Weekly Market Outlook: BOC, BOJ, ECB And Corporate Earnings In Focus

In the last full week before the US presidential election, all eyes turn to three major central banks - the Bank of Canada, Bank of Japan and European Central Bank - alongside a raft of key corporate earnings announcements from both US and European companies.

Traders will also be focused on the latest opinion polls of both US presidential candidates to try and identify early clues on the outcome. Currently, Biden has the lead and investors have focused on stocks that support a 'blue wave' victory such as those in the renewable energy and health sectors.

Weekly News

- Brexit talks between EU and UK negotiators resume with a trade deal aimed for mid-November.

- The UK signs a historic trade deal with Japan but the British pound remains focused on Brexit uncertainty.

- Pelosi announces that progress is being made in a stimulus deal but it may have trouble passing Congress.

- Eurozone economic activity shrunk once again in October due to the return of coronavirus restrictions and lockdowns.

- Gilead Sciences secures FDA approval for its COVID-19 treatment, Remdesivir.

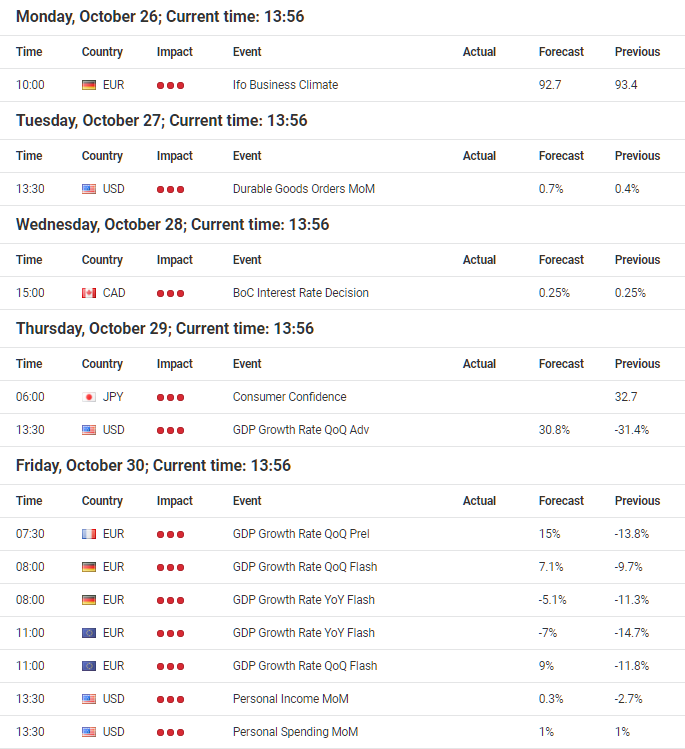

Source: Forex Calendar provided by Admiral Markets UK Ltd.

It is setting up to be another very interesting week in the markets with economic news potentially affecting most asset classes. But, election volatility and uncertainty could still weigh on some asset classes.

Trader's Radar - ECB Press Conference

All eyes will be on the economic data and monetary policy outlook coming from the European Central Bank (ECB) on Thursday, 29 October. This includes the:

- 12.45 pm GMT - ECB Main Refinancing Rate

- 12.45 pm GMT - ECB Monetary Policy Statement

- 1.30 pm GMT - ECB Press Conference

The press conference held by ECB president Christine Lagarde will be of particular interest as the bank has stated they are ready with an armoury of additional stimulus measures if needed. Most market participants are not expecting any policy changes in this meeting but many are expecting a shift in tone to open the doorway for new stimulus in December.

The Eurozone economy has been hugely affected by the second wave of coronavirus lockdown measures. Most businesses are not running at full capacity and the latest PMI figures suggest trouble could be brewing at many companies which could lead to higher unemployment, further denting the economic recovery.

The euro currency has been held in tight trading ranges against the majority of other major currencies but did appreciate against them last week. How the stimulus measures in the US play out and how that affects the US dollar may also prove to be a big factor on currency flows into and out of the euro.

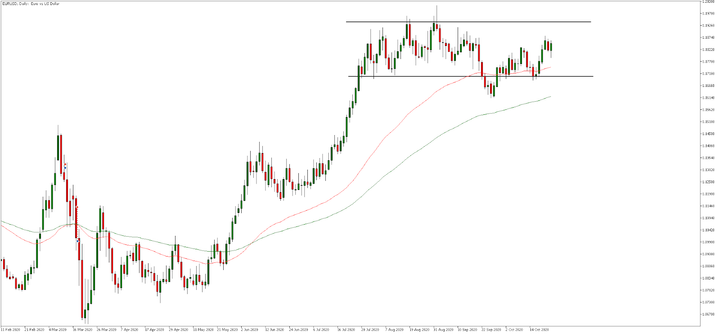

Source: Admiral Markets MetaTrader 5, EURUSD, Daily - Data range: from Feb 11, 2020, to Oct 23, 2020, performed on Oct 23, 2020, at 6.00 pm BST. Please note: Past performance is not a reliable indicator of future results.

Last five-year performance of EURUSD: 2019 = -2.21%, 2018 = -4.47%, 2017 = +14.09%, 2016 = -3.21%, 2015 = -10.18%, 2014 = -12.23%.

The daily price chart of EURUSD above shows the range that has developed since July. Price has failed to break the upper resistance line at 1.11943 and the lower support line at 1.1704 on multiple occasions. Traders may continue to employ mean reversion type strategies to participate within the trading range or may wait for the price to break through the top or the bottom of the range.

Currently, the momentum from other euro cross-rates shows the currency is in demand. For example, EURAUD broke through its long-term trading range that has developed since June. Although, much of this was due to the weakness in the Australian dollar after comments from the Reserve Bank of Australia suggest a rate cut is imminent. Any new Brexit-related developments could also make EURGBP an interesting currency to watch which is also currently in a trading range.

Corporate trading updates and stock indices

It was the second positive week in a row for most global stock market indices last week. Moves were quite limited as volatility dried up so close to the US presidential election and uncertainty around a stimulus plan being agreed upon sooner rather than later.

Currently, the main focus on both traders' and investors' minds is earnings. Last week, Intel shares dropped significantly as the chipmaker reported a 47% drop in its data centre sales. However, the likes of Gilead Sciences (GILD) surged higher after the FDA approved its Remdesivir drug as a treatment for COVID-19.

Stay up to date with the latest earnings release is essential in navigating the volatility of an announcement. Some heavyweight companies reporting this week, include:

- Tuesday - HSBC (HSBC), BP (BP), Pfizer (PFE), Microsoft (MSFT)

- Wednesday - Visa (V), Gilead Sciences (GILD), Boeing (BA)

- Thursday - Royal Dutch Shell (RDS-A), BT Group (BTGOF), Volkswagen (VLKAF), Airbus (EADSF), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), Facebook (FB)

- Friday - Exxon Mobil (XOM), Chevron (CVX)

(Click on image to enlarge)

Source: Admiral Markets MetaTrader 5, SP500, Daily - Data range: from February 10, 2020, to October 23, 2020, performed on October 23, 2020, at 7:30 pm BST. Please note: Past performance is not a reliable indicator of future results.

Last five-year performance of the S&P 500 circa: 2019 = +29.09%, 2018 = -5.96%, 2017 = +19.08%, 2016 = +8.80%, 2015 = -0.82%, 2014 = +12.32%

In the daily price chart of the S&P 500 stock market index above, it is clear to see that the long-term trend is still bullish with price trading above its 50-period and 100-period exponential moving averages. So far, however, the price has not managed to break through the all-time high price level of around 3,580 made in September.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more