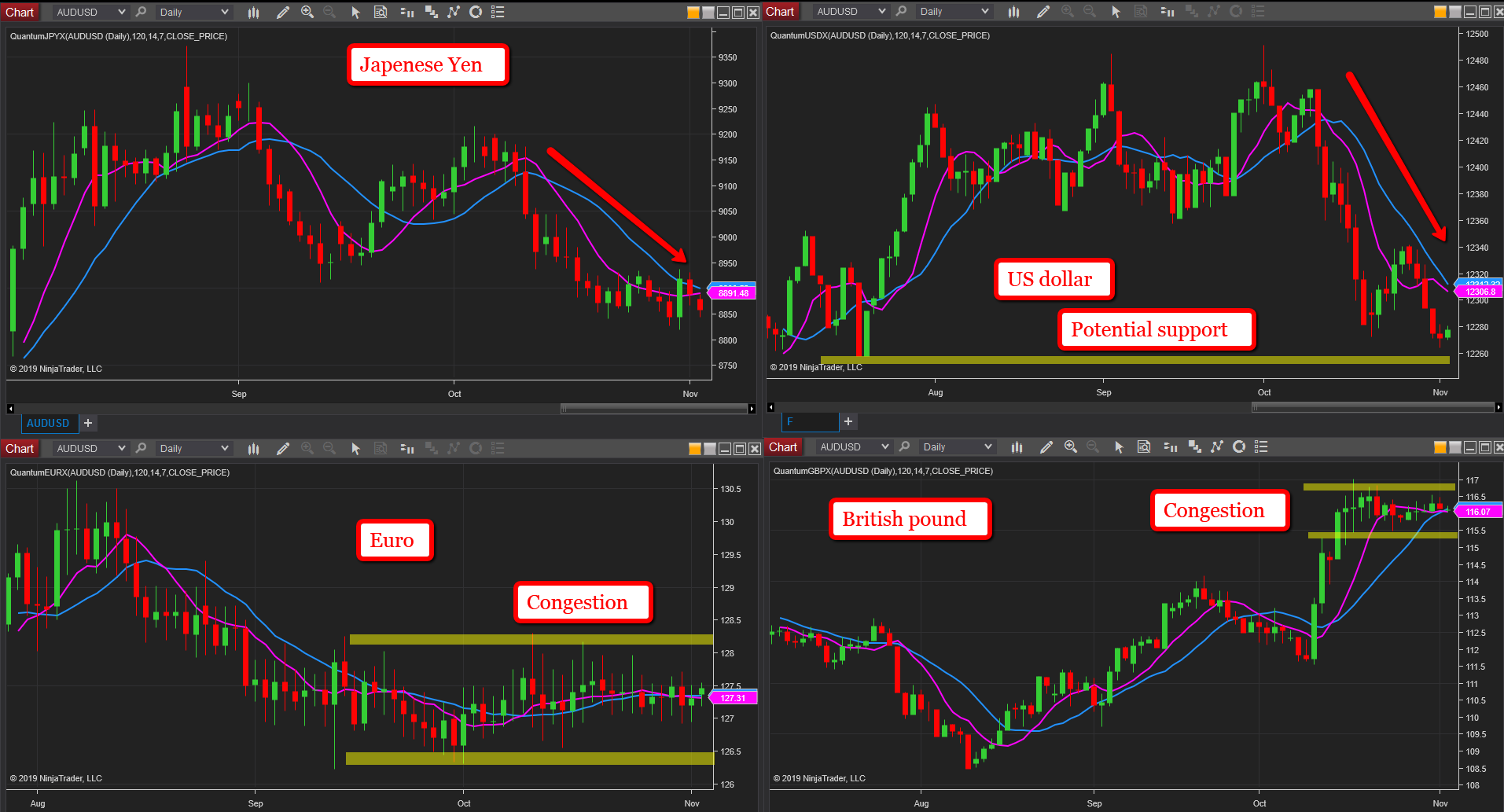

Where Next For Currencies This Week?

The start of the trading week is a good time to check on the daily charts of our four currency indices, namely the Japanese yen, the US dollar, the euro, and the British pound. And if we start with the Japanese yen, the trend for the currency continues to remain bearish and reflecting the current bullish risk on sentiment for US equities and markets in general, with the VIX also continuing to weaken and closing last week’s trading session at 12.30 and approaching key support at 12.00. For the last week or so the yen too has been testing important support in the 8850 area which continues to hold.

It’s clear the US dollar has now developed a significant bearish trend and continues to remain very weak with the 12,260 level now coming into play as a potential platform of support. However, if this is breached we are likely to see further downside momentum before the currency reaches an oversold state on the currency strength indicator as outlined in more detail on my post on gold.

The euro continues to remain rangebound and is failing to find much in the way of upside momentum, with the fundamentals of German PMI data weighing heavily on the single currency.

Finally, to the British pound where the price action is now likely to remain waterlogged interspersed with bouts of volatility until the result of the 12th December election. A clear majority for the Conservative party should see the start of a strong bullish trend for the currency.

(Click on image to enlarge)

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more