Weekend Report

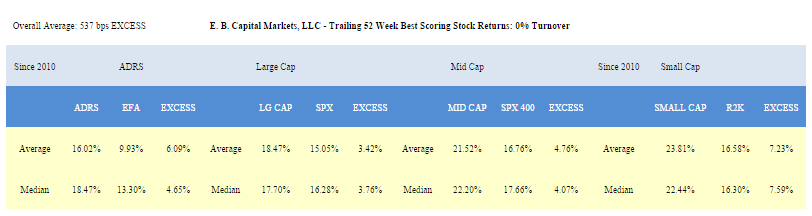

Top scoring weekly returns: Buy and Hold 1 Year

dddd.png)

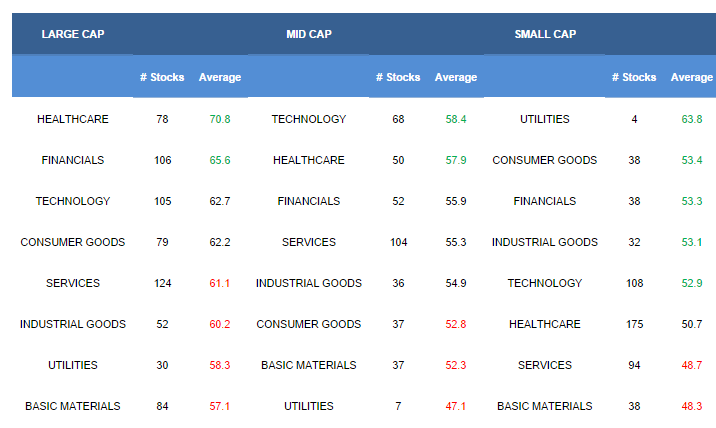

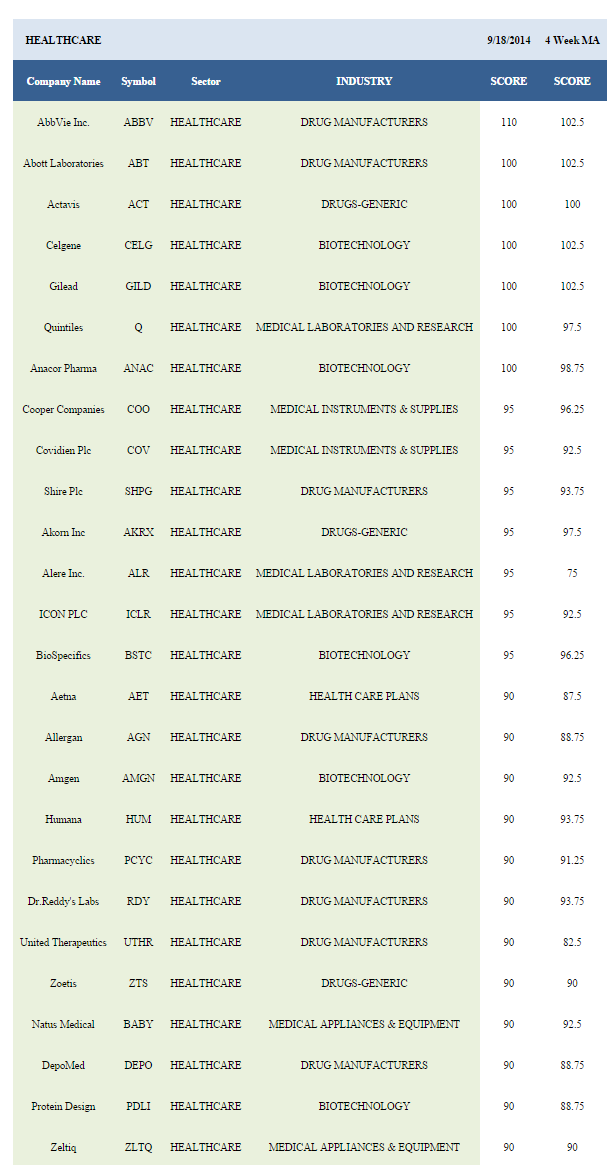

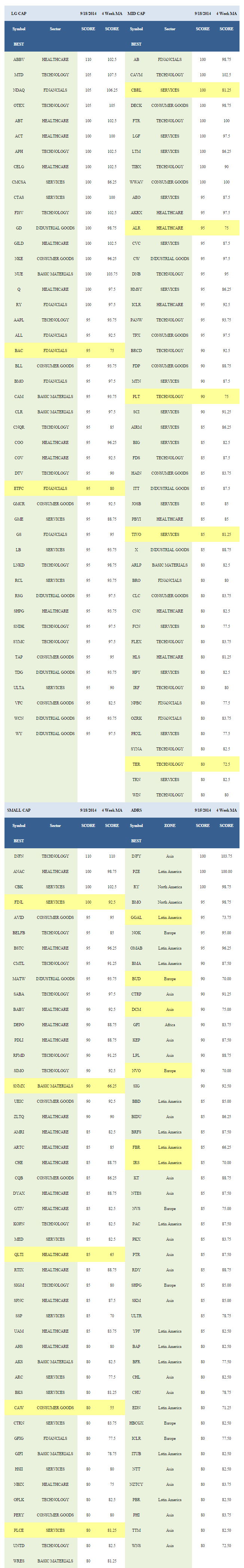

Healthcare is the top scoring sector across our universe. Financials and technology also score above the universe average score. In healthcare, concentrate on large and mid cap stocks.

Utilities, consumer goods, and industrial goods stocks score in line. Utilities are mixed. Typically, managers tend focus more on beta sectors into year end. That suggests sticking only with the best scoring names in the group from here through December. In consumer goods and industrial goods, focus on small cap. Services and basic materials score below average.

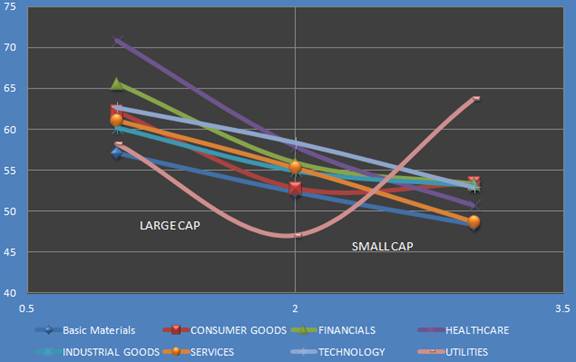

The following chart visualizes score by sector and market cap.

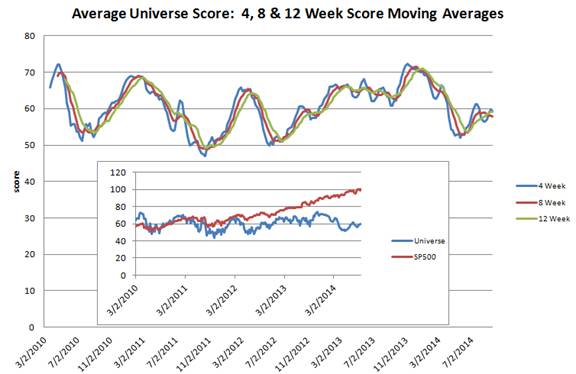

The next chart shows historical four, eight, and 12 week average universe score since 2010.

HEALTHCARE

Biotechnology and pharmaceuticals score highly across our healthcare universe thanks to high price next generation personalized medicine and label expansion opportunity. Increasing insurance enrollment (both private and public) continues to support script volumes. The second open enrollment period begins in November and offers additional opportunity for insurers to improve member mix (skewing younger). As exchange enrollment climbs, expectations improve for 3% to 5% margin. Medicare Advantage and Medicaid enrollment growth also supports earnings and dividend payouts.

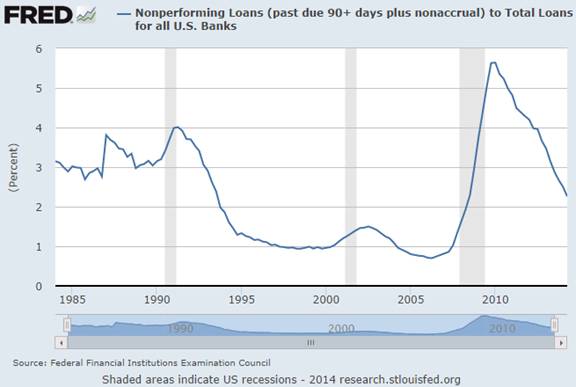

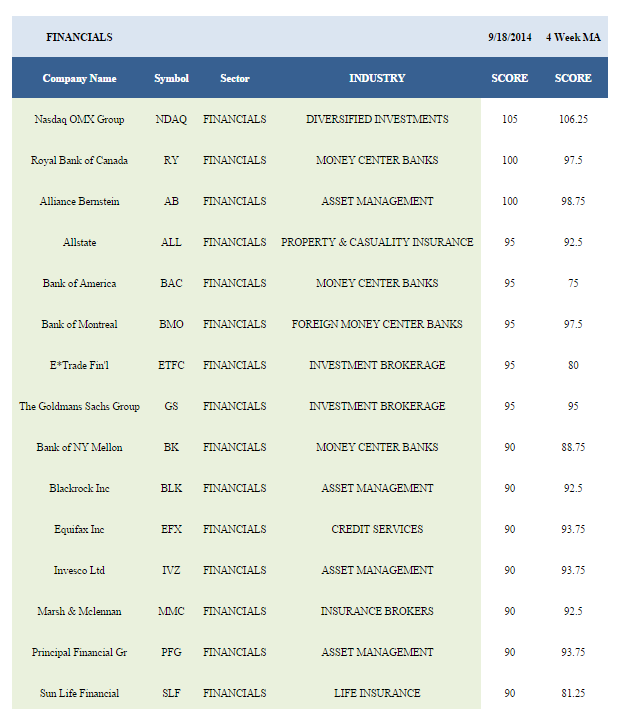

FINANCIALS

The top financials include money center banks and asset managers. Banks continue to benefit from rising loan demand. Commercial and industrial loans reached $1,748 billion in August, up from $1,683 billion in April. Total revolving credit outstanding and securitized totals $880 billion in July, up from $861 billion in March. That loan growth has come as non-performing bank loans continue to decline, hitting 2.26% in the second quarter, down from a peak of 5.6% in 2010.

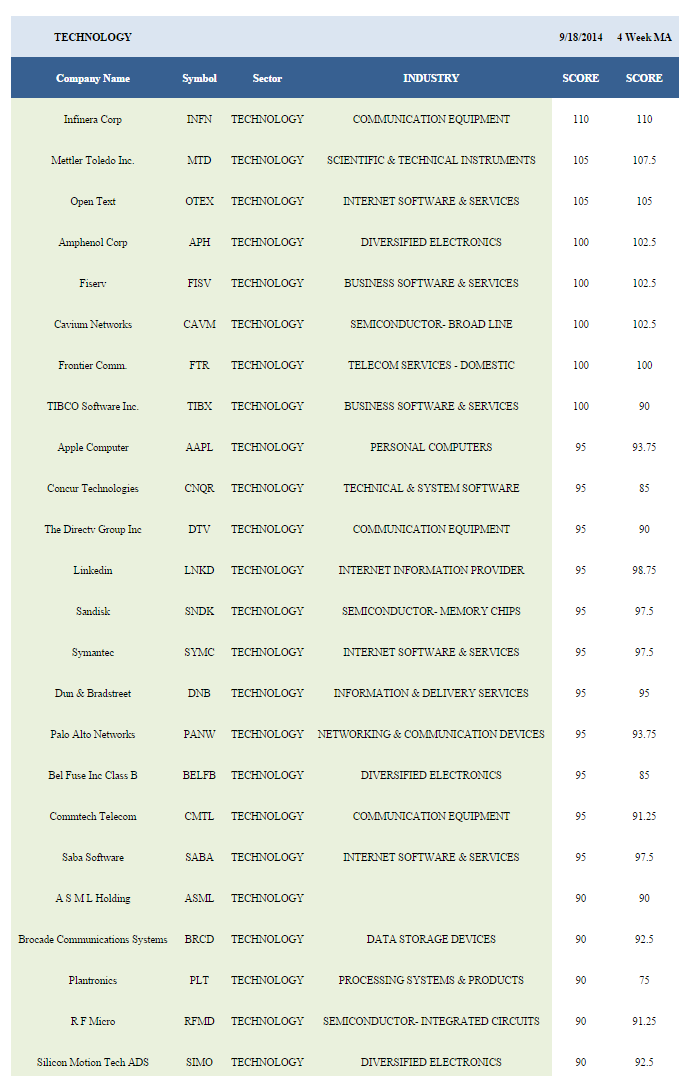

TECHNOLOGY

Software is heavily represented in our best scoring in technology ranking this week. Ongoing electrification and innovation in content creation, delivery, and security continues to support software industry growth, as evidenced by growth in software employment. Since 1990, the number of people employed in the software industry has climbed from less than 800,000 to more than 2.5 million people thanks to industry production growing 7.2% per year. Cloud software-as-a-service demand has continued to expand this year as government spending on SaaS is projected totaling $1.3 billion this fiscal year. IDC expects spending by federal agencies on private cloud services will hit $5.9 billion in 2018, up from $2.3 billion currently.

TOP SCORING

Disclosure: None.