What’s Holding Up The Market?

Mid-Week Report – March 14, 2018

VIX has risen above its 50-day Moving Average at 16.71, giving the VIX a probable buy signal. The Cycles Model now indicates that the rally may continue for up to two more weeks.

-- The NYSE Hi-Lo Index closed just beneath its trendline at 56.00, giving it a sell signal. A close in negative territory confirms the signal.

(ZeroHedge) Over the weekend, when we noted the ongoing blow out in the Libor-OIS spread, we asked whether a dollar funding crisis is emerging, now that this traditional indicator of monetary tightness and systemic credit stress has blown out to levels last seen during the European sovereign debt crisis of 2011.

One day later, Bank of America's rates strategist Mark Cabana used the same chart as his "chart of the day", noting that "the 3-month USD LIBOR-OIS spread recently widened sharply to levels not seen since the European peripheral crisis in 2011-12."

-- SPX has challenged the 50-day Moving Average at 2747.08 today, closing near the low. The SPX goes on a confirmed sell signal beneath the 50-day. Yesterday the SPX was repulsed at the upper Diagonal trendline in a second inverted Master Cycle. While highly unusual, the implication is that there may be another test of the low in a matter of days.

(Reuters) - The Dow Jones Industrial Average fell more than 250 points, or 1 percent, on Wednesday as industrial stocks tumbled over growing fears of a trade war with China after President Donald Trump sought to impose fresh tariffs.

Trump is looking to levy tariffs on up to $60 billion of Chinese imports, targeting the technology, telecom and apparel sectors, sources told Reuters on Tuesday.

The Trump administration is pressing China to cut its trade surplus with the United States by $100 billion, the White House said Wednesday.

The S&P industrial stocks were again the worst hit, falling 1.02 percent. Boeing tumbled 3.5 percent, leading the losers and wiping off 70 points from the Dow Industrials.

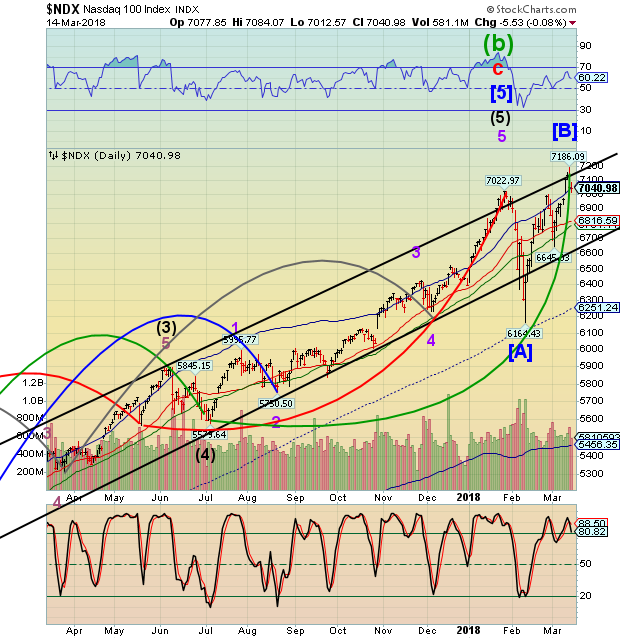

-- NDX closed beneath its Cycle Top at 7046.13 this afternoon after challenging the upper Diagonal trendline in a Master Cycle (inverted) high. This move puts the NDX on an aggressive sell signal. A decline beneath Intermediate-term support at 6816.59 and the nearby 50-day Moving Average at 6971.11 confirms the sell. However, the implications of an inverted Cycle are the same as the January 26 high.

(ZeroHedge) The Last Breakout

As stated, breakouts are indeed bullish and suggest higher prices in the short-term. This time is likely no different. However, breakouts to new highs are not ALWAYS as bullish as they seem in the heat of the moment. A quick glance at history shows there is always a “last” break out of every advance.

As a whole, the group is still outperforming the market. But upon closer inspection, there’s a performance gap between the index’s winners and losers not seen since 2015.

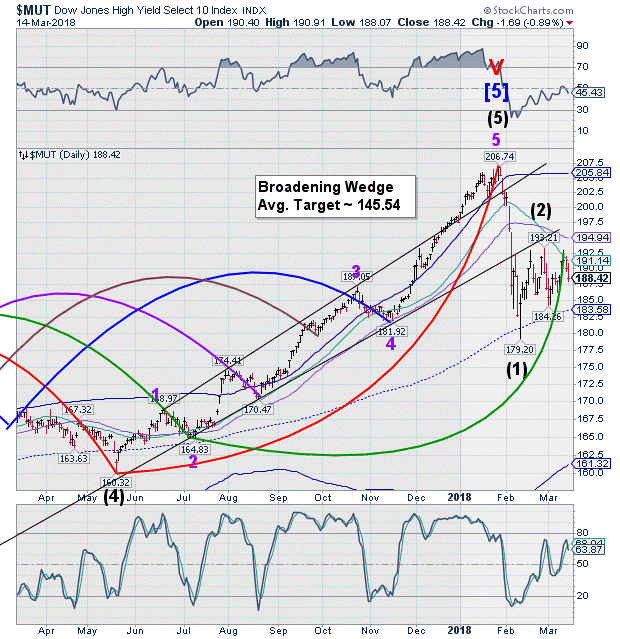

-- The High Yield Bond Index also appears to have had an inverted Master Cycle. Until now, the high yield Cycles have duplicated the equities Cycles. However, the message in high yield appears ominous. A decline equal to the first may take MUT to its Cycle Bottom.

(Forbes) High yield bonds, also known as “junk” bonds, have always had an identity crisis. They show up in our portfolio reviews under the category of “bonds,” but in reality, they move more closely with the stock market than the bond market. They’re an investment that has some characteristics of bonds and some of stocks – and may be an important part of your portfolio.

What are junk bonds? Like all bonds, they’re long-term IOUs from companies to investors. Just as individuals with poor credit have to pay high-interest rates, so do companies. And when a company’s credit rating is low enough, Wall Street calls those IOUs junk bonds – or, more genteelly, high yield bonds. Sometimes distressed companies issue junk bonds, but sometimes the issuers are companies on the rebound from hard times, such as telecommunications companies like Sprint or hospital operator HCA.

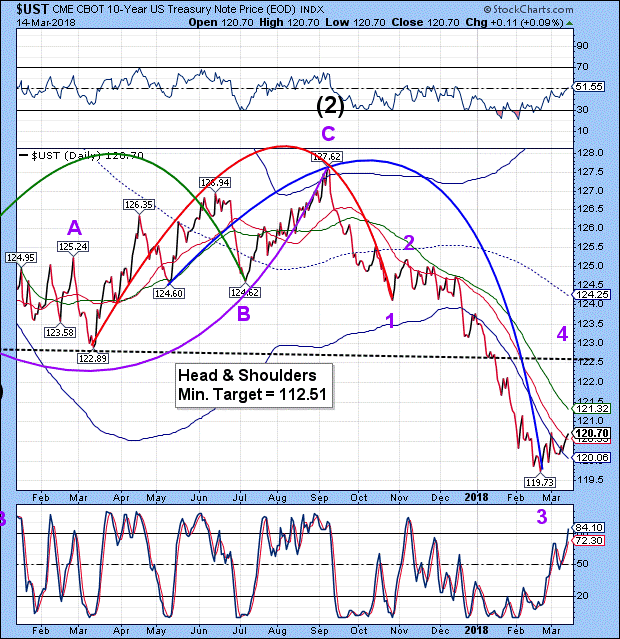

UST rallied through its Cycle Bottom resistance at 120.06, closing above Intermediate-term support/resistance at 120.55. While the Cycles Model suggests strength through the end of the week, the tide may turn quickly by early next week. Normally a retracement of this type would seek to retest the underside of the Head & Shoulders formation. However, the Cycles Model suggests another possible waterfall decline may resume through late March once the bounce is complete.

- Bloomberg) E. Craig Coats Jr. never set out to be a bond vigilante.

As the former head of Salomon Brothers’ Treasuries desk, the last thing on his mind running the world’s biggest debt trader in the 1970s and 80s was fighting Washington’s fiscal largesse. He had a much simpler agenda: survive.

In an era when inflation outbreaks could send yields surging hundreds of basis points in a matter of days, getting stuck on the wrong side of the bond market could end your career. That’s why for Coats, any hint consumer prices were poised to spike was a sign to sell with both hands. The knock-on effect, of course, was that he inadvertently became a disciplinarian of American budgetary freewheeling, forcing officials to curb inflationary policies or risk an upward spiral in funding costs.

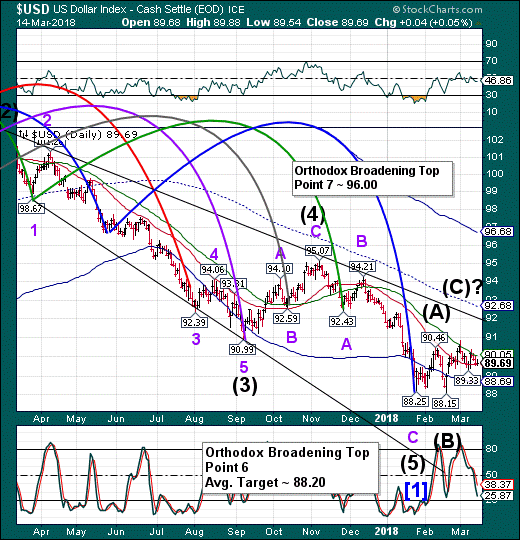

- The U.S. Dollar found support at Intermediate-term support at 89.61 today after being repelled by the 50-day Moving Average at 90.06 earlier this week. The Cycles Model indicates a probable move to the opposite side of the trading channel to point 7 of the Orthodox Broadening Top formation shown in the weekly chart unless a crisis occurs. The next probable resistance point may be the trendline near 92.00.

(Bloomberg) Here’s one sign that investors remain hostile to the dollar: Buyers of U.S.-listed funds are rushing into European and Japanese stocks without currency protection.

Money managers have pulled $2.1 billion from the WisdomTree Japan Hedged Equity fund this year, which is nearly a third of its total assets, data compiled by Bloomberg show. The exchange-traded fund, which buys stocks listed in Tokyo and shields them against fluctuations in the yen, has seen its shares outstanding plunge 5 percent this month to the lowest level since 2013.

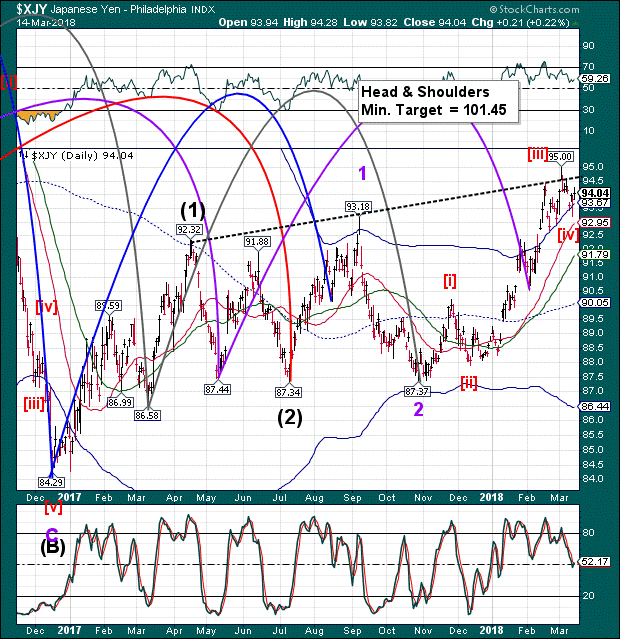

--The Yen rose above its Cycle Top support at 93.67 in a probable rally that may break through the Head & Shoulders neckline again. Should the Yen exceed the proposed Head & Shoulders neckline at 94.41, the Yen may extend beyond 100.00.

(Bloomberg) A deepening political scandal that has rattled Japanese Prime Minister Shinzo Abe’s administration has become a fresh reason for yen bulls to spy a move past 100 per dollar.

The stars had already been aligning for the yen to potentially cross 100 for the first time since 2016, thanks to a combination of trade flows, investor positioning, and monetary policy. Now Finance Minister Taro Aso has come under pressure thanks to a controversial land deal and currency traders are taking notice.

The Nikkei bounced off mid-Cycle resistance last week to stall beneath Intermediate-term resistance at 22064.36. It has fallen back today. The Cycles Model suggests weakness through late March. If so, it suggests Nikkei Index may be set up for a crash starting this week.

(FXStreet) The Nikkei 225 is struggling to regain its upward momentum after risk aversion took the equity index back down to support, and the Nikkei is now trading just beneath 21,700.0 heading into the end of the Asia market session.

Recent risk aversion in Asia markets spurred on by political scandal in Japan is beginning to ebb and the recent revelation that Japan's prime minister Shinzo Abe and finance minister Taro Aso forged documents involved in the sale of government land at a steep discount to a school operator with ties to Abe's wife has faded from market action. Risk aversion found a new plaything on Tuesday in Trump, who canned his own Secretary of State, Rex Tillerson, and headlines leaked that the US president is also aiming for a further $60B in trade tariffs aimed at China.

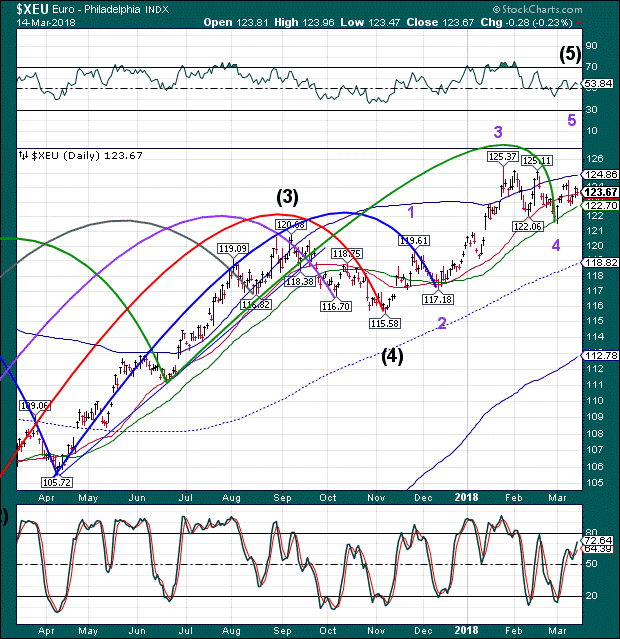

-- The Euro continues to ride along its Intermediate-term support/resistance at 123.52. Crossing above the Cycle Top resistance at 124.86 may reinstate the buy signal. Having established its Master Cycle low on March 1 implies at least another week of rally.

(DailyFX) Another quiet day on the European economic data docket puts a speech from ECB President Mario Draghi in focus. He is due to opine at the “ECB and Its Watchers” conference. Comments are also due from the central bank’s Vice President Vitor Constancio, its chief economist Peter Praet, Bank of France Governor Francois Villeroy de Galhau. Separately, Ignazio Angeloni of the ECB Supervisory Board will deliver a speech tellingly titled “Tapering and Final QE:The Effects on Assets Under Management”.

In all, traders will look to the tone of policymakers’ pronouncements to inform bets on the path of the central bank’s asset purchases. The current program – amounting to €30 billion per month – is currently scheduled to run through September. The Euro buckled as last week’s ECB policy call projected a dovish stance, hinting officials are in no hurry to tighten. Similar rhetoric this time may revive selling pressure.

EuroStoxx 50 Index tested Intermediate-term resistance and the Fibonacci 38.2% retracement level yesterday, then reversed down. The period of strength appears to have been extinguished and weakness may resume through the end of March. European stocks may be starting a panic phase in its decline this week.

(CNBC) Equities in Europe finished Wednesday's session slightly lower, as concerns surrounding a potential trade war resurfaced.

The pan-European Stoxx 600 provisionally fell 0.15 percent by the close, in what was a choppy trading session. The region's sectors, however, pointed in different directions by the close.

Major bourses closed relatively mixed, with the U.K.'s FTSE 100 falling 0.09 percent, and France's CAC 40 slipping 0.18 percent. Germany's DAX rose 0.14 percent.

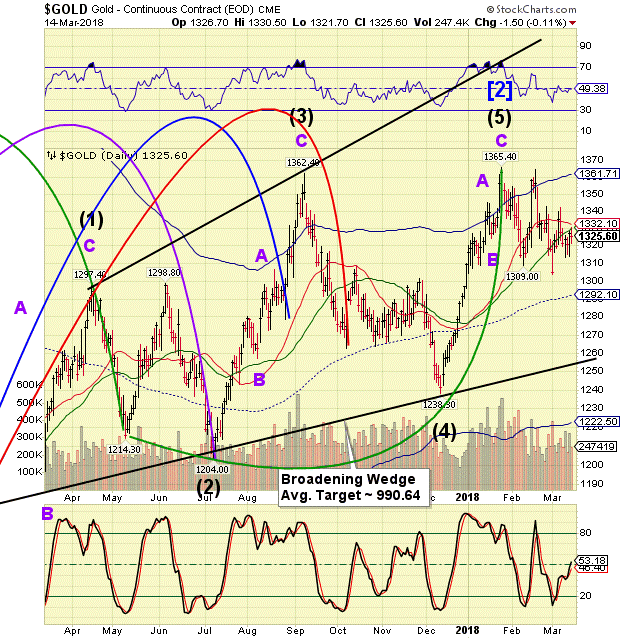

-- Gold attempted a challenge of the 50-day Moving Average at 1239.78, but closed beneath it, confirming the sell signal. This action implies a continued decline through the Broadening Wedge formation and possibly new lows over the next two weeks.

(Reuters) - Gold prices edged lower on Wednesday, pressured by a recovering dollar and an

expectation of higher interest rates, but supported by safe-haven buying after the sudden dismissal of U.S. Secretary of State Rex Tillerson.

Spot gold declined 0.1 percent at $1,324.40 per ounce by 1:36 p.m. EST (1736 GMT), earlier touching $1,330.02, its highest since March 7.

U.S. gold futures for April delivery settled down $1.50, 0.1 percent, at $1,325.60 per ounce.

"The political uncertainty has limited the downside price risk for gold in a raising rates environment, as opposed to driving prices significantly higher," said Suki Cooper, Standard

Chartered Bank precious metals analyst.

West Texas Intermediate Crude appears to be attempting to hold the line at 60.00 for the past two weeks. It remains on a sell signal with ever weakening bounces. The Cycles Model suggests the decline may resume through late March.

(MarketWatch) Oil prices notched a modest gain on Wednesday, as gasoline futures climbed on the back of a hefty decline in U.S. supplies of the motor fuel, offsetting earlier pressure from a bigger-than-expected rise in crude supplies.

April West Texas Intermediate crude CLJ8, +0.11% rose 25 cents, or 0.4%, to settle at $60.96 a barrel on the New York Mercantile Exchange. The contract tried for gains in the previous session, pushing briefly above $62, but gave up that run in the wake of perceived risks to the Iran nuclear deal after U.S. President Donald Trump’s ouster of Secretary of State Rex Tillerson.

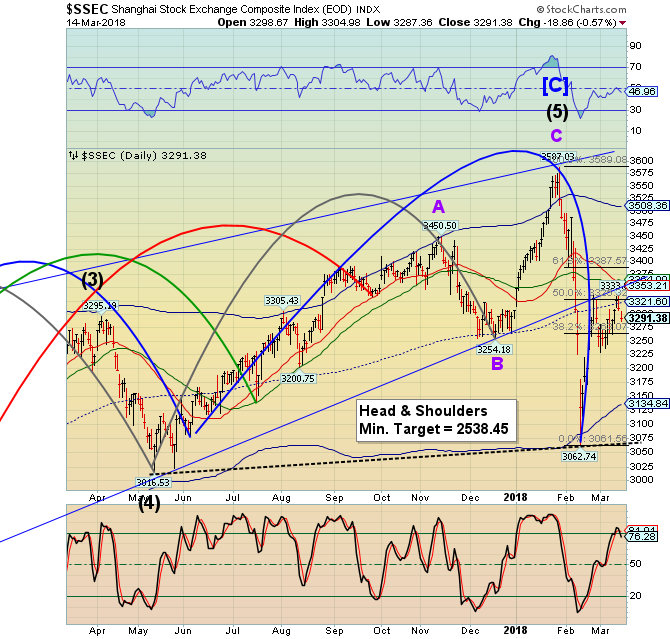

The Shanghai Index challenged mid-Cycle resistance at 3321.60 and the Fibonacci 50% retracement level on Tuesday before reversing back down today. The Shanghai is also due for a panic decline which may have begun today. The Cycles Model suggests a break of the neckline and Master Cycle low by the end of the month.

(Reuters) - China stocks retreated on Wednesday, weighed down by tech firms, as U.S. protectionism fears overshadowed strong China factory and investment data, while a regulatory crackdown on speculation dampened risk appetite further. ** At the close, the Shanghai Composite index was down 0.6 percent at 3,291.38, while the blue-chips CSI300 index ended 0.4 percent lower at 4,073.34. ** China’s industrial output grew much faster than expected at the start of the year, suggesting the economy may be picking up momentum even as U.S. President Donald Trump readies hefty tariffs against one its most strategic growth drivers — technology. ** Tariffs on tech exports could potentially hit the fastest growing segment of China’s industrial sector, an area that the country’s leaders have been keen to promote as they push for “higher quality” economic growth. ** Trump is seeking to impose tariffs on up to $60 billion of Chinese imports in the very near future and will target the technology and telecommunications sectors, Reuters reported on Tuesday.

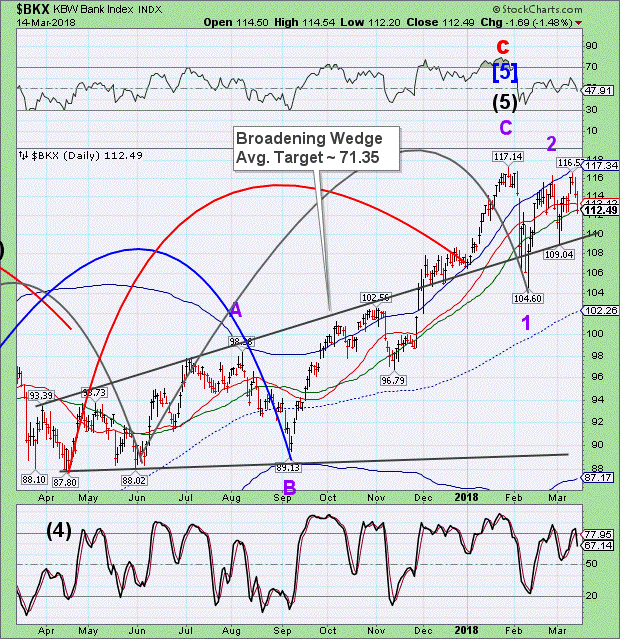

-- BKX rallied toward the Cycle Top resistance at 117.34 but was not able to match the January 29 high at 117.14. It closed beneath the 50-day Moving Average at 112.67, leaving it sell signal. Gravity may take over the index again as weakness sets in for the next three weeks.

(WaPo) The Senate on Wednesday passed the biggest loosening of financial regulations since the economic crisis a decade ago, delivering wide bipartisan support for weakening banking rules despite bitter divisions among Democrats.

The bill, which passed 67 votes to 31, would free more than two dozen banks from the toughest regulatory scrutiny put in place after the 2008 global financial crisis. Despite President Trump’s promise to do a “big number” on the Dodd-Frank Act of 2010, the new measure leaves key aspects of the earlier law in place. Nonetheless, it amounts to a significant rollback of banking rules aimed at protecting taxpayers from another financial crisis and future bailouts.

(ZeroHedge) Confirming previous reports, overnight Caixin announced that China plans to merge the banking (CBRC) and insurance regulators (CIRC) and to form a new agency called China Banking and Insurance Regulatory Commission (CBIRC) in the biggest industry overhaul since 2003. Meanwhile, the CBIRC will hand its central bank the power to write the rules for the financial sector, as part of a sweeping overhaul aimed at closing regulatory loopholes and curbing risk in the $43 trillion banking and insurance industries.

As Bloomberg notes, a new regulatory structure with the PBOC as the pivot is emerging as the annual legislative meetings progress through their second week. Still to come (see below) are personnel appointments, including the expected anointment for Politburo member Liu He as a Vice Premier in charge of financial and economic affairs, making him President Xi Jinping’s go-to official as he seeks to avert a financial crisis after years of rapid credit growth.

(ZeroHedge) As the US Treasury yield curve collapsed over the last year, various Fed speakers have promulgated the "it's probably nothing" or "it's different this time" narrative to divert attention away from the curve's almost-perfect record of predicting US economic recessions.

Even US Macro data has started to disappoint (and stocks briefly caught down to it)...

So, it is fascinating that none other than Janet Yellen's old haunt - The San Francisco Fed - has issued a report warning about the flattening of the yield curve...

"[it] is a strikingly accurate predictor of future economic activity.

Every U.S. recession in the past 60 years was preceded by a negative term spread, that is, an inverted yield curve.

Furthermore, a negative term spread was always followed by an economic slowdown and, except for one time, by a recession."

Disclaimer:

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a ...

more