What Does FXCM Management Know That Investors Don’t?

By Carly Forster and Sarah Roden

Shares of FXCM (NYSE: FXCM) shot up 6.5% in after-hours trading on Thursday, March 12th after the company announced its fourth quarter earnings and updated investors on efforts to repay Leucadia National Corporation (NYSE: LUK). This 6.5% increase comes as a welcomed surprise as FXCM was almost completely liquidated earlier this year when the Swiss National Bank abandoned their franc cap.

On January 15, the Swiss National Bank abruptly ended its franc cap that regulated the difference between the Swiss franc and the euro; a policy that had been in practice since the summer of 2011. As a result, the stock dropped nearly 90% and “caused a flash crash that lead to historic dysfunction never seen before in the FX markets,” according to an FXCM press release dated March 11th. Many believed that FXCM would not have the capital to resume normal operations, but the foreign exchange market received $300 million in cash from Leucadia to keep FXCM afloat. FXCM has already repaid $12 million of the rescue package

FXCM finally received some good news last week when the company’s fourth quarter report beat Wall Street’s expectations this week. Highlights from the report include earnings of $0.35 a share, beating analysts’ consensus of $0.17 earnings per share and marking a 337.5% increase on a year-over-year basis.The company posted revenue of $134.7 million, up 18% from the same quarter a year prior.

On March 12th, Citigroup analyst William Katz was still bearish on FXCM despite its decent Q4 results, maintaining a Sell rating on the stock with a price target of $0.75. He believes the company's overall equity value is "effectively zero even as management reconstitutes [the] business."

Overall, William Katz has a 72% success rate recommending stocks and a +7.9% average return per recommendation.

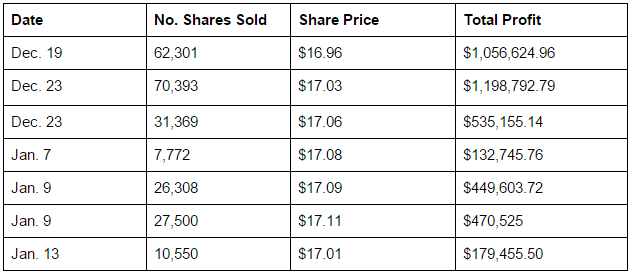

Just before Swiss National Bank suddenly deserted its franc cap that resulted in the massive FXCM stock drop, 10% FXCM owner and retired Chief Dealer Michael Romersa sold a large amount of his shares in the company. In several transactions dating from December 19 to January 13, Michael Romersa sold over 236,000 shares for an average price of $17, earning over $4 million. Here is a breakdown of the transactions:

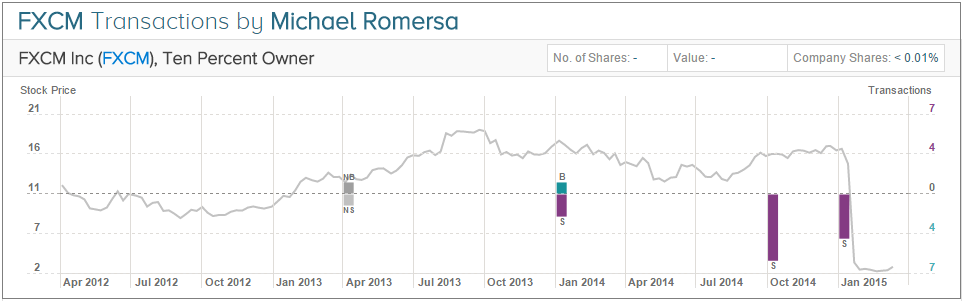

Michael Romersa sold over $4 million of FXCM shares in several transactions up to two days before the stock tumbled. However, Romersa also sold $5.5 million worth of FXCM shares in March of 2014 and another $4 million between October and November of 2014.

He has made 11 profitable informative transactions out of 13 total transactions, earning an 85% profitable transaction rate and a +64.5% insider average return per transaction.

Carly Forster and Sarah Roden write about stock market news. They can be reached at Carly@tipranks.com and Sarah@tipranks.com, respectively.

Disclosure: To see more recommendations for Zogenix, visit more