Weekly Unemployment Claims: Down 42K, Better Than Forecast

Here is the opening statement from the Department of Labor:

SEASONALLY ADJUSTED DATA

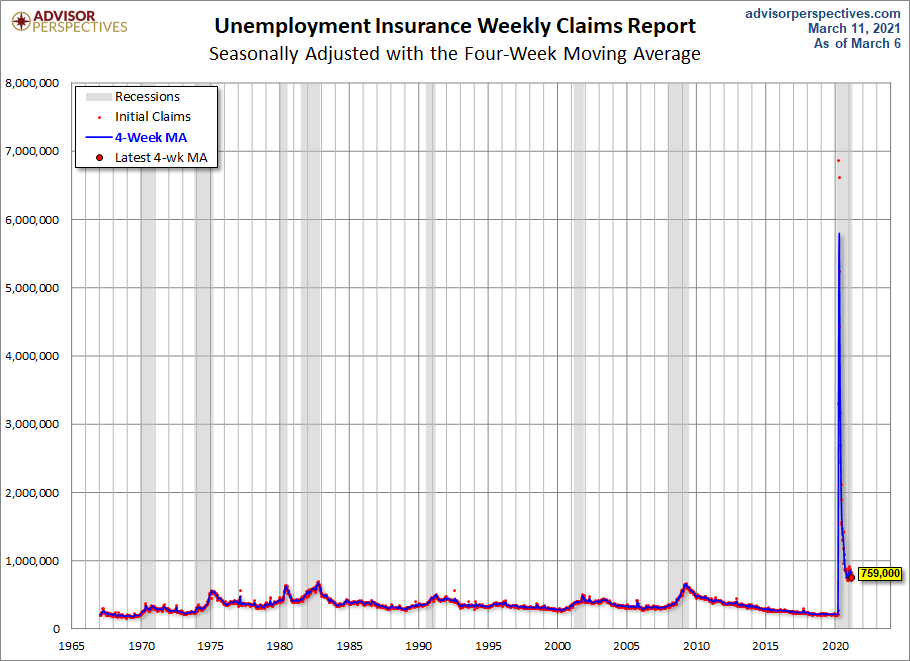

In the week ending March 6, the advance figure for seasonally adjusted initial claims was 712,000, a decrease of 42,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 745,000 to 754,000. The 4-week moving average was 759,000, a decrease of 34,000 from the previous week's revised average. The previous week's average was revised up by 2,250 from 790,750 to 793,000.

The advance seasonally adjusted insured unemployment rate was 2.9 percent for the week ending February 27, a decrease of 0.2 percentage point from the previous week's revised rate. The previous week's rate was revised up by 0.1 from 3. to 3.1 percent. The advance number for seasonally adjusted insured unemployment during the week ending February 27 was 4,144,000, a decrease of 193,000 from the previous week's revised level. The previous week's level was revised up 42,000 from 4,295,000 to 4,337,000. The 4-week moving average was 4,355,000, a decrease of 103,500 from the previous week's revised average. The previous week's average was revised up by 10,500 from 4,448,000 to 4,458,500. [See full report]

This morning's seasonally adjusted 712K new claims, down 42K from the previous week's upwardly revised figure, was better than the Investing.com forecast of 725K.

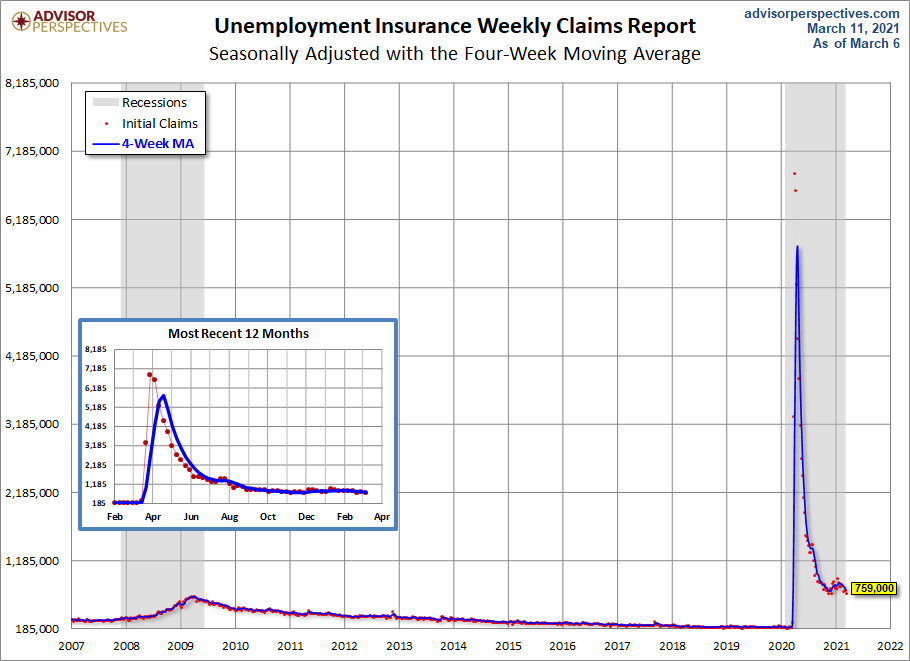

Here is a close look at the data over the decade (with a callout for the past year), which gives a clearer sense of the overall trend.

As we can see, there's a good bit of volatility in this indicator, which is why the 4-week moving average (the highlighted number) is a more useful number than the weekly data. Here is the complete data series.

The headline Unemployment Insurance data is seasonally adjusted. What does the non-seasonally adjusted data look like? See the chart below, which clearly shows the extreme volatility of the non-adjusted data (the red dots). The 4-week MA gives an indication of the recurring pattern of seasonal change (note, for example, those regular January spikes).

Because of the extreme volatility of the non-adjusted weekly data, we can add a 52-week moving average to give a better sense of the secular trends. The chart below also has a linear regression through the data.

Here's a look at each year's claims going back to 2009.

For an analysis of unemployment claims as a percent of the labor force, see this regularly updated piece The Civilian Labor Force, Unemployment Claims, and the Business Cycle. Here is a snapshot from that analysis.