Weekly Energy Roundup: Oil And Gas Companies, September 17 To September 21

The oil and gas industry as a whole continues to perform well, primarily due to strong Brent crude prices. We have also seen events such as President Trump’s proxy war on Iran continue to make headlines as well as the continual headlines about Russia. There have also been rumblings about a possible strike in the North Sea as the UK’s largest labor union rejected the pay offer presented by the Offshore Contractors Association. If this situation escalates, it could see rising oil prices in relatively short order due to the large volumes produced by the region. Now, let’s take a look at how the oil and gas industry stocks that are tracked by this report have held up.

ExxonMobil

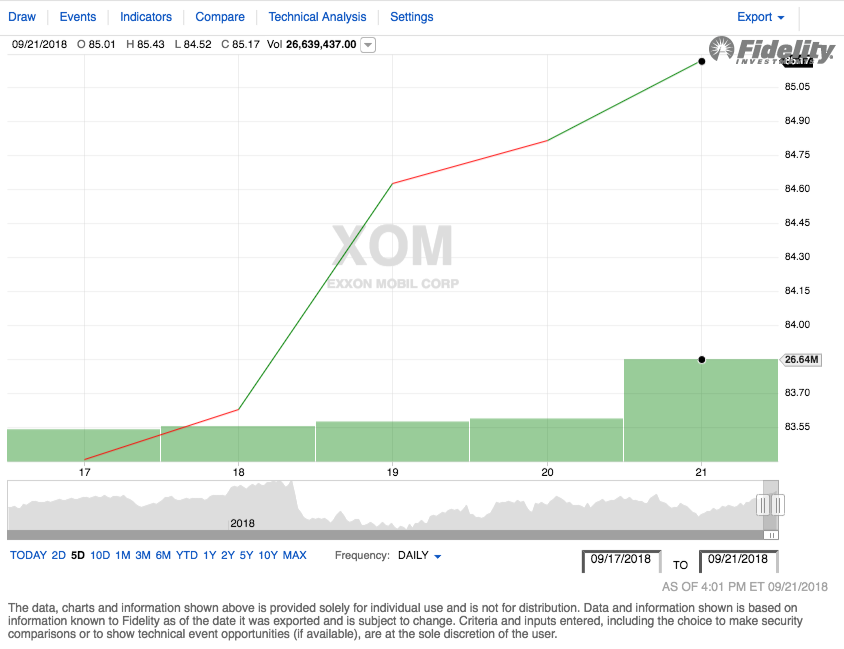

ExxonMobil (XOM) delivered a gain last week, steadily increasing during every day of the week. The company opened the week of September 17 at $83.00 per share and closed the week at $85.17 per share. This gives the stock an overall return of 2.61% over the week.

Source: Fidelity Investments

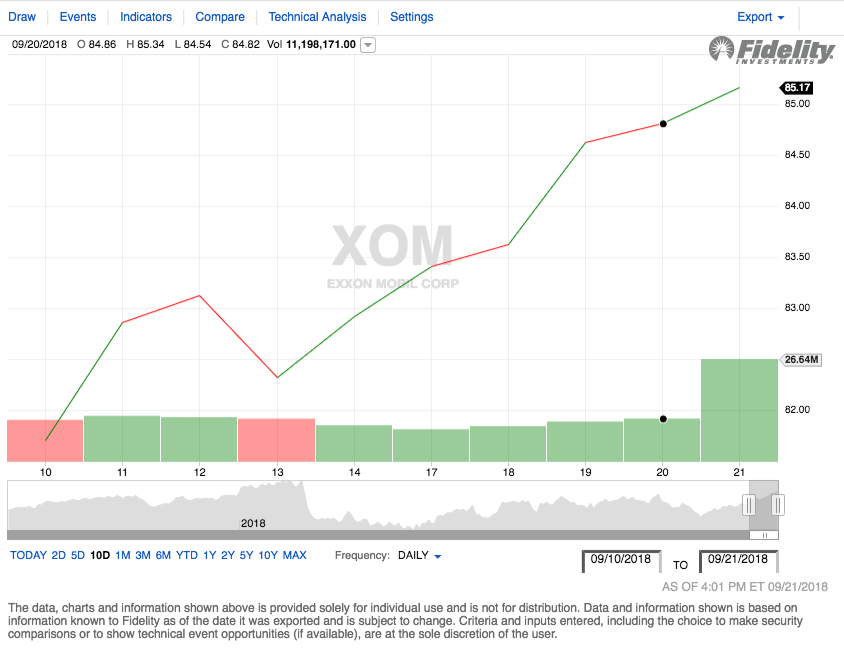

The stock’s two-week performance was also quite impressive, posting a fairly substantial gain over the period, due partly to ending only one day in the red. Overall, it went from $82.23 to $85.17 per share over the two-week period for a gain of $2.94, which works out to 3.53%. Shareholders should be relatively pleased with this gain.

Source: Fidelity Investments

On Friday, ExxonMobil was rated outperform by RBC (RBC) due to the company finally addressing past mistakes such as failing to build up its project pipeline to replace dwindling production and reserves. RBC did not explicitly say what stimulated the upgrade however except for crediting high oil prices and a new project pipeline. Nonetheless, upgrades do tend to have positive impacts on share prices and ExxonMobil proved to be no exception here.

Chevron

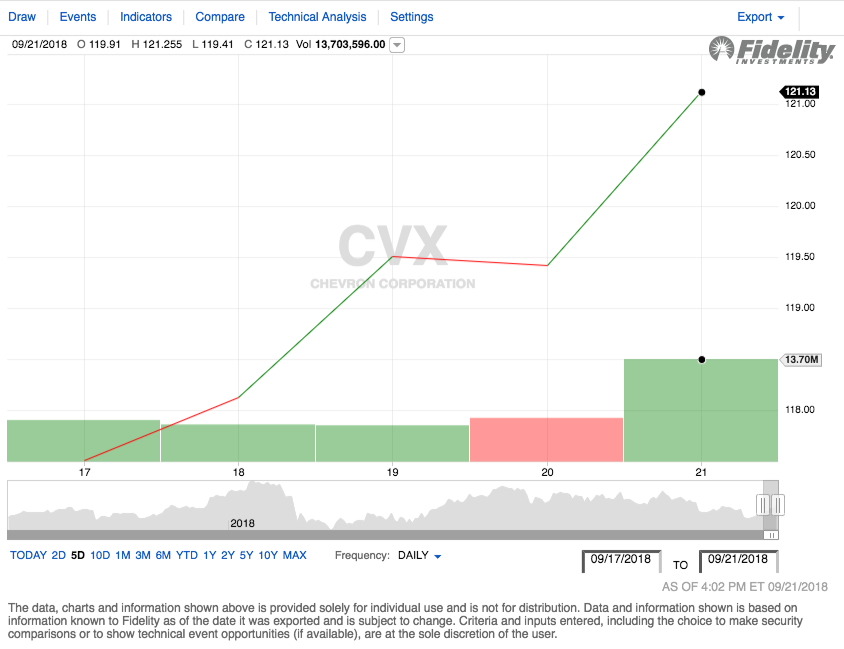

Chevron (CVX) also delivered a gain to investors last week although its performance was slightly more erratic than ExxonMobil's. This is because it declined slightly on Thursday, September 20 instead of delivering a gain as its peer company did. The stock opened the week at $117.61 per share and closed the week at $121.13 per share. This gives the stock a gain of 2.99% over the week.

Source: Fidelity Investments

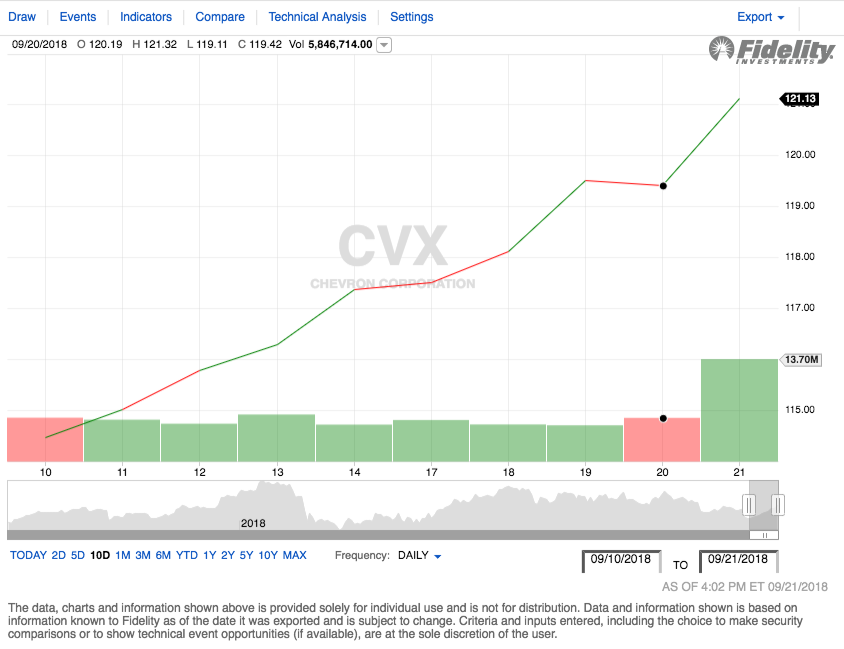

Chevron’s stock price action was more or less consistently positive over the trailing two-week period, as it only delivered one day of negative performance. On Monday, September 10, Chevron’s stock opened at $115.43 per share. This gives the stock a total gain of 4.94% over the period, substantially better than what ExxonMobil delivered.

Source: Fidelity Investments

On Saturday, September 22, workers at the company’s facilities in Nigeria announced that they are preparing to strike in response to what they say is a violation of their employment contracts with the oil company. The workers accuse Chevron of attempting to fire thousands of workers, which the union claims is in violation of their contract. While this news came out on Saturday and so therefore has not had any impact on the company’s share price (and might not), it could make for an interesting day in the markets on Monday when we consider that Nigeria is the largest oil producer in Africa.

BP

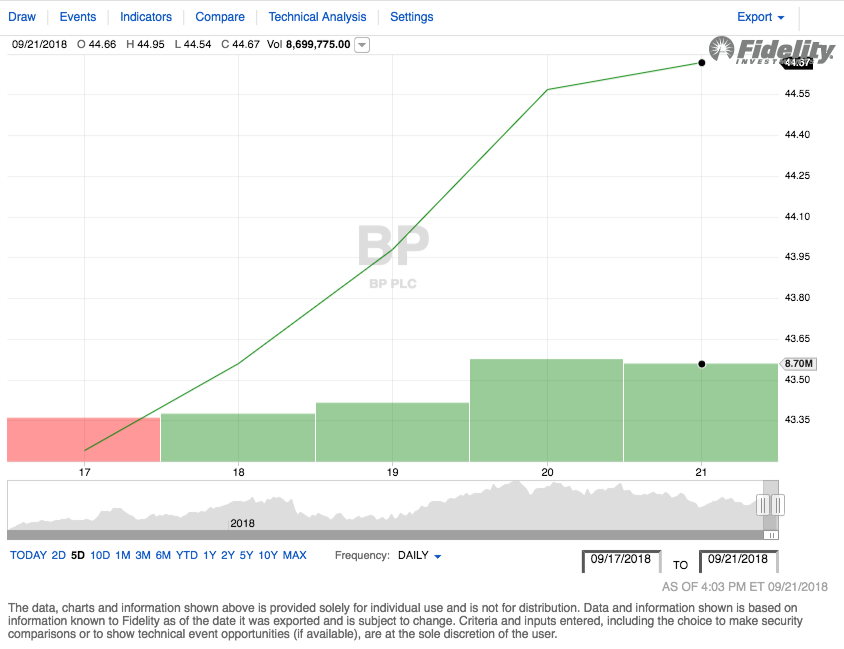

BP's (BP) stock also delivered relatively strong gains over the past week. On September 17, 2018, BP shares opened at $43.48 and rose to $44.67 by the end of the week. This gives the stock a weekly gain of 2.74%.

Source: Fidelity Investments

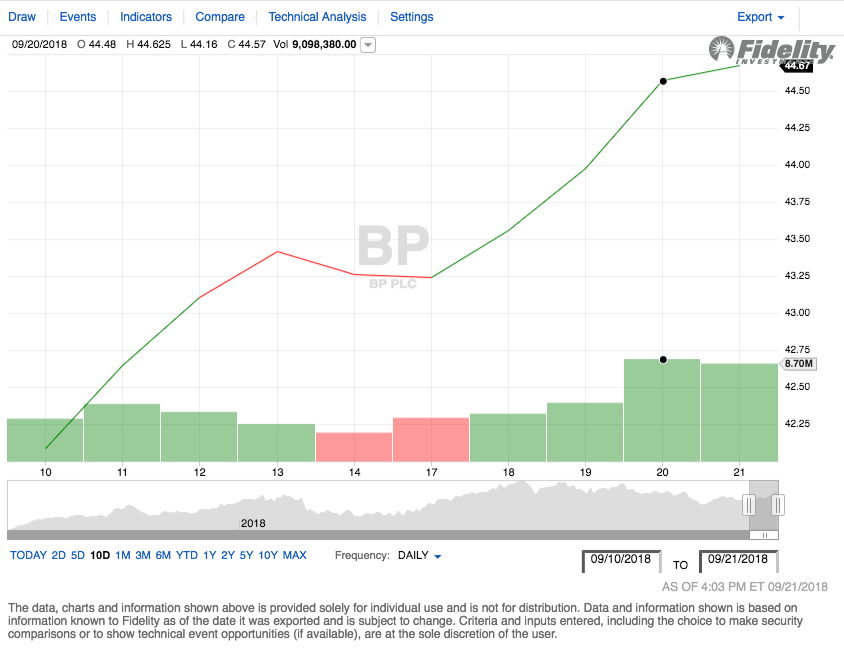

BP shares were somewhat volatile over the two-week period, although they did deliver an overall gain. The shares were not volatile enough to be appealing to most short-term traders, however. On September 10, BP shares opened at $42.17. The stock thus delivered a two-week gain of 5.93%, better than both of its already discussed peers.

Source: Fidelity Investments

On Wednesday, September 19, BP announced that it is shutting down the crude distillation unit at its 413 kbpd refinery in Whiting, Indiana for a planned outage. This is BP’s largest refinery in North America and the distillation unit is expected to be out of commission until mid-October. As this was planned, this will probably not have much of an impact on the short-term stock performance since it was likely already baked into the stock. Nonetheless, it may exert a slightly negative impact on the company’s third and fourth quarter results.

There are rumors that BP is also in talks with SDX Energy to sell its 50-year old business in Egypt. This is an asset that the company has been trying to sell for quite some time. Earlier this year, a report from Reuters valued the business at $500 million but it is uncertain exactly what the sale price will be. If this sale goes through, it will likely result in BP receiving an injection of cash that it will then need to put to work in new projects.

Royal Dutch Shell

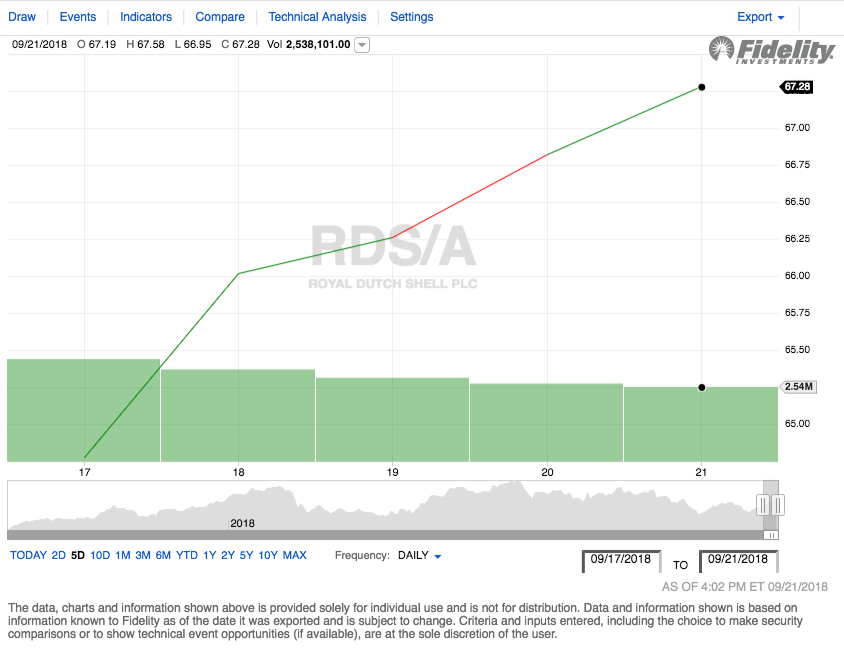

Royal Dutch Shell (RDS-A, RDS-B) likewise saw its stock deliver a gain to investors over the course of the week. On September 17, 2018, RDS-A opened at $65.05 per share. By the end of the week, the stock had climbed to $67.28 per share. This represents a weekly gain of 3.43%.

Source: Fidelity Investments

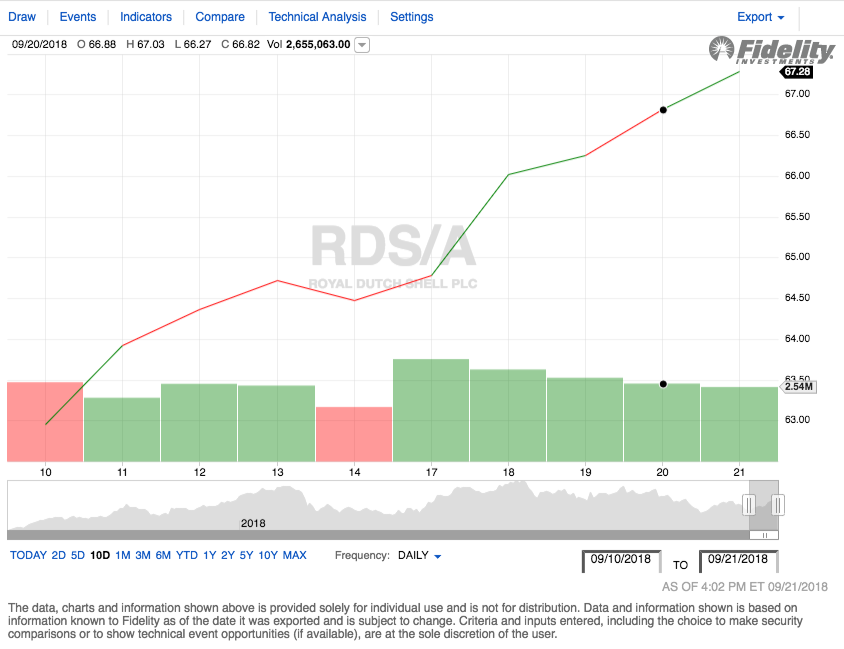

Royal Dutch Shell posted a gain over the past two weeks but was quite volatile just like BP. Traders may have been able to take advantage of this by exploiting some price fluctuations, although there were not enough fluctuations to keep most traders happy. On September 10, 2018, the stock opened at $63.13 per share. It thus delivered a two-week gain of 6.57%. This is certainly a large enough gain to keep most investors happy over the period.

Source: Fidelity Investments

Royal Dutch Shell was indirectly impacted by the recent North Sea worker problems at Total (TOT). In a move meant to avert a strike before it occurred, the company changed its rotation schedule so that workers are forced to spend less time offshore and thus away from their homes and families. This is unlikely to have much of an impact on the company’s high-level operations however so long as the same volume of work gets done.

Rumors also emerged this week that Royal Dutch Shell is in talks with Focus Oil to sell its stake in the Caesar Tongo oil field in the Gulf of Mexico. This would continue along with a long period of asset divestments that Shell has been engaging in. Personally, I am concerned about the impact that moves such as this will have on the company’s reserves, particularly since it had a reserve replacement ratio of 78% over the past three years.

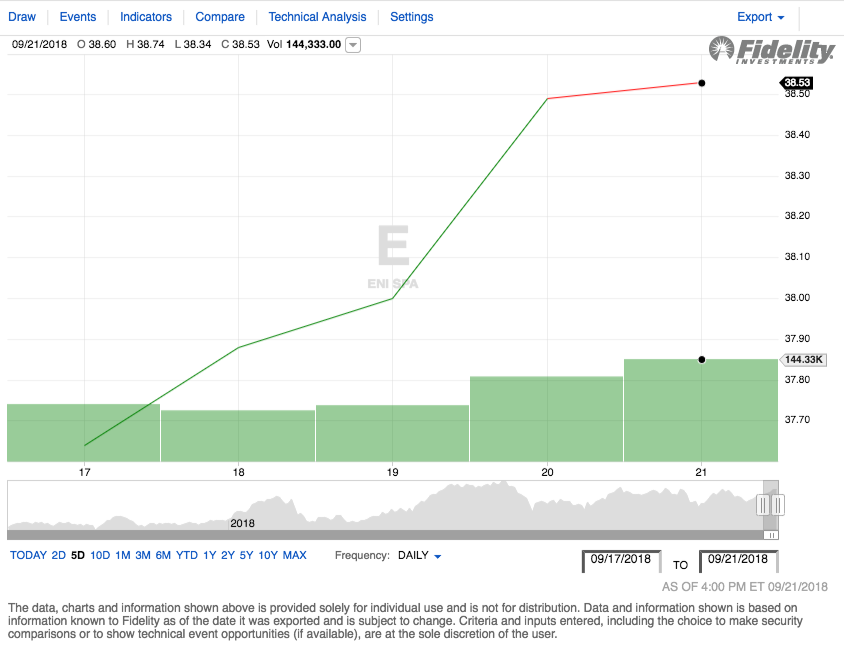

Eni

Italian oil giant Eni's (E) stock chart is one that would certainly appeal to investors as it saw nothing but increases over the past week. The stock opened the week at $37.79 and closed out at $38.53, delivering an overall gain of 1.96% for the week.

Source: Fidelity Investments

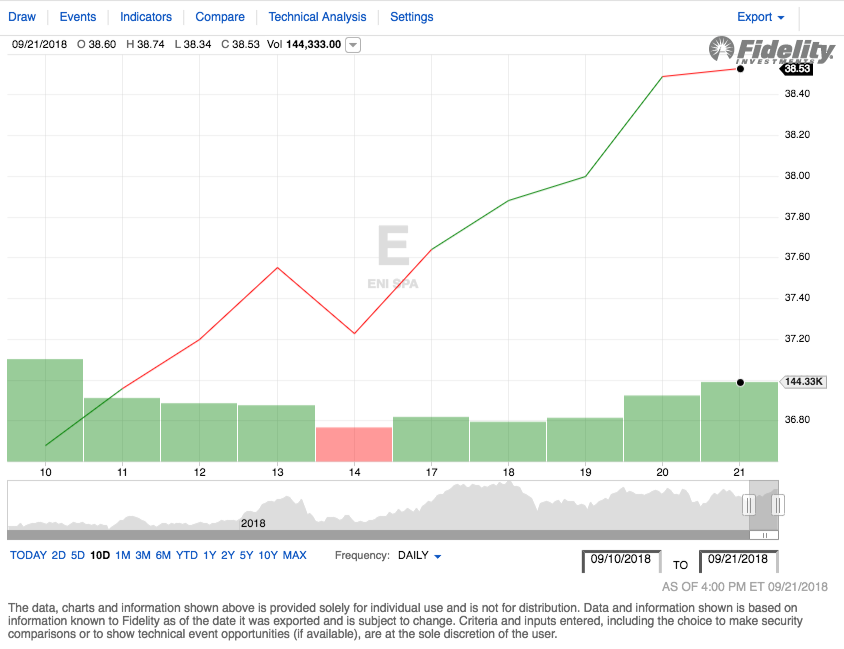

The company's two-week performance was slightly volatile, but there was nothing really out of the ordinary. It was, fortunately, overall positive. On Monday, September 10, Eni stock opened on the NYSE at $36.87 per share. As it closed at $38.53 as already mentioned, it delivered a gain of 4.50% to its buy-and-hold investors.

Source: Fidelity Investments

Eni is somewhat underfollowed by American financial news media and as such there is rarely much news over the course of a typical week. Nonetheless, we did see Eni acquitted in a graft case against ex-CEO Paulo Scaroni on Wednesday. However, the same court did find Saipem (a subsidiary of Eni) guilty of corruption and fined the entity €198 million. This amount of money is too small to have any real impact on the company so investors should not really worry about it. This was a cloud that has been hanging over the company for quite some time though so it is certainly nice to see it lifted.

Equinor

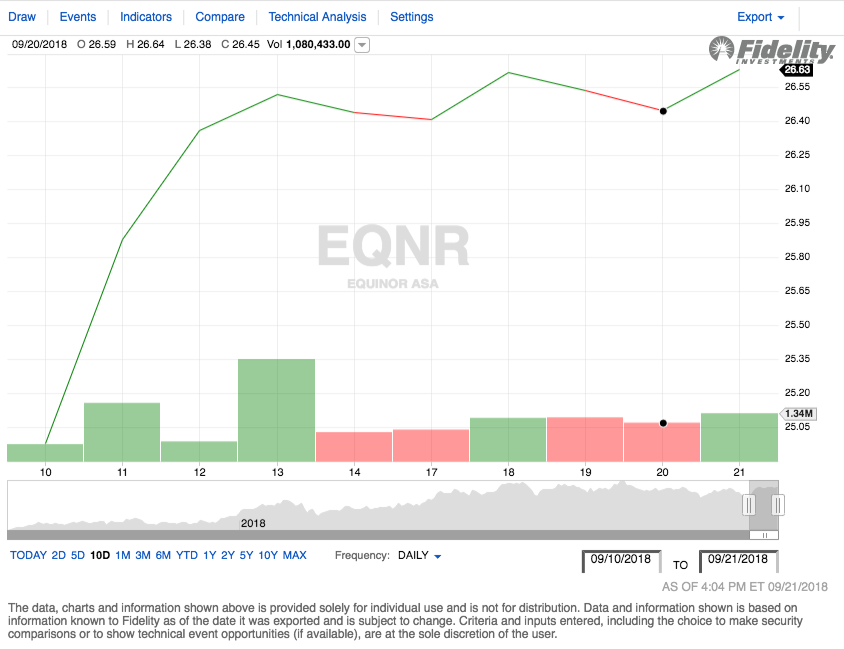

Norway's Equinor (EQNR) is often the most stable entity price-wise in these weekly reports, likely due to the Norwegian government’s substantial ownership stake in the company. This was certainly the case during the week of September 17, although it may not appear that way from a look at the price graph. Equinor opened the week at $26.56, and gave up all its early gains mid-week. The company did however recover and returned a gain to its owners over the course of the week. The company closed out the week at $26.63 per share, delivering a gain of 0.26% to its investors.

Source: Fidelity Investments

Equinor was likewise relatively stable over the past two weeks, although it did deliver very strong performance early in the period. As was the case with most of these companies, Equinor delivered a gain to its investors over the two-week period. On September 10, 2018, Equinor opened at $25.17 and thus delivered a 5.80% gain over the two-week period.

Source: Fidelity Investments

Equinor had no significant news over the past week. The company does own numerous oil fields in the North Sea, which could strike fear in investors that have seen the scenario that has played out with Total. However, Equinor itself has not been threatened with strike action and most of its North Sea assets are in Norway, not the UK, so it is likely that the company will avoid problems here.

Disclosure: I have no positions in any stock mentioned in this article and no plans to initiate any positions within the next 72 hours.