Weekend Report: Best & Worst - August 25, 2014

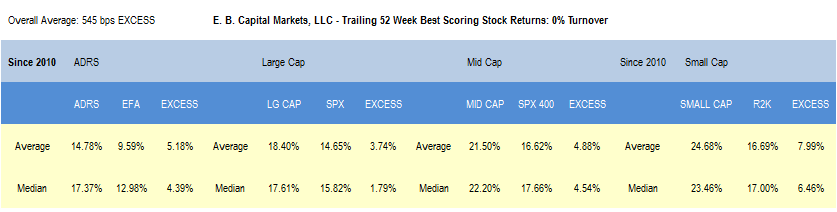

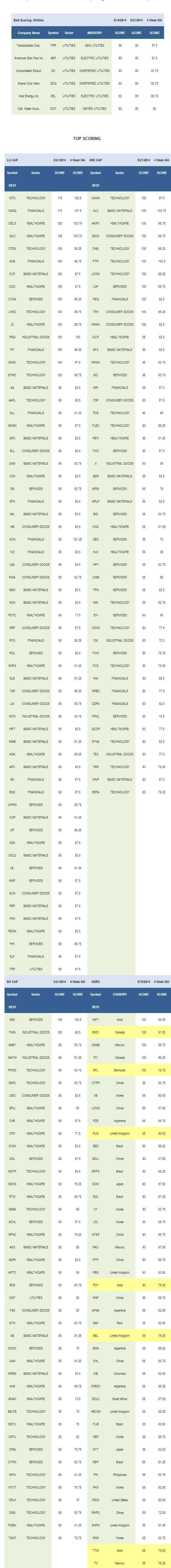

Top scoring weekly returns: Buy and Hold 1 Year

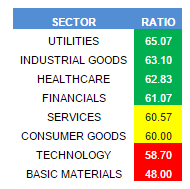

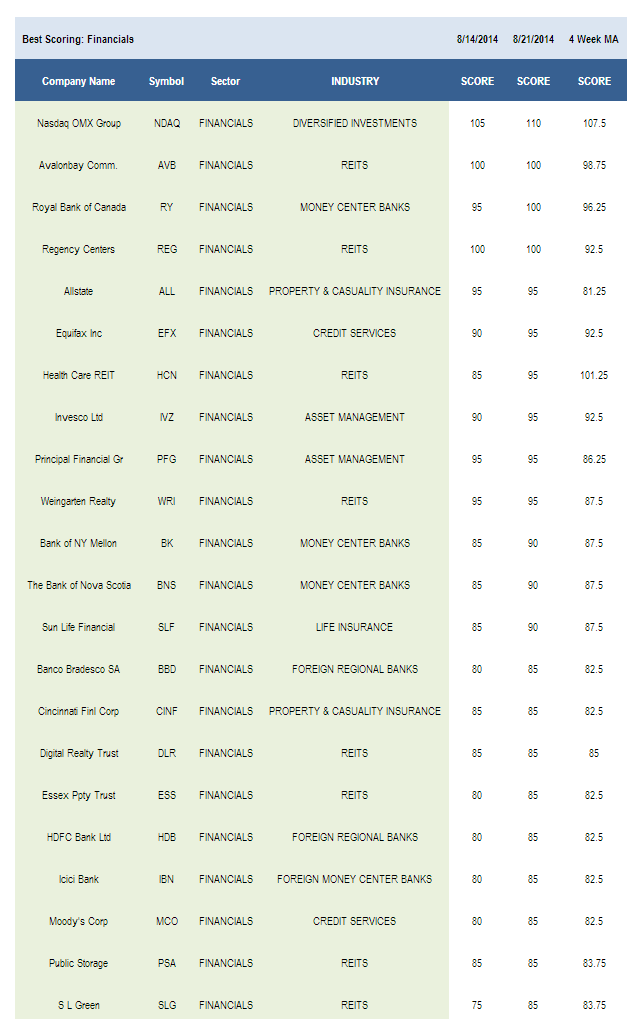

The top scoring sector across our 1,800 stock universe is financials. Healthcare and utilities also score above average this week.

Technology, basic materials, and consumer goods scoer in line. In basic materials, managers should overweight large and mid cap and underweight small cap.

Industrial goods and services score poorly. Retail typically weighs on services through the weak summer shopping season before re-exerting in the fourth quarter for a rally through the first quarter; plan accordingly.

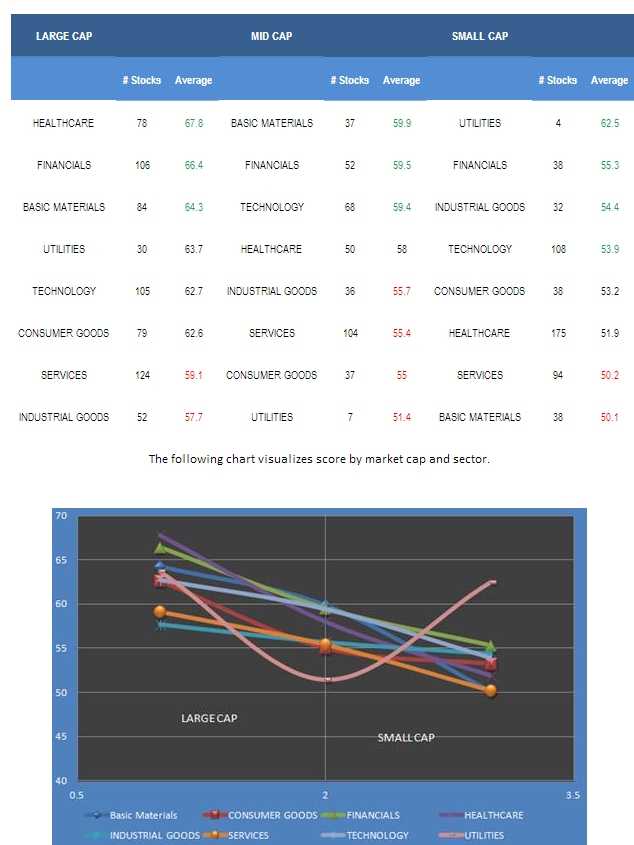

The next chart shows historical four, eight, and 12 week moving average scores since 2010. Typically, a move in the four week moving average above the eight and 12 week moving average supports increasing beta, while a move below suggests reining in risk.

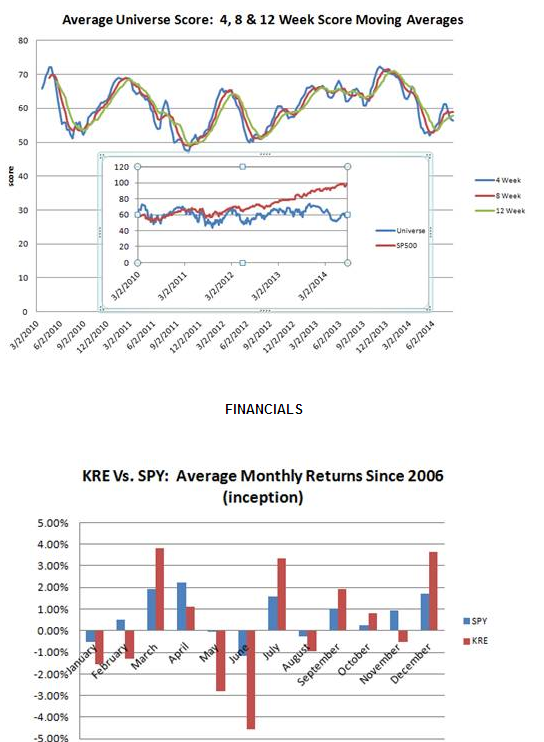

REITs and banks dominate the top scoring across financials. REITs continue to leverage easy-cheap access to capital for new projects and despite these new projects increasing supply, effective rents remain high and support FFO and dividend growth. REITs are usually solid performers through the weak summer months as managers de-risk and this year appears no different.

Bank of America's settlement continues to shift the narrative back to improving loan origination, particularly in commercial and industrial loans. As of July, C&I loans at U.S. commercial banks totaled $1,731 billion, up from $1,561 billion a year ago. As loan volume increases, look for managers to focus less on anemic net interest margin.

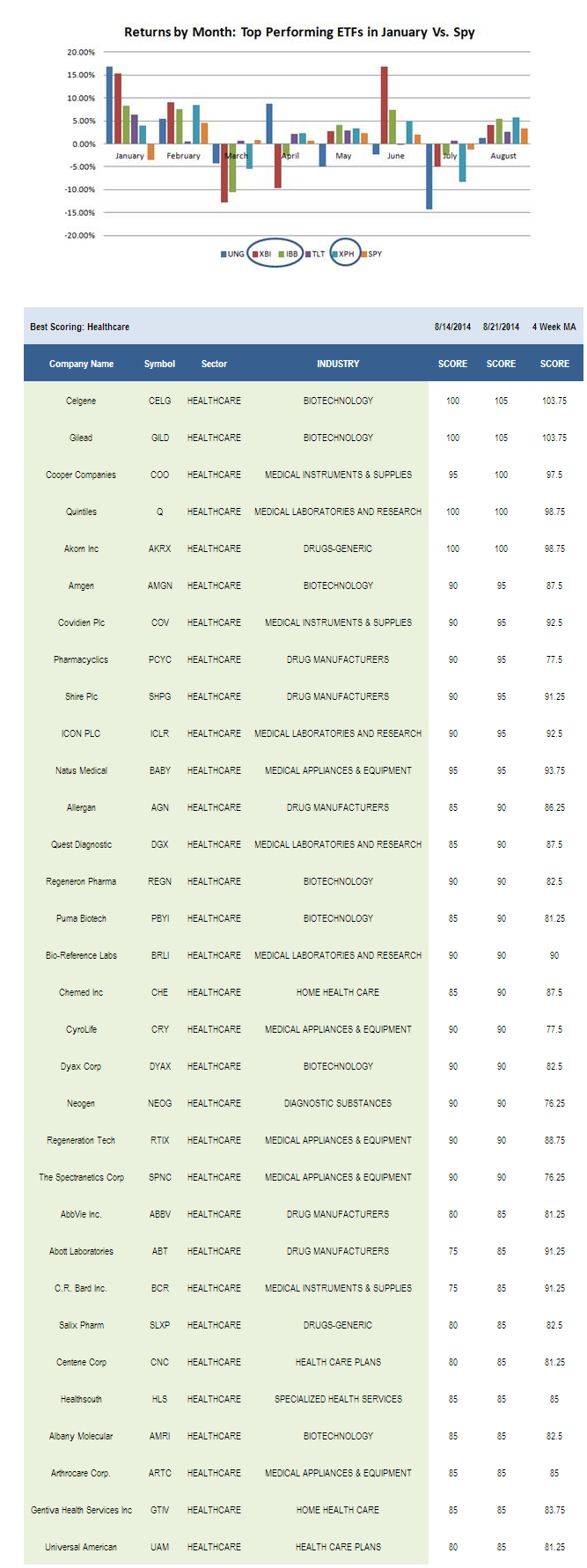

HEALTHCARE

Healthcare stocks were among the top performing baskets in January and the group has cotinued to benefit as managers boost allocations from underweight back to equal weight are reform fear dimishes. With the second open enrollment season looming, managers should expect 2015 price increases to turn exchange plans profitable, with a long-term 3% to 5% margin goal. Biotechnology pricing remains favorable and label expansion offers ongoing revenue opportunity for established therapies.

The following chart shows year-to-date monthly returns for January's top performing ETFs.

UTILITIES

Although utilities remain top scoring, managers should recognize that utilities tend to outperform the broader market in summer, but lag the S&P 500 in the fourth quarter. Reduce exposure to tertiary names and lock in gains/normalize weights.

Disclosure: None.