Wells Fargo Is Oversold

Amid a financial sector whose equities have been collapsing with shocking speed Wells Fargo stands out as a bank that has sold off faster than its peers for no discernible sensible reason. Wells Fargo is a bank that has been plagued by regulatory problems for years but the current selloff seems overdone.

Currently Wells Fargo seems to be at an attractive entry point, for a long-run investor as the current historically volatile market environment means declines and turbulence may still continue for some time, to a generally seemingly healthy financial institution likely to survive the current and immediate future economic turmoil.

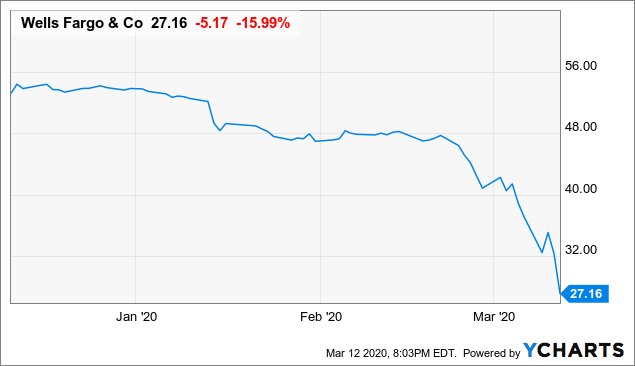

Data by YCharts

A Financial Sector Annihilation Where Wells Fargo Is Particularly Burned

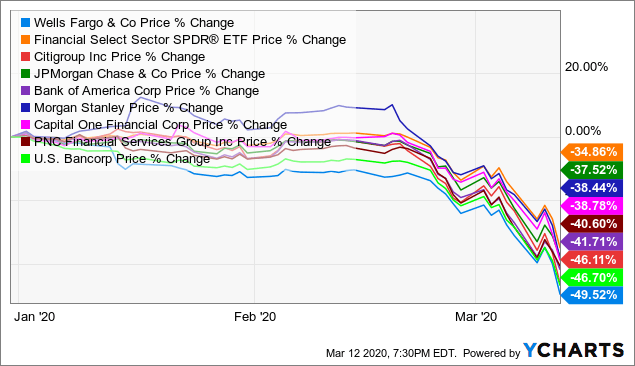

As shown in the chart below Wells Fargo is comparatively oversold relative to other similar banking peers and the banking-oriented financial services sector as a whole.

Data by YCharts

Past Sins Still Haunt Wells Fargo - But Most Of Its Risk Is Gone

A potential reason why Wells Fargo faces greater investor hesitation as compared to other major U.S. banks is because it is still the subject of continuing regulatory concern. In Wells Fargo's seemingly frequent game of musical leadership chairs nowadays the bank's Chair Betsy Duke resigned a few days ago after the Chair of the House Financial Services Committee called for her ouster.

CEO Charlie Scharf spent the immediate aftermath, while its share price tanked amid the broader market losses of the week, doing a mea culpa of hearings before the House Financial Services Committee amid government reports that its corporate governance since its historic 2018 Federal Reserve asset-limitation hasn't improved much. The Federal Reserve's consent order was due to the multi-year fake accounts scandal, among other poor and deceptive practices, that resulted in the bank spiraling into the public spotlight as a "bad bank" for public scapegoating.

Banking Is About To Experience A Brutal Onslaught But It - Or Most - Will Survive

Wells Fargo, like other major financial institutions that have been tanking in valuation and equity price these past few weeks, faces potentially dramatic earnings and revenue risk due to the oil and coronavirus shakeups that could affect the ability of the energy, tourism, airlines, consumer, and other industries to properly repay their loans.

Furthermore, the collapse in bond rates as now the yield curve flattens and potentially invert, in the meantime with the curve itself shifting rapidly downwards possibly towards zero and beyond, means that banks like Wells Fargo will face difficulty in the traditional deposit-and-lending function of taking short term deposits and lending them out as long term loans, bringing in net interest income.

Yet, like with the rest of the market, eventually, it is likely the associated industries the financial sector is reliant on, the financial markets, and the economy as a whole will rebound and recover - it is more of a question of when than if. Wells Fargo is a massive banking institution that at the end of Q4 2019 boasted over $1.322 trillion in deposits, $962 billion in outstanding loans, and a healthy Basel III Equity Tier I capitalization ratio of 11.1%.

Wells Fargo appears no more at risk than any other banking institution in the current selloff. The regulatory risks for the bank that the market may be pricing in likely will not materialize I believe as the overall market downturn takes the focus of regulatory action and government may be sensitive to not push banks too far amid the declines.

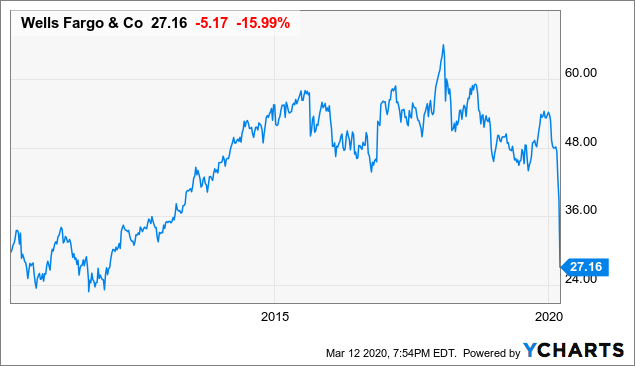

Data by YCharts

Conclusion

Given the softness right now of the equity markets and particularly banks, which have sold off at a faster pace than the rest of the market due to the aforementioned credit and lending risks, when the market returns to a stable level Wells Fargo likely will be among them as well.

Due to Wells Fargo's oversold point at the moment compared to other banks, perhaps for unlikely to materialize regulatory scrutiny fears, right now seems like a good entry point to get some footing in the company for when it returns to a 'normal' level once again.

Disclosure: I am long WFC.

Disclaimer: These are only my opinions and do not constitute investment advice.