What Real Rates Are Saying About Economy

Back in the summer of 2018, inflation estimates were riding high as economists expected the Fed to hike rates 3 times in 2019. Everything changed when the economy started slowing, energy prices crashed, and the Fed balked at the idea of raising rates at all as they introduced the word “patience”. The 10-year treasury yield has fallen to 2.60% which means if the Fed were to raise rates, it could invert more of the yield curve, with the Fed funds rate being potentially above the 10-year yield.

Of course, the Fed is highly unlikely to raise rates in this environment as the Fed fund futures market shows there is a zero percent chance of a hike this year. The Fed fund futures market isn’t accurate when you start talking about a few quarters of policy in advance, but it’s still important to know what the market expects for all time frames. That’s the first step in making bets. The February PPI reading was the last inflation reading the Fed will get before its March 20th meeting where there is no chance of a hike and a 1.3% chance of a cut.

PPI Shows Inflation Slowing

The PPI report showed headline yearly inflation fell from 2% to 1.9%. PPI without food and energy fell from 2.6% to 2.5%. Finally, inflation without food, energy, and transportation fell from 2.5% to 2.3%. This signals March CPI could be weaker than February as PPI is the producer’s measurement of inflation which means it leads consumer prices. One interesting part of the PPI report is that consumer food prices fell 0.4% monthly. In the February CPI report, yearly food inflation was 2% which was the highest reading since April 2015. If food price inflation weakens, that will further suppress headline inflation which has already been below core inflation.

Core PCE Expected To Be Weak

The chart below shows the probability distribution of core PCE inflation at the next few Fed meetings. As you can see, few economists are projecting inflation to be above the Fed’s 2% target for the June and September 2019 meetings.

A flatter Phillips curve: JPM models for core PCE inflation see just a 25% chance it is running above 2% when the Fed meetings in December. They have it running at 1.8% at that meeting. pic.twitter.com/aZOdiwlonb

— Nick Timiraos (@NickTimiraos) March 14, 2019

Only about one quarter expect core PCE to get above 2% in December 2019 and March 2020. That means very few economists expect the Fed to be in trouble in the near term. To be clear, the February PCE report will be released on March 29th.

Real Rates Are Low

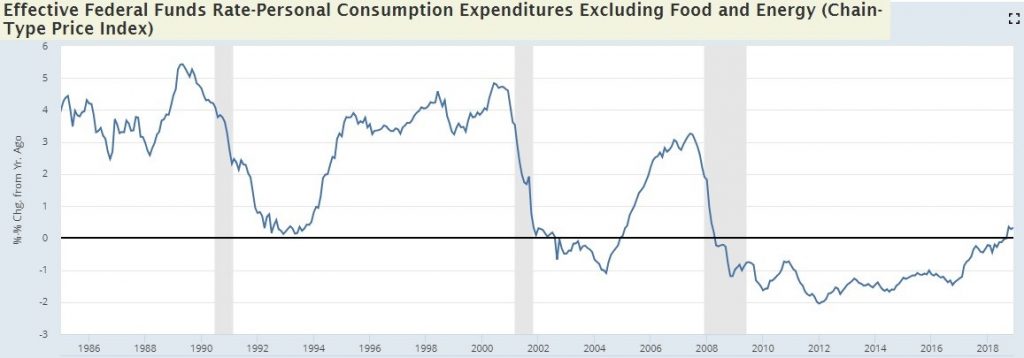

The Fed is in a Goldilocks scenario if inflation stays below 2% and economic growth recovers modestly after the weak Q1. CNBC surveyed estimates show a median expectation of just 1.4% growth; the Atlanta Fed Nowcast is only at 0.4%. As you can see from the chart below, the Fed funds rate deflated by core PCE inflation is just barely positive. It never even fell to the negatives in the 1990s business cycle.

(Click on image to enlarge)

Even if the difference continues its multi-cycle downtrend where it peaks at a lower rate, real rates should still be higher. However, the Fed can’t raise rates in this slowing environment where the 10-year yield is this low. The only way real rates will rise this year is if core PCE falls.

Housing Market Set To Have A Solid Spring

The decline in mortgage rates, real wage growth, and the decline in house price growth should all combine to help the housing market in the spring selling season. The MBA mortgage applications index is starting to agree with that thesis as the purchase index was up 4% weekly in the week of March 8th. The yearly growth in the purchase index is up 4 straight weeks as growth is now almost 2%.

The new home sales report was solid as there were 607,000 new homes sold in January which slightly missed estimates for 612,000. The December report was revised much higher from 621,000 to 652,000. The 3-month moving average increased 19,000 in January to 629,000 which is the best reading since June 2018. The West improved mightily as yearly growth was -3.2%, but monthly growth was 27.8%. The South is responsible for the monthly decline in the overall reading as yearly growth was 6.1% and monthly sales fell 15.1%.

As you can see in the chart below, yearly sales were -4.1%.

30Y mortgage rates are down over the last year, and off about 50bps from their November 2018 highs. Rates are inversely correlated with new home sales, as our chart illustrates. Thus, we see scope for new home sales to strengthen into the spring quarter. pic.twitter.com/phTaKbnCiT

— Renaissance Macro (@RenMacLLC) March 14, 2019

The chart suggests sales will be strong in the spring because mortgage rates are falling. That doesn’t even take into account the strong wage growth and weak housing price growth. Median new home prices fell 0.6% monthly and 3.8% yearly to $317,000. Supply fell 1.5% which pushed inventory up from 6.3 months to 6.6 months.

Passive Market

Growth in passive funds is dominating active funds which is why passive funds are stealing market share. At the end of 2018, in America, there was $5.7 trillion in passive funds and $7 trillion in active funds. As you can see from the chart below, passive funds are 31.8% of the market and are set to pass active funds in 2021. The percentage of passive ownership in the S&P 500 float is 15%. It was slightly below 5% in 2008.

The next crisis could be interesting because of the high passive ownership. Investing in stocks has become like a public utility in the sense that 7% gains per year are expected and access is easier than ever. You can get a diversified portfolio from your phone if you have any amount of savings. Net worth as a percentage of disposable income is near a record high which is why it has become more politically important to keep the stock market up. If you are invested in a passive strategy don’t sell during a crisis.

Mark your diaries: Passive assets poised to surpass active in the US by 2021 — Moody’s https://t.co/ru5zgBK177 pic.twitter.com/OLKElm9fxh

— Robin Wigglesworth (@RobinWigg) March 14, 2019

Great Returns

The S&P 500 probably just lapped its best 10 year return period in a while because the stock market bottomed in March 2009. Because the S&P 500 has returned 16.7% annualized in the past 10 years, some passive investors are going all in on the index. We don’t believe that is a passive strategy. It’s a country-specific play with some international exposure. If you live in America and your paycheck is determined by the health of the American economy, it’s not great diversification to only invest in American stocks.

10-year annualized return of US stocks. $SPY pic.twitter.com/6Cp0bf3iS1

— Alex (@MacroOps) March 14, 2019

Conclusion

Inflation expectations are low. If core PCE estimates are reached, the Fed fund futures will be correct about the Fed not raising rates in 2019 even though real rates are barley positive. The housing market should recover nicely in the spring. Passive investing is very popular now. Investing in stocks is easier than ever. Just because the S&P 500 has done well in the past 10 years doesn’t mean it should be your only investment.

Disclaimer: Please familiarize yourself with our full disclaimer here.