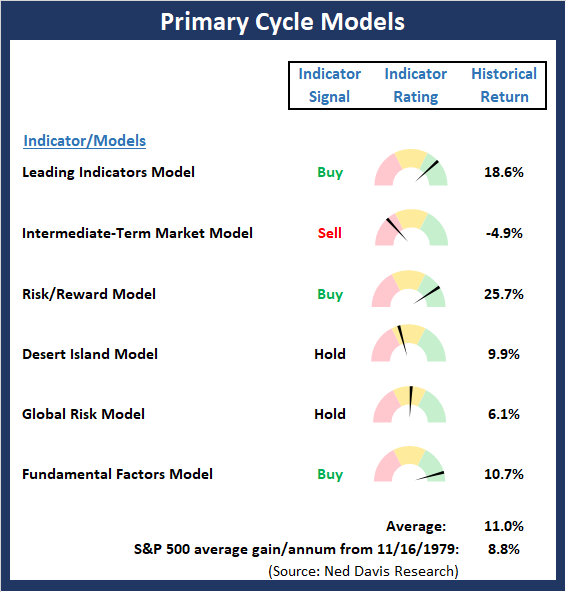

The State of My Favorite Big-Picture Market Models

There are no changes to the Primary Cycle board this week. While the price action has been weak in response to the trade headlines, the overall "state" of the primary cycle indicators hasn't changed much and the odds continue to favor the bulls from a big-picture standpoint.

This week's mean percentage score of my 6 favorite models was unchanged at 60% (Prior readings: 72.5%, 81.1%, 83.9%, 84.7%, 74.6%, 58.0%) while the median also held steady at 62.5% (Prior readings: 80.0% 82.5%, 86.7%, 86.7%, 81.8%, 65.9%, 50%).

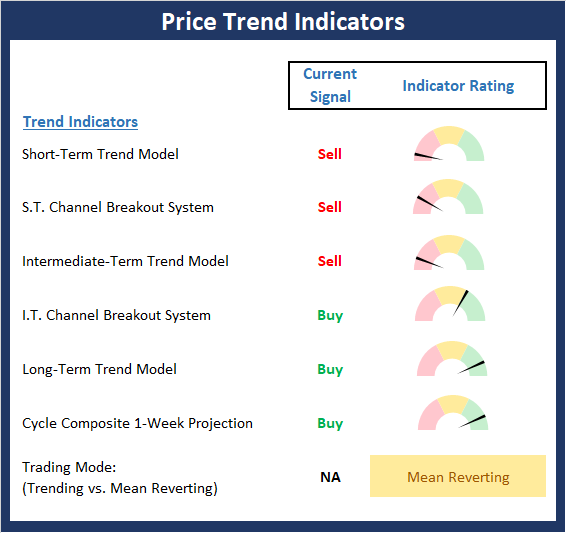

The State of the Trend

With the President continuing to surprise markets and uncertainty increasing on a daily basis, Captain Obvious tells us that the pullback/corrective phase is likely to continue unabated. As expected, the major indices have all broken below their respective 200-day moving averages, which causes some to change their view of the overall environment. However, with the S&P's 200-day basically flat, such pronouncements should be taken with a fairly large grain of salt.

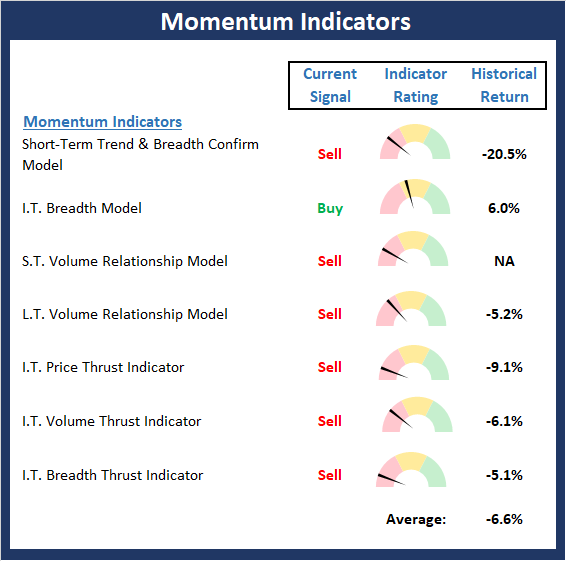

The State of Internal Momentum

Not surprisingly, the Momentum Board continues to weaken. And with only one buy signal on the board, an objective analysis suggests that the current decline could become more meaningful in the coming weeks.

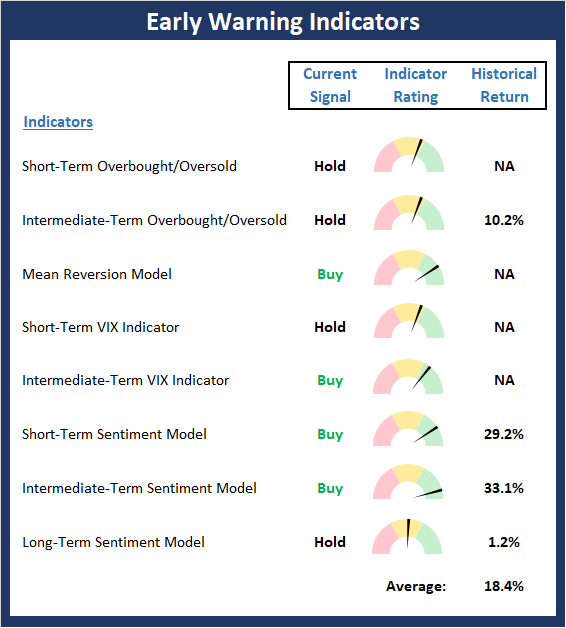

The State of the "Trade"

The Early Warning board pulled back a bit last week. And while the current setup is not "table pounding" as this time, it is moving in that direction.

The State of the Fundamental Backdrop

There were no changes to the Fundamentals board this week. So the bottom line remains the same: I believe the backdrop continues to support an ongoing bull market once the current corrective phase/news-driven environment plays out. (As long as the trade war doesn't persist and damage the economy, of course.)

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more