Weekly Wrap-Up, Market Forecast, Sector Watch: SPX, Nasdaq - June 1, 2015

Last weekend, in my Market Forecast, I wrote:

“We might see some weakness in the broader market to start the week. We will have to see if sideline buyers are ready to jump in once again. SPX has support between 2120 and 2100. If SPX breaks above 2130 again, watch out bears!”

The market did indeed took a quick drop on Monday. Buyers also came in when SPX hit 2100. Tuesday, we saw a big rush of buying, partially helped by the rally in semiconductors, as M&A activities heated up in the sector. But, SPX saw some resistance above 2125. Thursday was a struggle for direction. Stocks slide again on Friday.

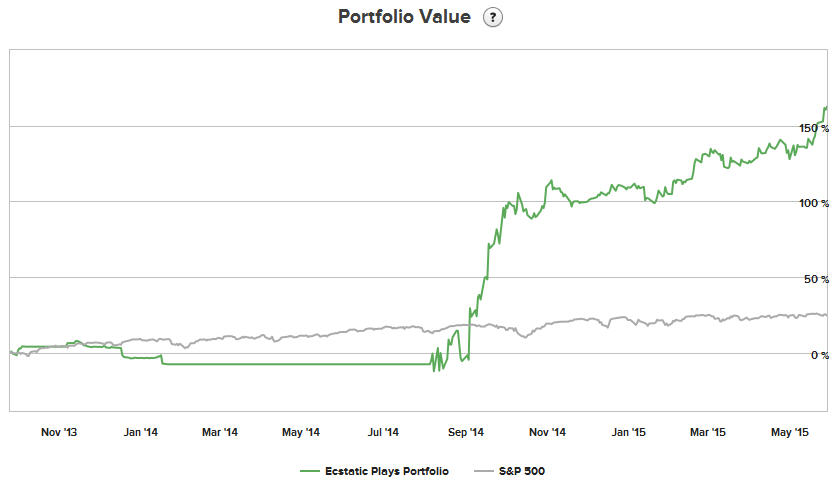

We traded really well last week, continuing to propel the value of my Ecstatic Plays higher:

This portfolio is now up +25.5% for 2015 and +184.4% over the last 365 days!

We had mostly profitable trades. BRCM, CAVM, AVGO, and XLNX calls were all winners! Here are the closed trades for the week:

For the week, the Dow was down 221.34 points; SPX fell 18.67 points; Nasdaq slid 19.33 points. Gold fell again, this time closing below $1200/ounce. Oil got a big pop on Friday, ending the week above $60/barrel (WTI). At the time of this writing, Asian markets were mixed, with China (up +2.8%) and Hong Kong (up +0.7) bouncing. Let’s where the US markets closed on Friday:

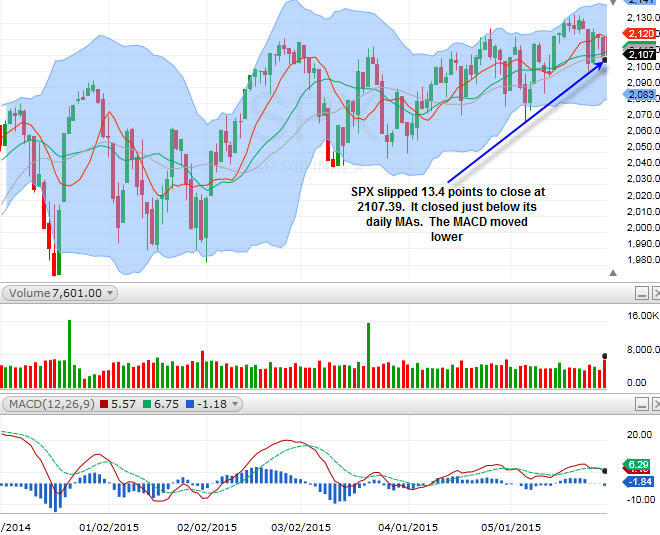

SPX

On Friday, SPX slipped 13.4 points to close at 2107.39. It closed just below its daily MAs. The MACD moved lower.

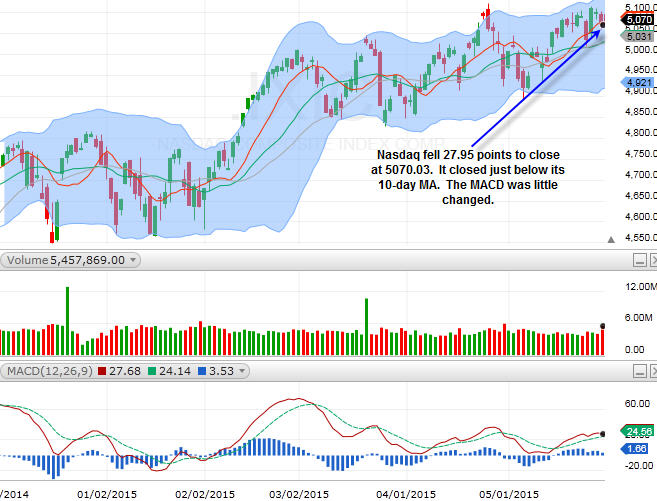

Nasdaq

Nasdaq fell 27.95 points to close at 5070.03. It closed just below its 10-day MA. The MACD was little changed.SPX slipped just below its daily MAs. But, Nasdaq is much stronger, helped by the semiconductor sector. For the new week…

Disclosure: None.