Weekly Market Outlook - Santa Claus Rally & The Dollar

It wasn't a full trading week, but the bulls were able to pack a lot of buying into just three and a half days of trading last week. All told, the S&P 500 (SPX) (SPY) advanced 2.7% last week, reversing a sharp pullback that looked like was going to turn into something bigger two weeks ago.

Still, though the momentum is bullish [the BigTrends TrendScore fought its way back to a bullish 63.6; anything above 60 is bullish] and we're at what's usually a bullish time of year, but it's advisable to keep a close eye and a short leash on things right now - there remain a couple of stumbling blocks for the market.

We'll weigh the upside and downside after a quick run-down of recent economic news.

Economic Data

Though fewer than usual were watching, this past week was actually rather busy in terms of economic news.

It was a particularly big week for real estate, though not an especially encouraging one. Existing home sales fell from an annualized pace of 5.32 million in October to a multi-month low rate of 4.76 million last month. Economists were expecting 5.3 million. Meanwhile, new home sales hit a pace of 490,000, up from 470,000 in October, but well shy of the forecast for 505,000.

Though the bigger trend is still broadly bullish, we're starting to see a lot of volatility on this front... even if last month's big stumble in existing home sales was exaggerated by the "seasonal adjustment" calculation.

Home Sales Chart

Source: Thomas Reuters

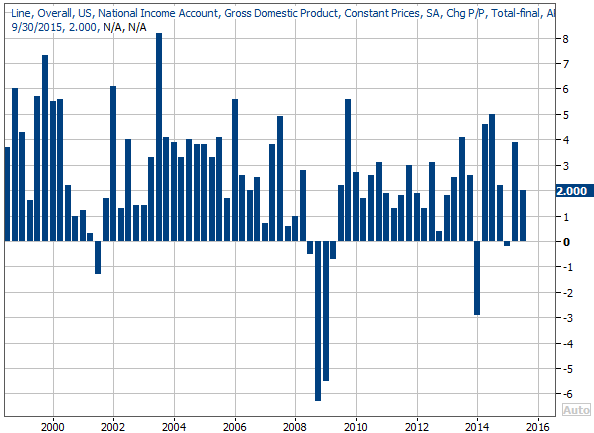

We also heard the third and final GDP growth calculation for the third quarter. It was down from the second guess of 2.1%, though not by much. It rolled in at 2.0% growth. Still, that's forward progress for a second quarter in a row, suggesting the economy isn't as near a recession as many like to say it is.

GDP Chart

Source: Thomas Reuters

Last but not least, November's durable goods orders were posted last week. They weren't stunning, with or without transportation orders factored in. On the other hand, bear in mind that the figures represent a comparison to October's totals - not November 2014's totals. It's also pretty clear from the chart below that we can't sweat tepid - or even negative - durable goods orders comparisons. It's clearly a volatile piece of data.

Durable Goods Orders Chart

Source: Thomas Reuters

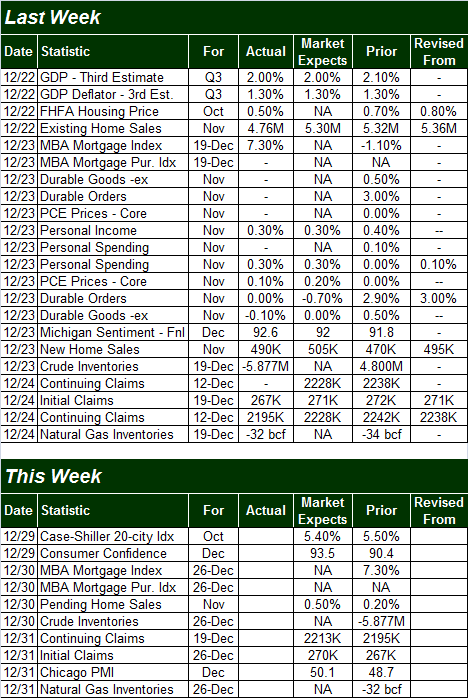

All the other data is on the following grid:

Economic Calendar

Source: Briefing.com

This week isn't going to be nearly as busy as last week in terms of economic news, which is good, since many traders will be taking the week off due to the holidays (market is closed this Friday for New Year's). The only items of real interest are Tuesday's consumer confidence and the Case-Shiller Index, and neither of those are necessarily game-changers.

Stock Market Index Analysis

First and foremost, take everything that happened last week (along with the analysis below) with a grain of salt. Last week was unusual due to the approaching holiday. It's usually bullish phase, just by default. That being said...

Most of the time, the Santa Claus rally lasts all the way through the first day of the new calendar year. And, this time around it looks like there's room and reason for stocks to keep rallying for at least a few more days... just as scripted.

Take the S&P 500 for example. Two weeks ago the index pushed up and off of its lower Bollinger band as well a new support line (black, dashed), and bounced up and off of it rather firmly. It's yet to bump into any proven ceilings. Specifically, it's yet to bump back into its upper Bollinger band, nor has it bumped into a ceiling defined by a resistance line that plots the last two major peaks (red, dashed). One or other are the most likely levels where the bears could start to dig in again.

S&P 500 & VIX Daily Chart

Chart created with TradeStation

You'll also see we got a bullish MACD cross as of Friday, even if "just barely."

It's not a rally without potential flaws and pitfalls though. For instance, the S&P 500 is having a bit of trouble getting over some moving average lines that are known resistance levels. And, even if it does, it's not as if there's a ton of room before other known ceilings get in the way. [Santa Claus rallies may be reliable, but they aren't necessarily huge.]

The litmus test, or confirmation that a rally has really taken hold, is the Percent R line. It needs to get - and stay - above its 80 threshold rather than peel back from it to say with any real certainty this is more than just another short-lived Santa Claus rally.

Meanwhile, the big floor is still the convergence of straight-line support and the lower Bollinger band, currently at 2002.

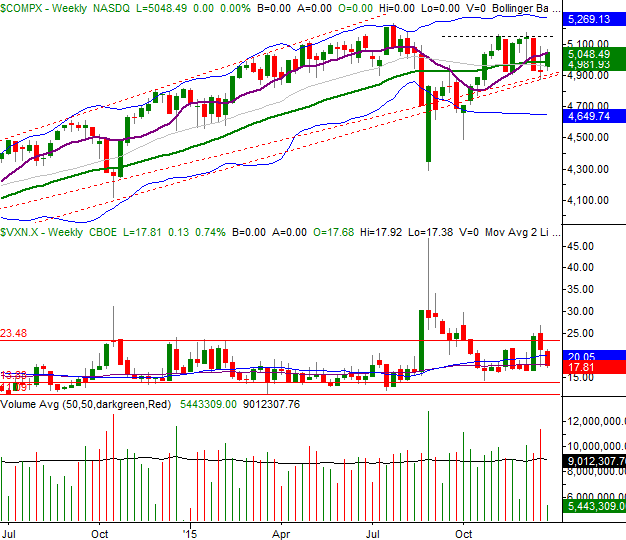

A longer-term view of the market isn't necessarily any more telling, but it does offer some more perspective on what's going on. Take a look at the Nasdaq Composite's (COMP) weekly chart below. The long-term support lines that extend all the way back to late-2012 - the ones that temporarily failed in August and September - appear to have been put back in play. That's where the composite bounced two weeks ago, setting up last week's gain.

NASDAQ Composite & VXN Weekly Chart

Chart created with TradeStation

In this timeframe, there's quite a bit of room before the upper Bollinger band is bumped into again. Keep an eye of 5145, however, as that's been a more important ceiling since early November.

The real challenge will be exercising enough patience to not flinch before the market shows its cards. It may not happen this week either, as it's another holiday-shortened week where the market's participants are going to be a little disinterested.

U.S. Dollar Back in a Downtrend

Last week, the consistently volatile U.S. Dollar Index (UUP) broke back under its 20-day and 50-day moving average lines... a retreat ultimately fueled by another brush with March's peak right around 100.4.

Given its history, the odds favor a dip all the way back to a well-defined floor around 94.0. Still, there's a minor floor around 97.20, and some longer-term moving average lines around 96. Should the Dollar Index break below those long-term moving averages though, there's nothing to stop that pullback until the index gets back to that major floor near 94.

U.S. Dollar Index Chart

Chart created with TradeStation

This could have an impact on, and be impacted by, the bond market, which was just shaken up by the first interest rate hike in years (though the impact may have already been priced in by the time it actually happened).

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!