Week In Review: MJ Highs And Lows, Rising Commodity Prices, Rising Interest Rates, Lower VIX

“Bubble” no longer captures what is going on in financial markets right now. The best I can do at the moment is Post Modern Mass Psychosis @CathieDWood @elonmusk @chamath $SPY $QQQ $IWM $DOGE.X $GME $TSLA

— Top Gun Financial (@TopGunFP) February 8, 2021

In prepositioning myself to be sold to a SPAC I am considering purchasing billions in Bitcoin, investing in EVs, launching rockets to Venus and developing the next generation of on-line payment processing simultaneously - while buying substantial out of the money call options.

— Peter Atwater (@Peter_Atwater) February 10, 2021

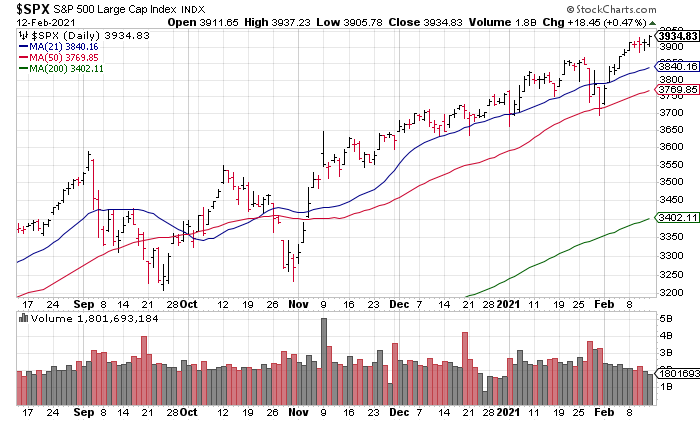

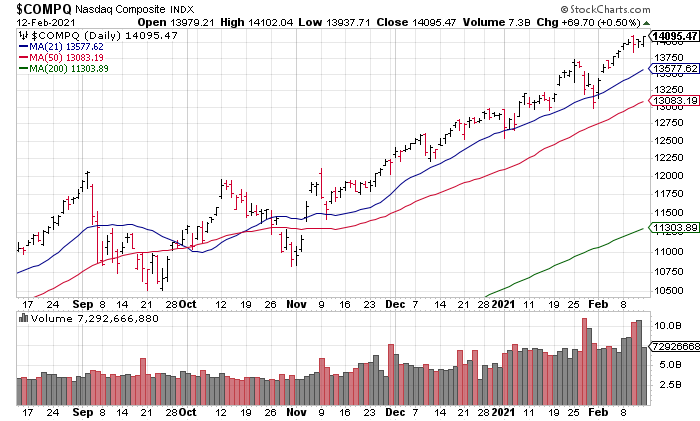

Stocks continued their relentless rise higher last week as the S&P (SPX) rose 1.23% to 3,935, the Nasdaq (COMP) rose 1.72% to 14,095 and the Russell rose (IWM) 2.97% to 2,289 – all new All Time Closing Highs.

The most interesting action last week was in the marijuana stocks. The main Marijuana ETF (MJ) was +42% through Wednesday before falling 26% on Thursday and Friday.

Tuesday.

— Carl Quintanilla (@carlquintanilla) February 11, 2021

Thursday. pic.twitter.com/k2khdOuEGA

The most interesting market commentary I heard came from Josh Brown on CNBC’s Closing Bell Wednesday. Brown said that “valuation is junk science” in the sense that it provides “no signal” for stock direction. Stocks have been expensive for years and have gotten more expensive during the pandemic. But Josh thinks it doesn’t matter: “You throw your dart, I’ll throw mine”.

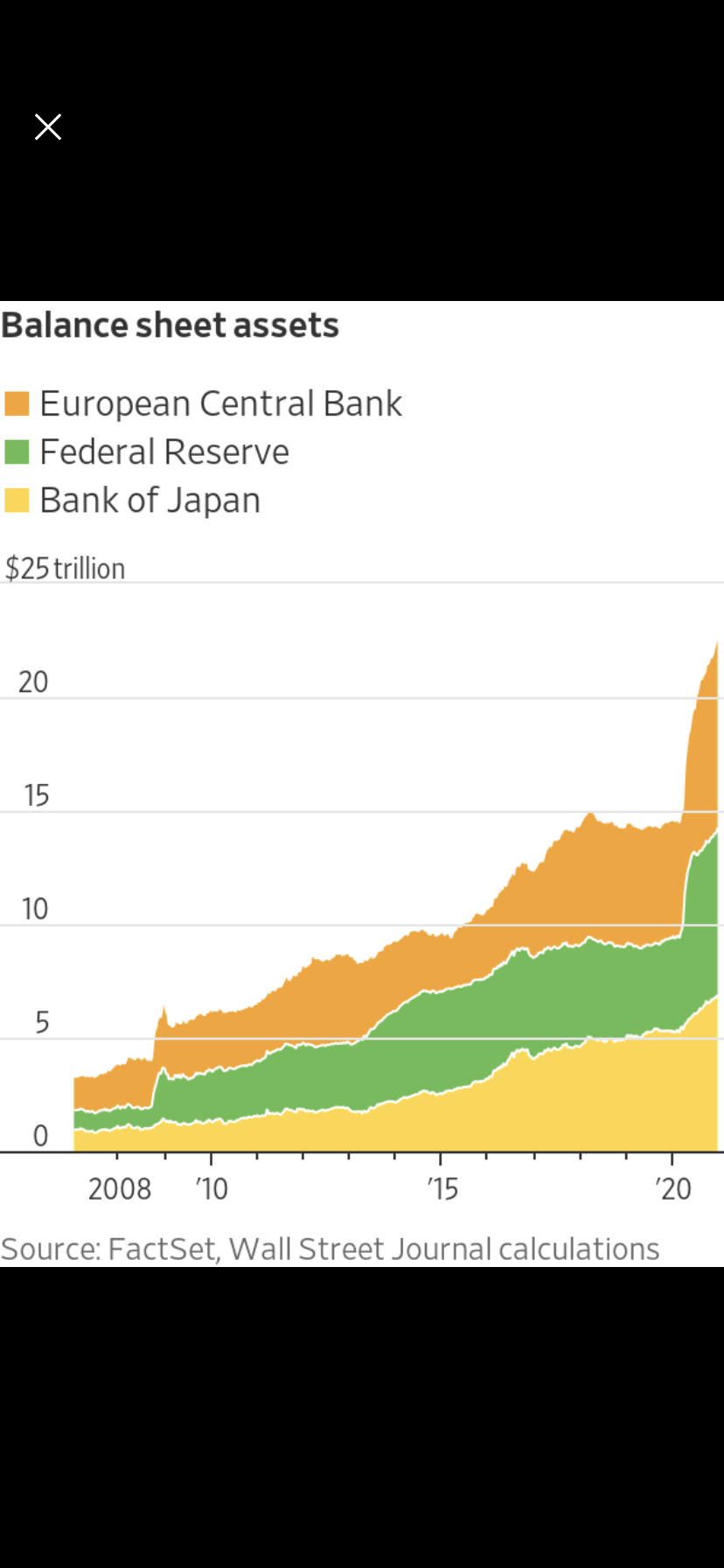

What then are we to base our investment decisions on? Josh talked about how the market had been correctly pricing growth stocks like Salesforce (CRM), Netflix (NFLX) and Tesla (TSLA) at extremely high multiples for years. He also said that “liquidity” is much more important than valuation. Putting it together, it almost seems like Josh is saying to buy the leading stocks at any price as long as the liquidity backdrop is good and hold forever. This is the philosophy espoused regarding The Nifty Fifty in the early 1970s and it didn’t work out very well. It won’t this time either.

The price action is getting The Kiddie Technicians all worked up as well and they are convinced this is just the beginning.

they keep telling me that stocks are in a bubble. I keep telling them that we haven't even broken out yet. boy does that piss them off pic.twitter.com/AKBQ2Z0qG2

— J.C. Parets (@allstarcharts) February 12, 2021

Watching relationships like this unfold in this manner, I'm not convinced we are closer to the end than we are to the beginning... https://t.co/2Iso8fNURL

— Ian McMillan, CMT (@the_chart_life) February 12, 2021

Close enough 🤷♂️ pic.twitter.com/nCcRWlmXQK

— Ryan Patrick Kirlin 🐎 (@RyanPKirlin) February 12, 2021

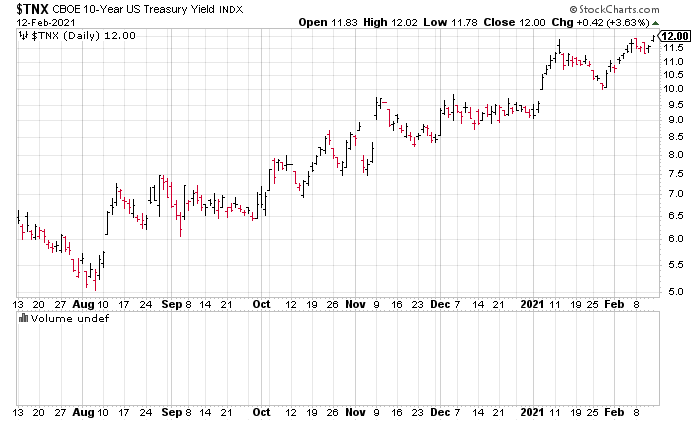

Meanwhile, all the liquidity injected into financial markets over the last 11 months is starting to percolate in other areas of the market besides for stocks. The 10 Year Treasury Yield has risen from just above 0.5% in early August to 1.2% Friday.

This has not been a problem so far for stocks as yields and stock prices have been positively correlated according to Ned Davis Research Strategist Tim Hayes. However, Hayes also said: “If the correlation would return to inversion, it would tell us that the market had started to view rising yields as a threat to economic growth, and in turn corporate profits” (quoted in “The Stock Market Keeps Rising. The Reasons To Be Hopeful Are Also The Reasons To Worry”, Ben Levisohn, The Trader Column, Barron’s, Saturday February 13 [SUBSCRIPTION REQUIRED]).

Liquidity is now also flowing into commodities which is potentially inflationary.

Earlier in the week , Copper broke out of a small continuation pattern. It continues to lead the way for Industrial Metals. $HG_F pic.twitter.com/9B1mLbm10L

— Ian Culley (@IanCulley) February 12, 2021

#Lumber futures all-time highs with cup and handle

— Tarek I. Saab (@FibLines) February 12, 2021

Anyone building a house? #realestate $LBS_F pic.twitter.com/I7GENFxKFO

Lastly, the VIX, known as the fear index, closed below 20 for the first time in almost a year Friday as investors become more and more comfortable with the market environment.

$VIX closing below 20 for the first time since, wait for it: Feb. 21, 2020. pic.twitter.com/9qzF7cTNs4

— Fred Imbert (@foimbert) February 12, 2021

Summing up: Massive global central bank liquidity infusions in the wake of the coronavirus pandemic have created a massive stock market bubble that continues to inflate and is now percolating into other areas of the market like interest rates and commodity prices. This is not real economic growth. It ends when the mass psychological mania this has created breaks but nobody knows when that will be – although the level of speculative excess in recent weeks suggests it is close.