WhatsTrading Recap - 01/22/2015

A 30-point gain has lifted the S&P 500 to session highs and into positive territory for 2015. Heading into the final hour, the index is up 31.18 points to 2063.30.

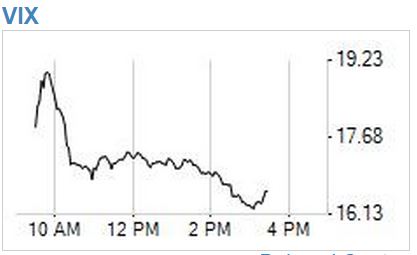

Implied volatility across the options market has been crushed. CBOE Volatility Index (VIX), which tracks the expected or implied volatility priced into a strip of S&P 500 Index (SPX) options, is off 2.77 points, or 14.7%, to 16.09. VIX is a far cry from Friday’s high north of 23 (in this case, ‘far cry’ = 27.4%).

Nasdaq Volatility (VXN), Small Cap IV (RVX), and Implied Volatility on the Dow (VXD) are also lower and the steep drop in vol indexes is reflecting the diminishing risk perceptions that has helped buoy equities.

Treasury bonds are lower and the yield on the benchmark ten-year is back towards 1.9%. Gold is holding its bid and has recaptured $1300 after gaining $10. Crude oil dropped $1.07 to $46.91.

Trading is active. On the options front, for instance, 8.3 million calls and 6.8 million puts traded across the 12 exchanges, which is about 10% more than the recent daily average.

SPY Mar 220 calls are the most actives after one player bought a hefty block of 157,000 contracts for 15 cents per contract midday. 230,000 traded at that strike. And, for the third time this month, more than 100,000 Feb 215 calls on SPY have changed hands. Buyers are taking positions in these rather deep out-of-the-money calls and the action seems to be expressing confidence in the S&P for the weeks ahead.

Earnings remain an important part of the picture and GE Weekly 24 puts, Jun 21 puts, and Mar 22 puts are active today ahead of the company’s profit report, due tomorrow morning. Altera (ALTR), Starbucks (SBUX), are seeing pre-earnings action as well.

Bullish options flow was also noted in Conoco (COP), US Steel (X), and IAC Interactive (IACI). Bears are active in Hartford (HIG), Linear Tech (LLTC), and Navistar (NAV).

Disclosure:None