Weekly Energy Roundup: Oil And Gas Companies, June 25 To 29

The last week has certainly been an interesting one for the oil markets. On Saturday, President Trump called the king of Saudi Arabia to ask them to increase oil output by two million barrels per day to escalate the proxy war on Iran. Meanwhile, Brent has continued to trade at much higher prices than it did during the same time last year (it closed at $79.44 on Friday). Energy companies as a whole have been benefiting from the turmoil, with many reporting record profits in the first quarter. We expect that they will do so again in the second quarter.

ExxonMobil (XOM)

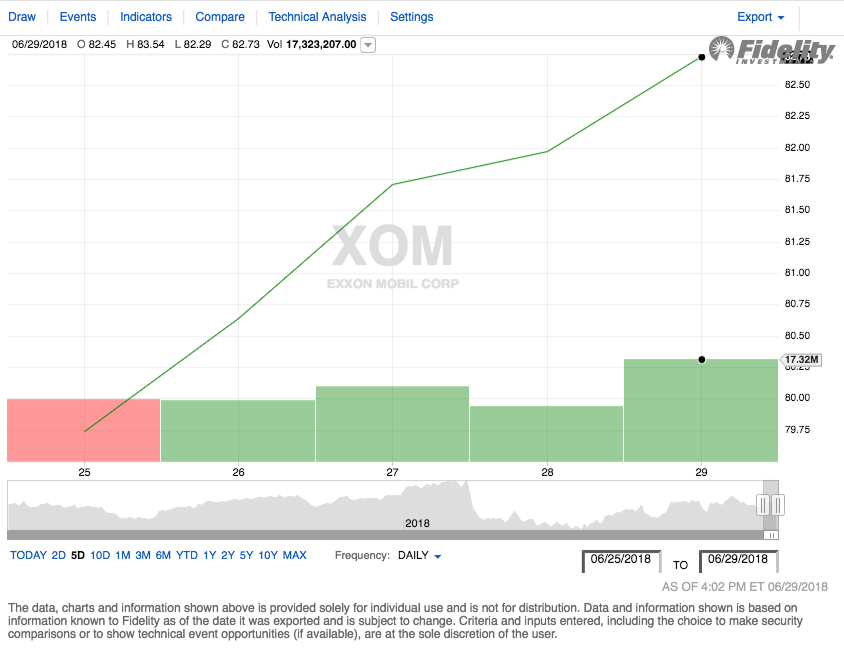

ExxonMobil delivered a gain last week, steadily increasing during every day of the week. The company opened the week of June 25 at $80.78 per share and closed the week at $82.73 per share. This gives the stock an overall return of 2.41% over the week.

Source: Fidelity Investments

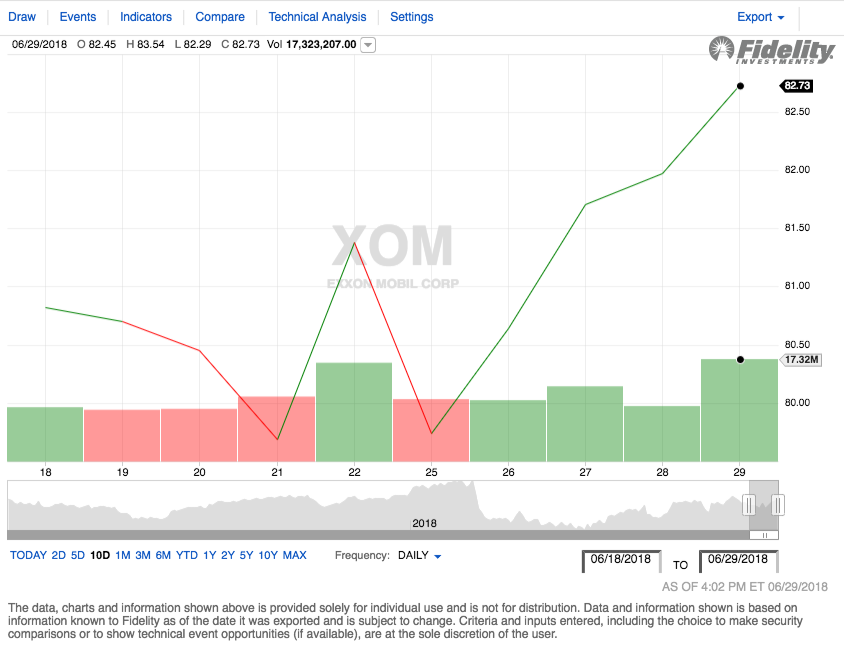

The stock’s two-week performance was also quite impressive, posting a fairly substantial gain over the period, although it had some volatility towards the end of the week of June 18. However, it went from $80.40 to $82.73 per share over the two-week period for a gain of $2.33, which works out to 2.90%. Shareholders should be relatively pleased with this gain.

Source: Fidelity Investments

There were two big news stories affecting ExxonMobil over the past week. The first was the news that U.S. Federal District Judge dismissed a lawsuit against ExxonMobil and several big oil peers effectively claiming that the companies should pay to protect cities against the ravages of climate change. The judge said that "the situation demands a political solution and not one that can be supplied by a judge in a public nuisance case." This lawsuit had the potential to result in massive payouts to plaintiffs should the companies have lost it, so the fact that the judge will no longer allow it to proceed is a positive sign for all of the companies involved.

The second major piece of news affecting the company is that ExxonMobil along with its partner company Eni (E) have begun marketing the natural gas from the extremely gas-rich Area-4 block in Mozambique. The goal here is to see if there exists sufficient demand for the gas to proceed with the development of an LNG plant to export it. This could result in growth for the company as this gas is in prime position to be exported to the growing markets of Asia.

Chevron (CVX)

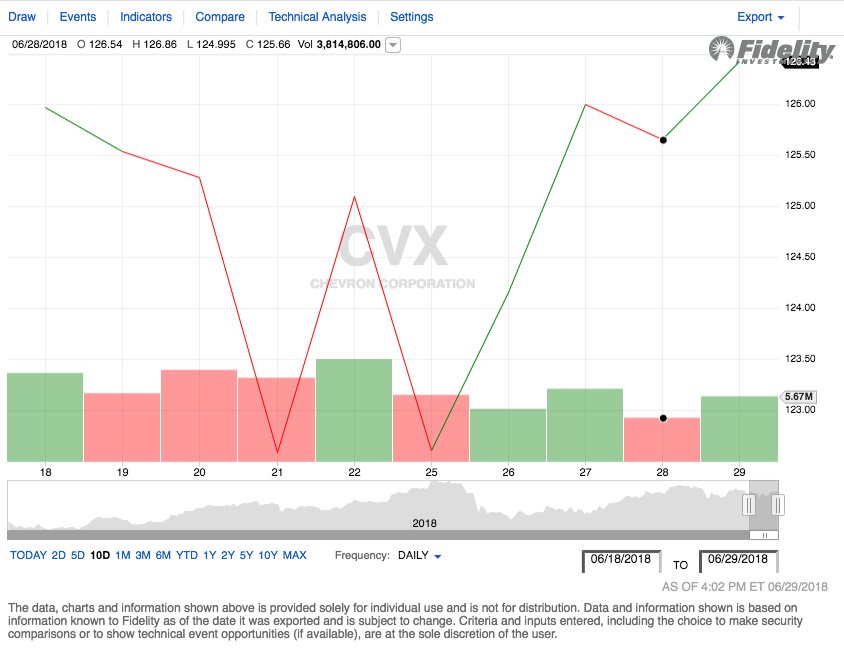

Chevron also delivered a gain to investors last week although its performance was slightly more erratic than ExxonMobil's. This is because it declined on Thursday, June 28 instead of delivering a gain as its peer company did. The stock opened the week at $124.43 per share and closed the week at $126.43 per share. This gives the stock a gain of 1.61% over the week.

Source: Fidelity Investments

Chevron’s stock price action was quite volatile over the past two weeks, in some contrast to ExxonMobil's. Immediately after opening on June 18, the stock price declined and continued this decline for most of the remainder of the week. It then showed some volatility mid-period before beginning to climb again on June 25. On Monday, June 18, Chevron’s stock opened at $124.35 per share. This gives the stock a total gain of 1.67% over the period, substantially worse than what ExxonMobil delivered.

Source: Fidelity Investments

Chevron also benefited from the dismissal of the climate change lawsuit as it was one of the parties that was mentioned in the complaint. This should at least somewhat protect the company from having to pay out the massive sums that losing such a case would entail. In addition, the company announced that its capital expenditures related to a deepwater gas project would be approximately $6 billion less than originally planned without having to decrease planned production. It is always a good thing when a company saves money as that frees up the capital for other growth projects, so investors should be happy about this development.

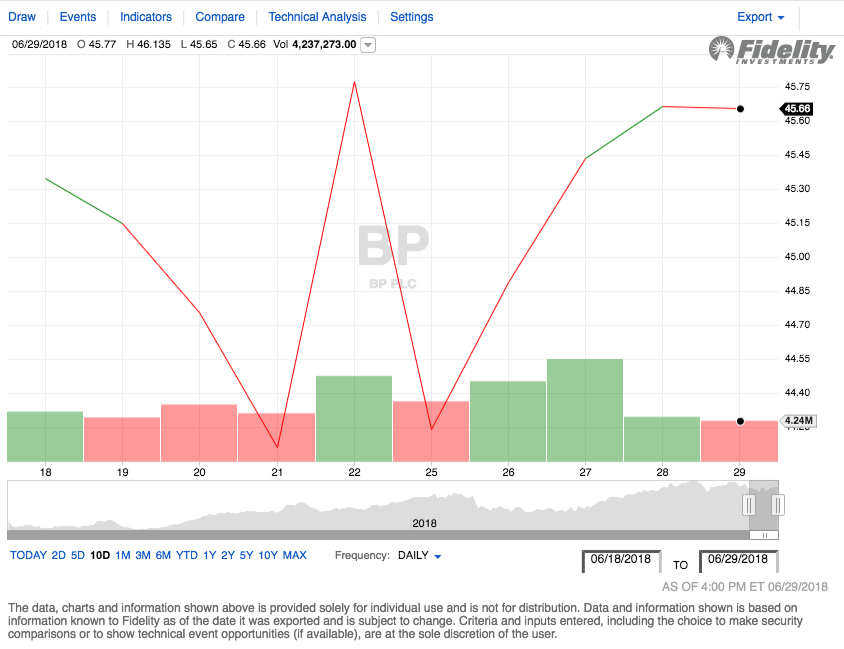

BP (BP)

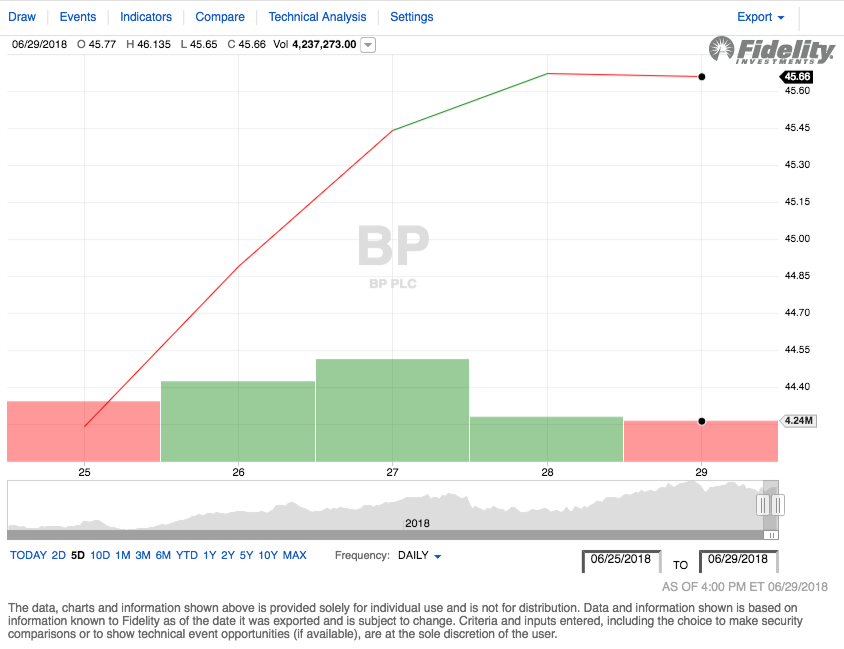

BP's stock price graph looks remarkably similar to ExxonMobil's although its gain on Thursday, June 28 was a little more pronounced. On June 25, 2017, BP shares opened at $44.92 and rose to $45.66 by the end of the week. This gives the stock a weekly gain of 1.65%.

Source: Fidelity Investments

BP shares were somewhat volatile over the two-week period, although they did deliver an overall gain. This would thus be appealing for both traders seeking to profit on the volatility as well as buy-and-hold investors looking for long-term gains. Interestingly, the stock did not reach its high point for the period on June 28 as both ExxonMobil and Chevron did but rather hit this level on June 22. On June 18, BP shares opened at $45.03. The stock thus delivered a two-week gain of 1.40%, worse than both of its already discussed peers.

Source: Fidelity Investments

As with many of the companies listed here, BP also benefited from the dismissal of the climate change public nuisance lawsuit as it was a plaintiff in the case. This should save it the horrors of having to pay out large sums in the future should the oil companies have lost this case.

In another interesting development, on June 28, it was announced that BP is acquiring ChargeMaster, a company that owns a network of electric car charging stations across the UK. BP has long been attempting to make its mark on the Green Revolution and this acquisition could certainly be a start.

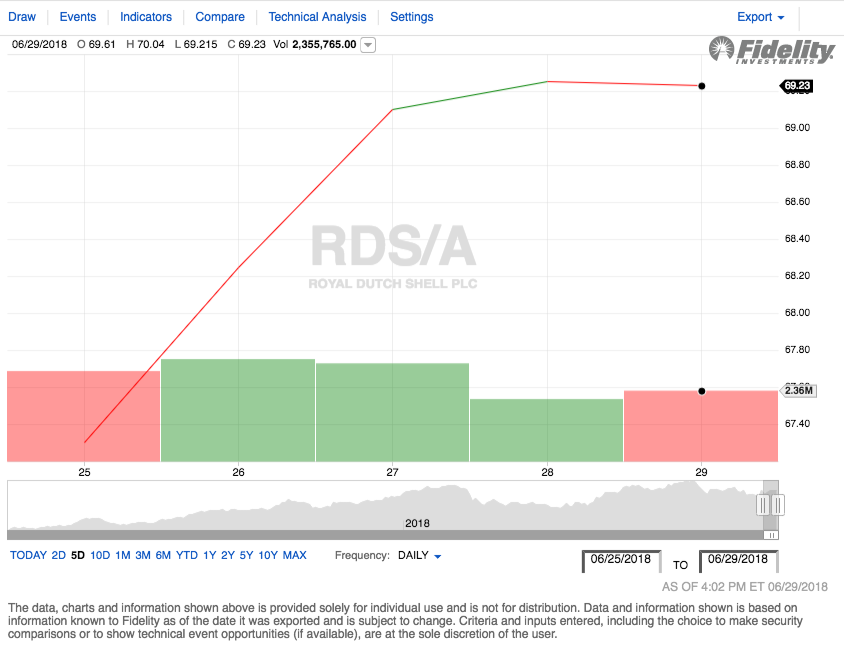

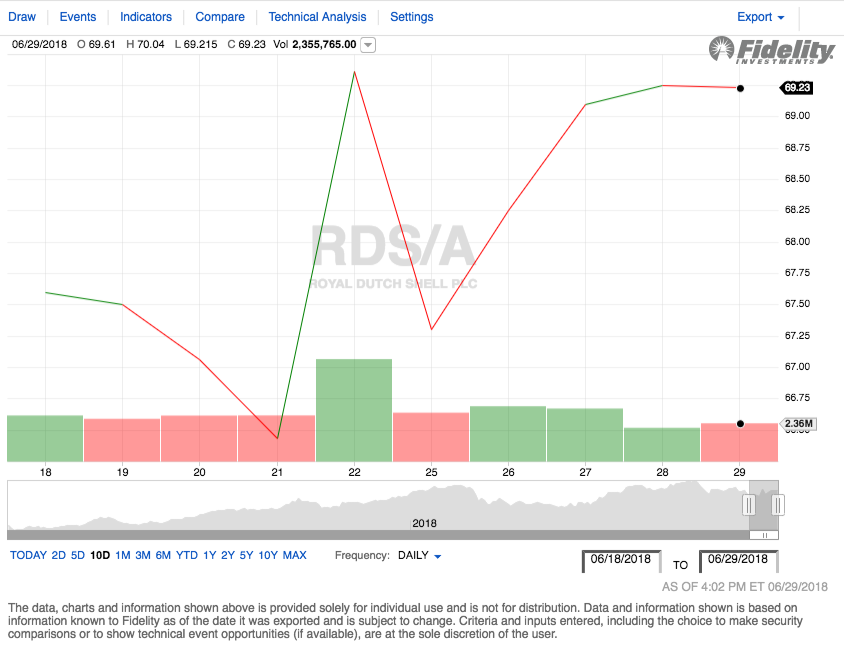

Royal Dutch Shell (RDS-A, RDS-B)

Royal Dutch Shell saw similar price action to that of BP although it declined slightly on Friday, June 29. On June 25, 2017, RDS-A opened at $68.08 per share. By the end of the week, the stock had climbed to $69.23 per share. This represents a weekly gain of 1.69%.

Source: Fidelity Investments

Royal Dutch Shell posted a gain over the past two weeks but was quite volatile just like BP. Traders may have been able to take advantage of this by exploiting some price fluctuations. On June 18, 2018, the stock opened at $67.30 per share. It thus delivered a two-week gain of 2.87%.

Source: Fidelity Investments

As was the case with many of the other companies discussed in this update, Royal Dutch Shell was a named plaintiff in the climate change case that was dismissed this week. This is clearly a positive for the company for the reasons already discussed, namely that it is much less likely that the company will have to pay out a massive financial settlement should the lawsuit go poorly for it.

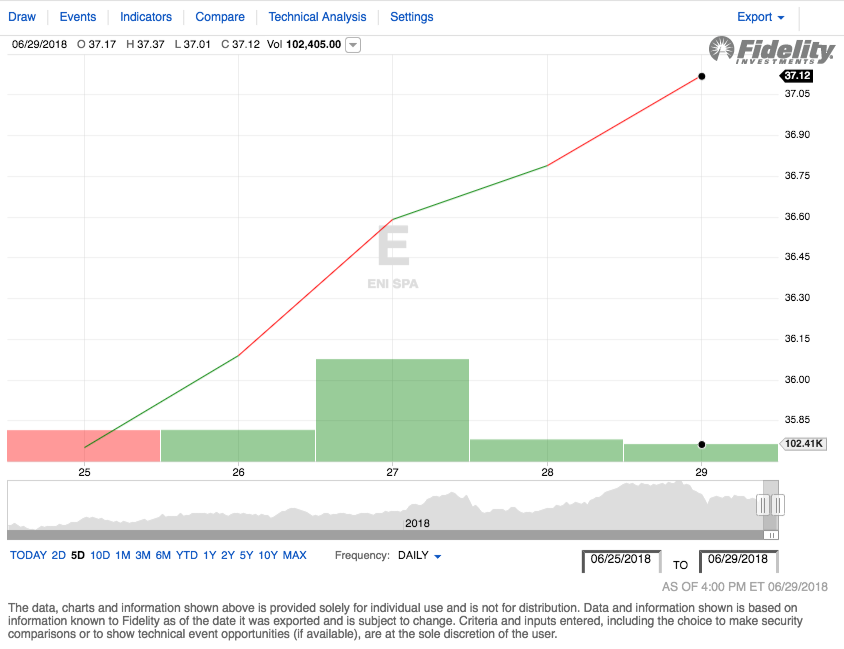

Eni (E)

Italian oil giant Eni's stock chart is one that would certainly appeal to investors as it saw nothing but increases over the past week. The stock opened the week at $36.23 and closed out at $37.12, delivering an overall gain of 2.46% for the week.

Source: Fidelity Investments

The company's two-week performance was quite volatile, showing numerous peaks and troughs on the chart. It was, however, overall positive. On Monday, June 18, Eni stock opened on the NYSE at $35.66 per share. As it closed at $37.12 as already mentioned, it delivered a gain of 3.93% to its buy-and-hold investors. Traders could have also profited quite handsomely by taking advantage of the volatility.

Source: Fidelity Investments

As already discussed for ExxonMobil, Eni began marketing efforts for the natural gas from the extremely gas-rich Area-4 block in Mozambique. Should the marketing efforts prove fruitful, the company will then begin work on a liquefied natural gas plant to facilitate the export of this gas. As I speculated earlier this week, this has the potential to turn Eni into a major exporter of natural gas to Asia, which is likely to be the most rapidly growing market for the fuel over the coming 35 years. This is certainly a promising development for the Italian company.

Equinor (EQNR)

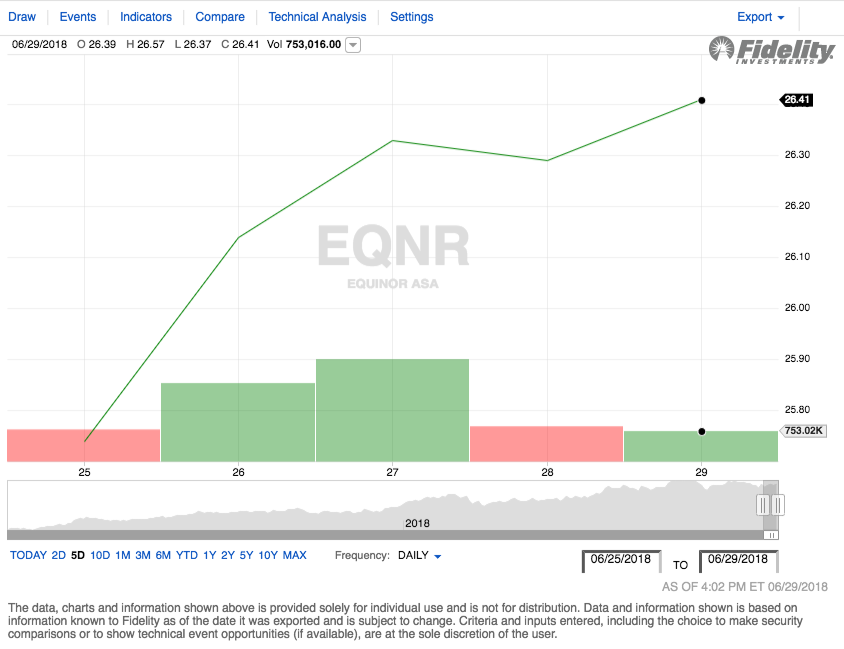

Norway's Equinor is often the most stable entity price-wise in these weekly reports, likely due to the Norwegian government’s substantial ownership stake in the company. However, this was not the case during the week of June 25. Equinor opened the week at $26.06, and steadily increased on every day except Thursday. As Equinor closed out the week at $26.41 per share, it delivered a gain of 1.34% to its investors on the week.

Source: Fidelity Investments

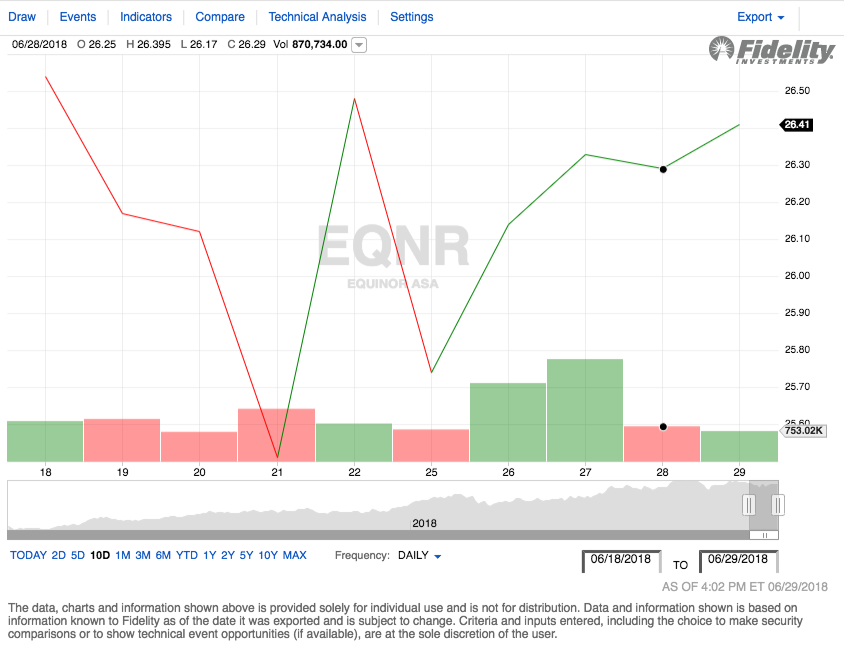

Equinor was surprisingly volatile over the past two weeks, showing numerous up days and down days. Despite this, Equinor's stock was almost completely flat for those that were holding it over the entire period. On June 18, 2018, Equinor opened at $26.35 and thus delivered a 0.23% gain over the two-week period.

Source: Fidelity Investments

Equinor had no significant news over the past week. As the company was not named in the climate change lawsuit, the dismissal of this case had no direct effect on it (although it is likely that the entire energy industry would have been affected in some way by that case). The company is trading at a very cheap ratio compared to analyst consensus earnings growth, however, so it might be worth a look for that reason.

Disclosure: I am long XOM and CVX via ETF holdings but have no direct long positions in any stocks mentioned.