WhatsTrading Recap - 02/04/2015

Quiet trading on Wall Street despite ongoing volatility in the energy market. Crude oil was recently down $4.42 to $48.63 in the wake of this morning’s Weekly Inventory data.XLK

Consequently, energy (XLE) is off 1.7% and the worst performing S&P sector. Utilities (XLU), basic materials (XLB), industrials (XLI) are also lower, but some of those losses are being offset by gains in financials (XLF), tech (XLK), and consumer staples (XLP).

The S&P 500 has traded in a rather narrow 12 points range and, with less than an hour to trade, is off 1-point to 2049.05.

Volumes remain light. In the options market, for instance, 7.1 million calls and 6.65 million puts traded across the exchanges. Projected volume for the day is 14.7 million contracts and 15% below the recent daily average.

We continue to see pre-earnings call and puts buying ahead of profit reports. Genworth (GNW), 20th Century Fox (FOXA), and Coca Cola Enterprises (CCE) are among the names seeing heightened options activity ahead of their respective earnings reports.

Some of the largest equity options blocks of the day are in AMD, Microsoft (MSFT), and Coca Cola (KO).

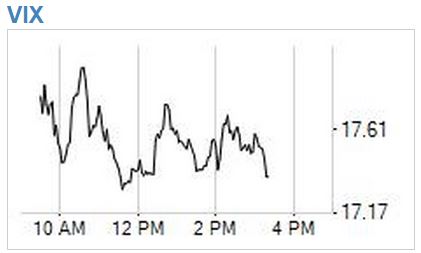

Overall, the options activity seems to reflect mixed sentiment. Unlike last week, we’re not seeing big blocks of ETF or index puts that suggest managers are aggressively hedging portfolios for fear of a market meltdown. Consequently, VIX is steady at 17.23. February is turning out to be a very different beast than the roller coaster month of January. But, then again, we are only three days into the new month. So it might be a bit too early to draw conclusions about correlations and overall levels of volatility that tend to drive sentiment to one extreme or the other.

Disclosure:None