Wednesday, Dec. 19 FOMC Meeting Statement: Federal Funds Rate Increased

The Federal Open Market Committee (FOMC) - the board of directors of the Federal Reserve increased the federal funds rate as expected, and stated:

.... The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term ....

Overall the Fed appears to believe the economy was generally stronger since the last meeting.

Analyst Opinion of the FOMC Meeting Minutes

There is really nothing unexpected in these meeting minutes - and the pundits who believed there would be no raising of the federal funds rate were wrong. The economic projection of the FOMC members is at the end of this post. CoreLogic Chief Economist, Dr. Frank Nothaft, had the following to say:

The Federal Reserve's increase in its federal funds target of 0.25 percentage points, to a target range of 2.25 to 2.5 percent, is consistent with the latest data on labor markets and inflation. The economy has produced an average of 170,000 nonfarm jobs over the September-to-November period, and the unemployment rate has remained at a 49-year low of 3.7 percent. Further, the latest inflation reading for personal consumption expenditures is running at 2 percent (October over October), and 1.8 percent excluding food and energy, consistent with the Fed's long-term inflation goal. The Fed considers monetary policy as accommodative for economic growth and prefers to raise short-term interest rates gradually to reduce the degree of economic stimulus coming from low interest rates. The rise in the federal funds target will increase other short-term interest rates, including those that serve as an index for adjustable-rate mortgages and HELOCs.

The Federal Funds rate was revised up. Econoday consensus forecast was for a quarter point rise in the Federal Funds rate.

08 November Statement |

19 December Statement |

|---|---|

| Information received since the Federal Open Market Committee met in September indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance. | Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance. |

| Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced. | Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. The Committee judges that risks to the economic outlook are roughly balanced, but will continue to monitor global economic and financial developments and assess their implications for the economic outlook. |

| In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 2 to 2-1/4 percent. | In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2‑1/2 percent. |

| In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. | In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. |

| Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles. | Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles. |

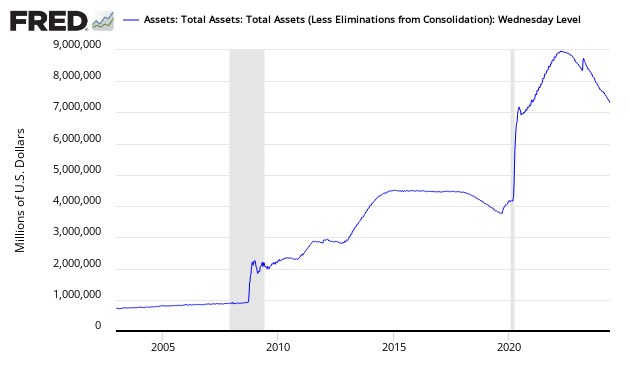

Fed Balance Sheet

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more