What Nobody Sees... Effective Demand

As markets look forward to Trump, nobody sees how close the economy is to the Effective Demand Limit.

Basically, the business cycle had already reached its end and was heading toward a recession slowly with low interest rates. Then the prospect of low corporate taxes, less regulation and strong fiscal stimulus has made it look like the business cycle is being brought back to life. Yet the effective demand limit is still sitting right in front of us.

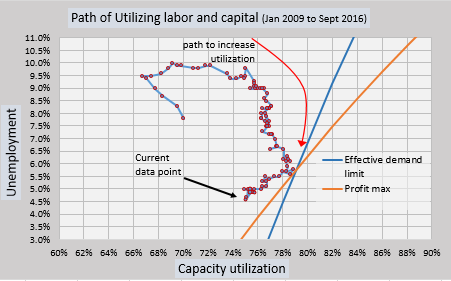

What is the effective demand limit? It has been my research to determine an effective demand limit which forecasts the profit cycle and the level of real GDP where the economy will start toward a recession. My research points toward labor share... showing it sets a limit upon the optimal utilization of capital. As labor share rises, more capacity can be utilized optimally. However, we have seen labor share fall over the last decade plus. As such capacity utilization has not been able to return to previous levels. Capacity utilization is currently low at its lowest point since 2010.

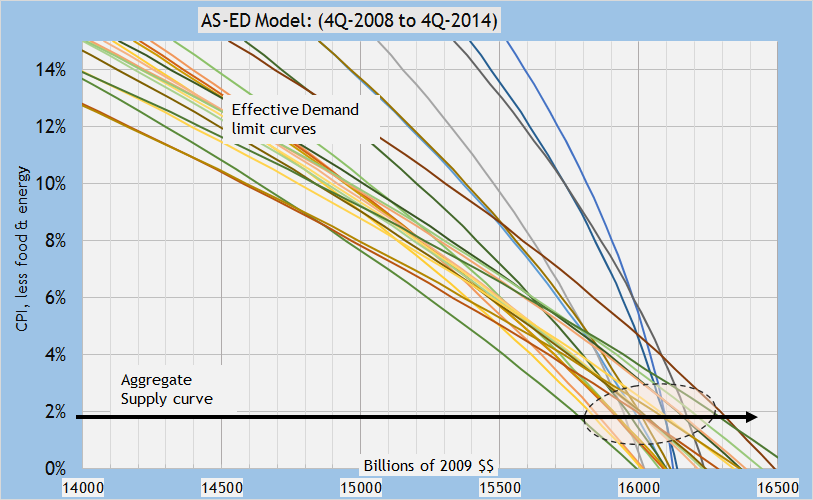

Real GDP hit its effective demand limit at the end of 2014 at around $16.150 trillion. I had seen it coming for years. Here is the graph I had been tracking. The Effective demand limit lines kept pointing at that level of real GDP for 5 years. The profit cycle peaked at the same time.

Unless labor share starts to rise significantly now as it did at the end of the 1990's, the effective demand limit will resuscitate. Labor share is currently sitting at a low level where it was at the end of the 2008 recession. I do not see anything in the policies being formed by Trump that will lead to higher labor share. There is an army of supply-siders coming into the administration. I see the cost of capital falling to boost investment which will make the cost of labor fall in convergence. As has happened for decades, supply-side economics allows labor share to fall thinking that will extend the business cycle. In actuality, the business cycle is cut short in terms of capacity utilization... But corporations are fine with that because profit rates rise.

So as the markets celebrate money flowing back into firms, they do not see the effect of labor being cut out of the loop again. There will not be enough effective demand to extend the business cycle. My prognosis is for the economy in 2017 to fall back down after the reality sets in that inflation is not rising and that the profit cycle cannot be resuscitated.

I look at the graph above... It graphs the utilization of labor with the utilization of capacity. One can see how the plot bounced off of the effective demand limit. That has been normal since the 1960's. (I do not have data for capacity utilization before that.) Now capacity utilization is falling, while the utilization of labor rises. That is a normal process leading into a recession.

But where can the plot in the graph go now? Can capacity utilization rise? If so, what will unemployment do? Will it keep falling too? At what point does the wage pressure cut so much into profits that capacity utilization has to start falling again?

There is no way out of the trap unless labor share is allowed to rise significantly as it did in the year 2000. And I do not see the markets aligning to do the same this time. The same type of euphoria from rising productivity is not in the air.

A cold hard reality from effective demand will hit in 2017.

The only supply side that worked was Reagan, who cut taxes for the middle class and poor and Trump will not get money into the hands of labor.