Weekly Review: Trading Forex - Tuesday, May 29

Forex Week In Review

USD

We continued higher in the Dollar index with a 0.6% rise, to close at 94.25, exactly at our area of interest. This has been a very strong push and we are at strong resistance, so we will be careful around this technical level, but we will look for pullbacks unless a strong catalyst pushes it higher.

EUR

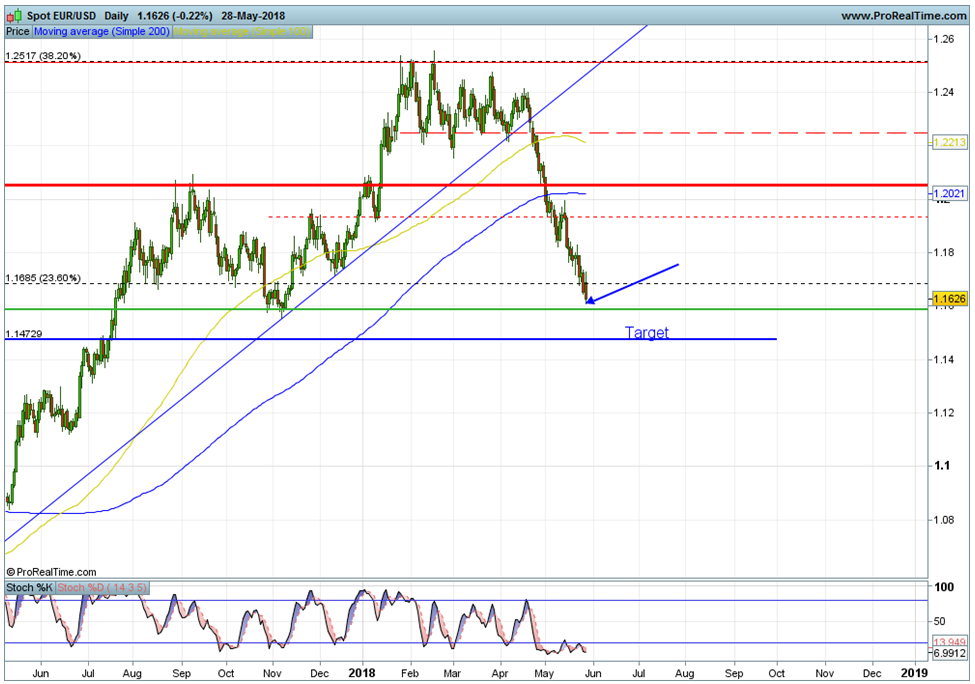

The Euro lost more ground, mostly due to the Italian situation and the ongoing situation will probably lead to more volatility.

GBP

Mixed data last week keeps the Pound under pressure, and Brexit is dominating the British Headlines the Pound will underperform until we have a definitive breakthrough and some conclusions.

YEN

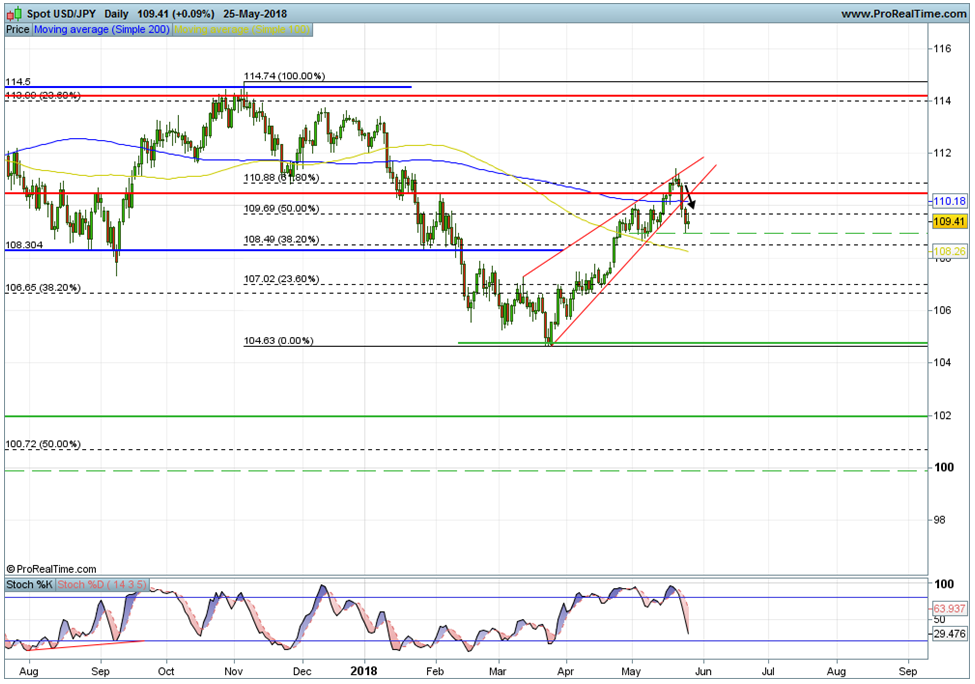

We had been looking at some exhaustion in the USDJPY and the Yen finally stopped its recent weak spell and moved higher, gaining 1.2% against the USD and 2.5% vs. the Pound.

The Week Ahead

Last week ‘But we always expect some nice movement and surprises in the markets.’ Our quote from the Weekly Report, and indeed we had volatility in most markets. With the collapse of the Italian Coalition (again mentioned this could happen) we now have calls for the impeachment of the Italian President as he appoints an interim PM, ex-IMF economist Carlo Cottarelli. Who knows what will happen now, but with Spain also having political instability, this could lead to further tremors through the Eurozone and markets.

Across the pond, we still have the on/off Korean Summit and President Trump’s hard-line approach to NAFTA and the trade wars. But the main attention in the financial world was the sharp reversal higher in Bonds.

So, with all that said we will look for lots of volatility this week, data-wise we have GDP from the US, Switzerland and Canada, plus Canada has its rate decision. Plus, some PMI’s and we end the month and have Non-Farm Payroll on Friday

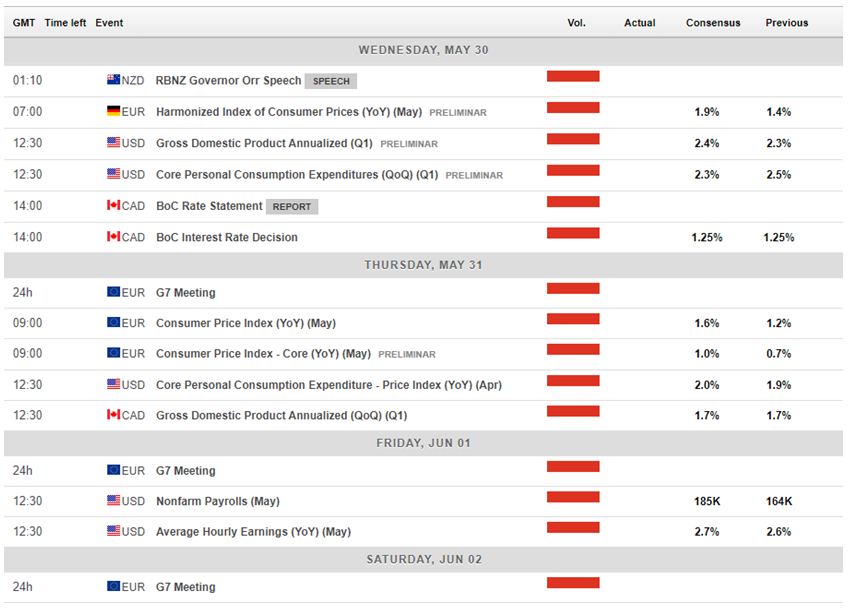

Major Data Releases

(Data provided by FX Street)

Currency Pairs to Watch

We will be developing our ‘Currency Pairs to Watch’ list to have a great overview of the week to help you keep an eye on some pairs. We now have an accompanying video to show our weekly watch list.

We will be interested in the USD, YEN and GBP this week. We will be looking at the ’trade of the week’ and the EURUSD, Gold, and GBPJPY.

Trade of the Week

So Last week we looked at the USDJPY, and we had a great trade with the technicals working out perfectly, we mentioned the indecision two Fridays ago, and that Monday would probably see a move higher, but then we would look for a fall below 110.50 and it went to 109.31.

(Click on image to enlarge)

(Click on image to enlarge)

So, to look at this week’s trade, we love to keep it simple, and with this Weekly Report focusing on the Eurozone turmoil, we will simply look for an EURUSD trade short. With a break of support at 1.1588 to the next support level of 1.14729. The key is not to be greedy as it will pull back at some point, and this can surprise the markets with bad news a retracement may still occur.

(Click on image to enlarge)

Weekly Progress Report

We had 2 Reports last week due to family reasons I was away, the AUDCAD and EURAUD. The AUDCAD ran to target. Did not trigger and fell due to the Italian political situation.