Where's The Smart Money Investing Now?

Let's face it: nobody thinks they're the dumb money. But to quote Warren Buffett, "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy."

In the vast majority of cases, retail investors are the patsies, hype-buying and panic-selling at the worst possible times. In the battle of the 'tutes (institutional investors) versus the 'tails (retail traders), the 'tutes almost always outperform the 'tails.

Hedge funds base their allocations more on data, while retail investors are driven by sentiment - but in this day and age, with easy access to plenty of data, retail traders have few barriers and no excuses when it comes to financial information. With that in mind, let's examine some of the data which might shed a bit of light on where the smart money is - and just as importantly, is not - positioning itself now.

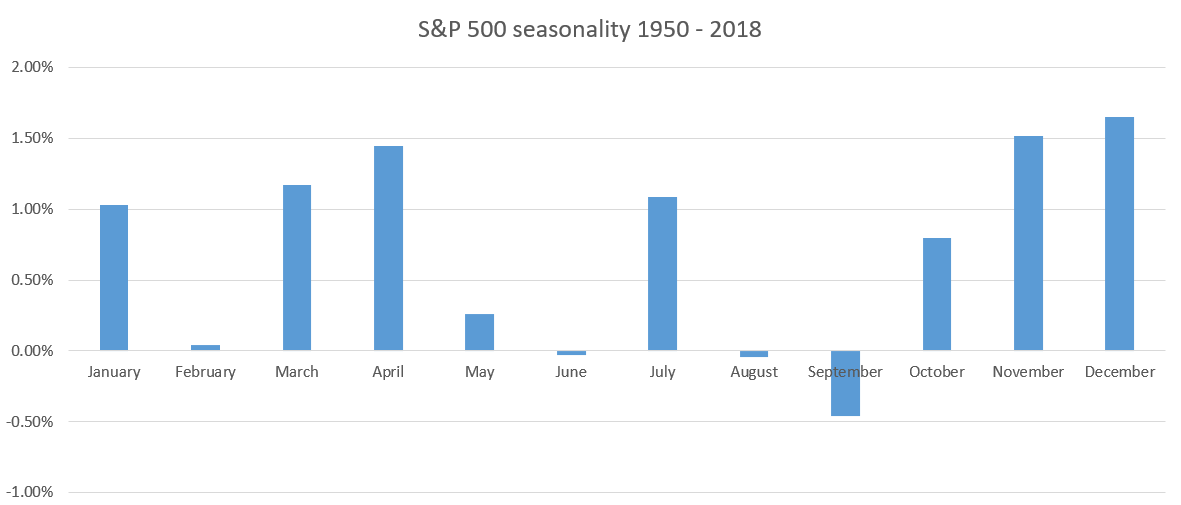

First of all, seasonality dictates that September is likely to be worse than August:

(Click on image to enlarge)

Courtesy: bullmarkets.co

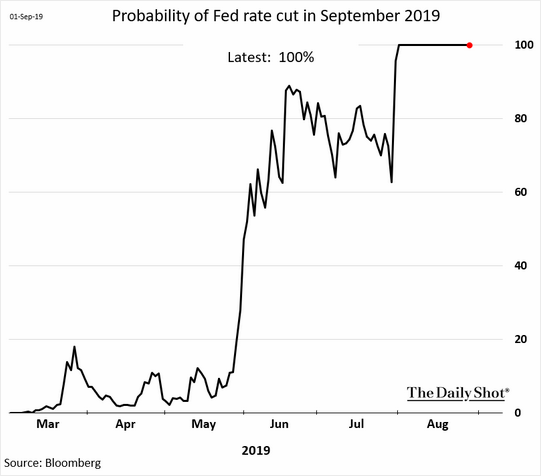

Everybody knows that a rate cut is coming in September, a known fact that's already been priced into the equities markets:

Courtesy: Bloomberg, The Daily Shot

The entire bond market is one gigantic yield curve:

.png)

Courtesy: Treasury Department, U.S. Global Investors

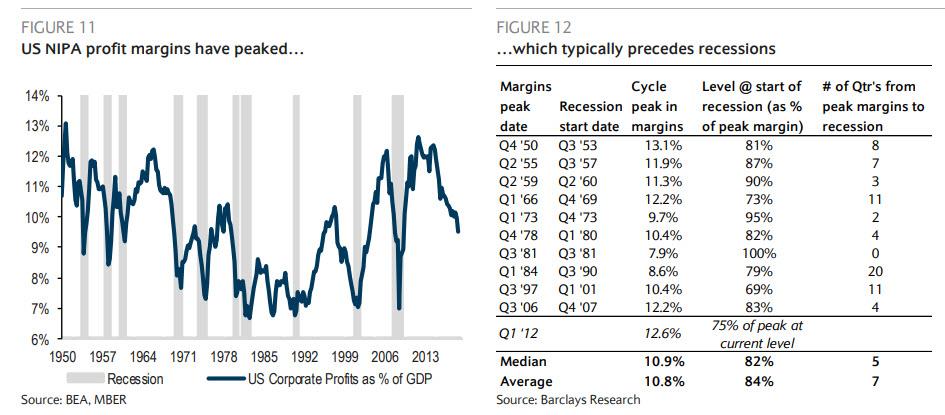

There's a glut of yield-curve charts going around, so now I'll mix it up with equally reliable and ominous but lesser-known U.S. NIPA profit-margins recession indicator:

Courtesy: BEA, MBER, Barclays Research

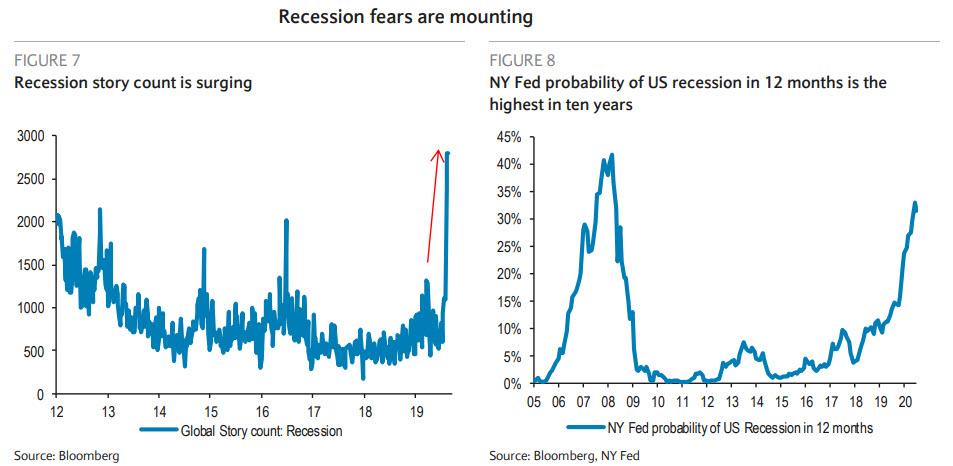

Even the Federal Reserve is admitting that a recession is becoming increasingly likely:

Courtesy: Bloomberg, NY Fed

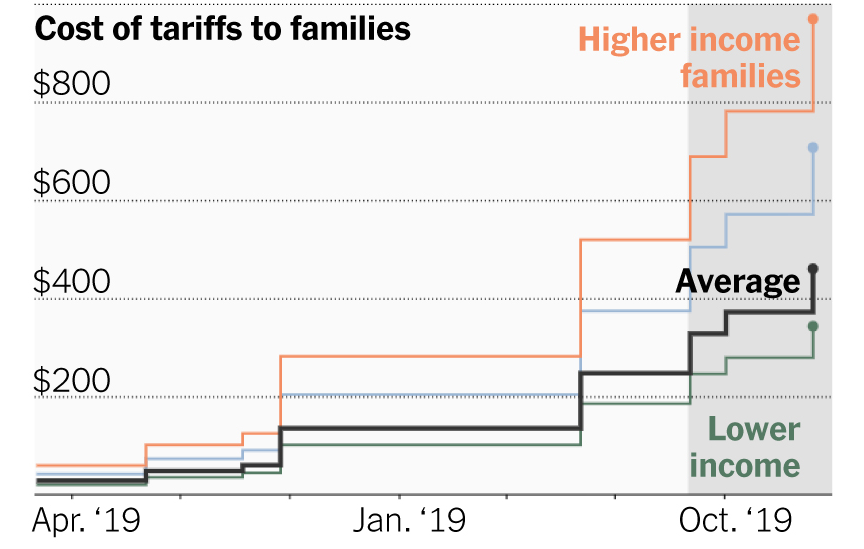

Whether you agree with the trade war or not, there's no denying that it's taking a toll on the economy at all strata:

Courtesy: New York Times

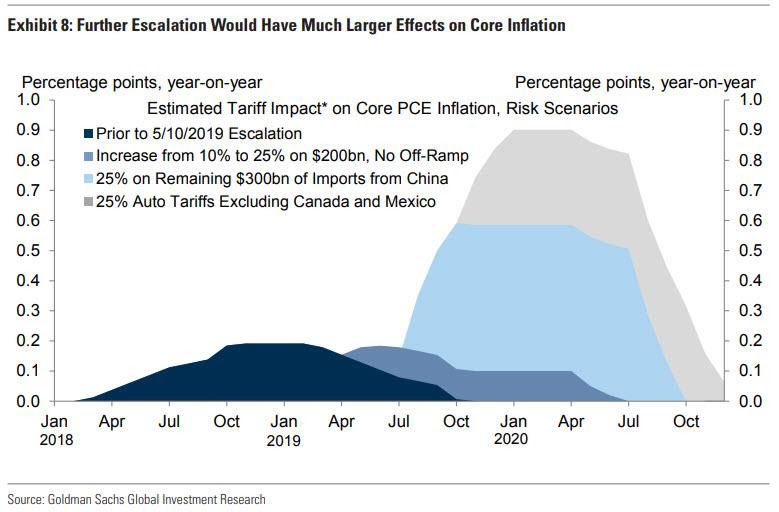

Further trade-war escalation, which is pretty much inevitable at this point, will make the price of practically all consumer goods go up (we're already seeing this happening), which in turn will take a major toll on the economy:

Courtesy: Goldman Sachs Global Investment Research

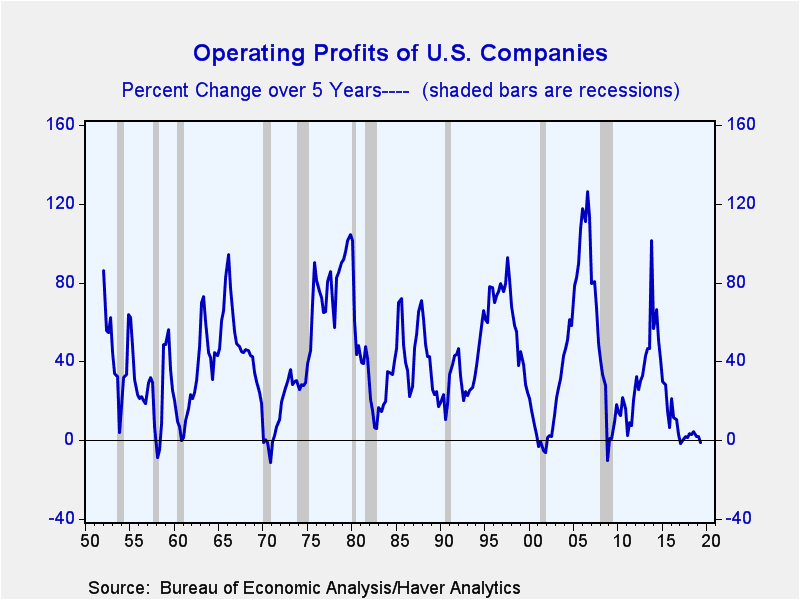

American companies' operating profits are already where they would typically be during a recession:

Courtesy: Bureau of Economic Analysis/Haver Analytics

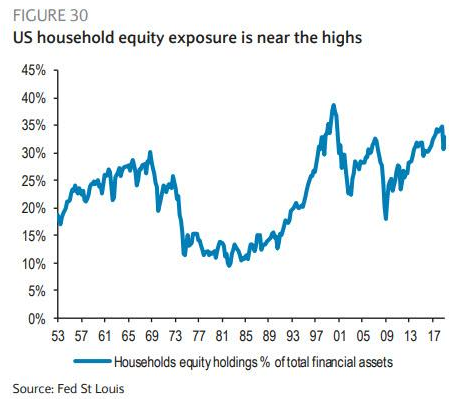

Of course, the retail crowd doesn't know (or worse yet, doesn't care) about any of the foregoing, and is panic-buying stocks en masse:

Courtesy: St. Louis Fed

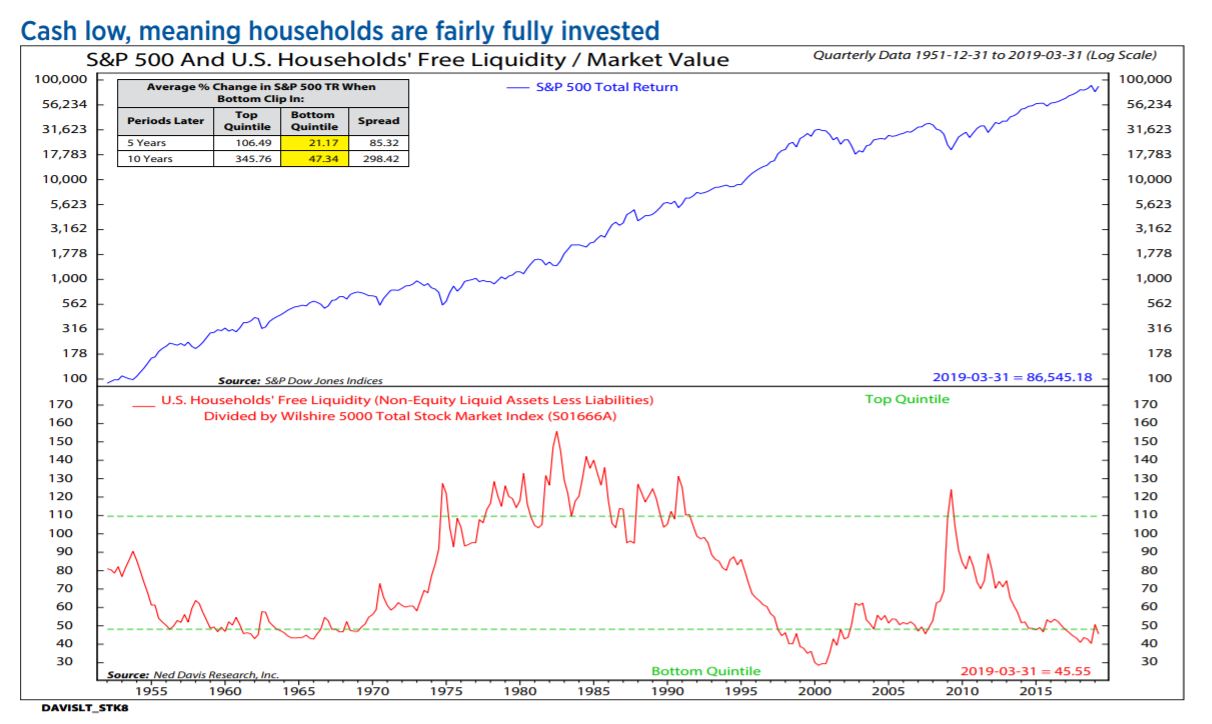

Indeed, the 'tails are fully invested to the point that they're cash-poor:

Courtesy: Ned Davis Research, Inc.

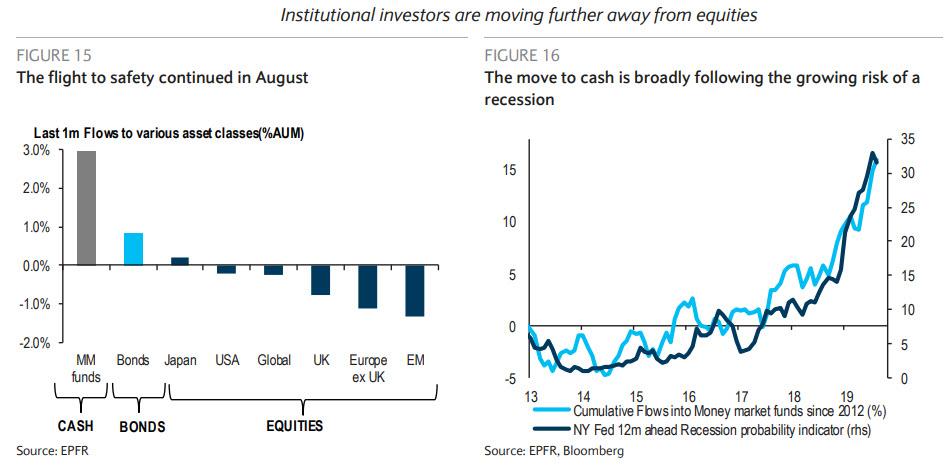

As expected, the 'tutes are moving in the opposite direction of the 'tails, pulling out of stocks and moving into cash in response to the unappealing data:

Courtesy: EPFR, Bloomberg

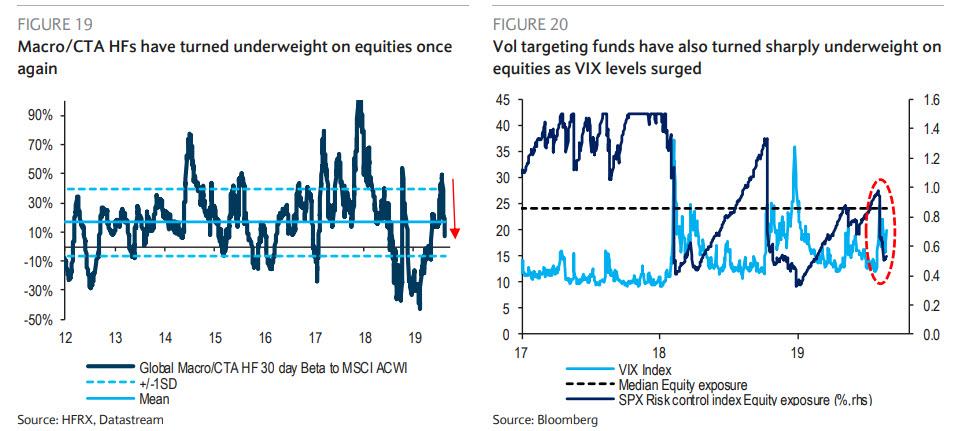

Both macro-focused hedge funds and vol-targeting funds are shunning equities:

Courtesy: HFRX, Datastream, Bloomberg

Along with a cash position as dry powder in anticipation of lower equities prices, the smart money is also making a move into precious metals:

.png)

Courtesy: Bloomberg, U.S. Global Investors

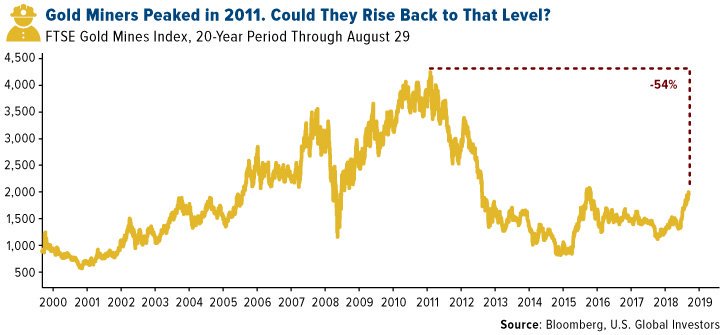

... and miners, which have plenty more room to climb:

Courtesy: Bloomberg, U.S. Global Investors

When it comes to investing, there's no safety in numbers: swim with the crowds and you'll drown sooner or later. If you're smart, you'll follow the smart money; if not, you're better off staying out of the markets.

Disclosure: David Moadel is not a licensed or registered investment advisor, and has no position in any securities listed herein.