We Have A Deal Reportedly

Energy

Out of the window with fundamentals again, and the trade story takes center stage. We have a trade deal, apparently, with President Trump reportedly having 'signed off' on Phase One of the deal, and in doing so, the threat of further tariffs against China on 15 December disappear. Details are still lacking, but unsurprisingly part of the deal reportedly involves China agreeing to buy more US agricultural products. We could see some tariffs on Chinese goods reduced. We still need to wait for an official announcement; however, President Trump did tweet yesterday that they were “Getting VERY close to a BIG DEAL with China.” Unsurprisingly markets have responded very positively to the latest developments, ICE Brent spiked as high as US$64.85/bbl on the back of the news, although finished the day up 0.75%.

Turning back to oil fundamentals, yesterday the IEA released its monthly market report, and it made for less constructive reading. Despite deeper OPEC+ cuts of 2.1MMbbls/d that were agreed last week in Vienna, the IEA still believes that the oil market will remain in surplus of 700Mbbls/d over 1Q20. The agency has revised lower its non-OPEC supply growth for 2020 down from 2.3MMbbls/d to 2.1MMbbls/d. Meanwhile, demand growth estimates for 2019 and 2020 have been left unchanged at 1MMbbls/d and 1.2MMbbls/d respectively. IEA numbers do call into question how much more upside we could see in prices going into 2020, particularly given the fact that it will not take long for the market to focus on the larger surplus that is estimated over 2Q20, in the absence of OPEC+ action.

Metals

The trade developments mentioned above have obviously proved constructive for other parts of the commodities complex, including industrial metals.

Copper pared losses after sinking to US$6,089/t earlier in the day. Gains were also seen in LME Zinc, which closed up 1.85% on the day, whilst LME aluminum settled 0.85% higher for the day at US$1,775/t, despite LME stocks continuing to surge higher. The bulk of this inventory movement has happened at Port Klang in Malaysia, and the swelling in stocks has seen the aluminium cash/3m spread collapse from a backwardation of US$22.75 in early December to a contango of US$13.25/t on Thursday. Even nickel had a strong close, despite also seeing pressure earlier in the day following 7,698t of the metal delivered into LME warehouses - the highest day-on-day increase since 2007. The ShFE market has also largely ignored the stock builds on the LME, with the Chinese market continuing to be bolstered by speculative buying.

Agriculture

The latest export sales data from the USDA shows that net export sales of soybeans for the week ending 5 December totaled 1.18mt, with China the largest known buyer over the week, with 241.6kt of purchases. Total net sales in the week are up from 684kt the week before, and a little over 391kt in the same week last year, and does reflect the stronger buying that we are seeing from China as a result of tariff waivers the Chinese government has provided to buyers.

Turning to corn, and we also saw a pick-up in net export sales over the week. US corn export sales have struggled this year, partly as a result of stronger competition from Brazil. However, in the week ending 5 December, net export sales totaled almost 876kt over the week, up from 548.5kt in the previous week. Mexico made up the bulk of these sales, with the country buying a little over 517kt over the week. Meanwhile in a separate statement yesterday, the USDA said that Mexico purchased 1.6mt of US corn. These stronger demand numbers, along with trade optimism provided a boost for CBOT corn, with it closing almost 2.6% higher yesterday.

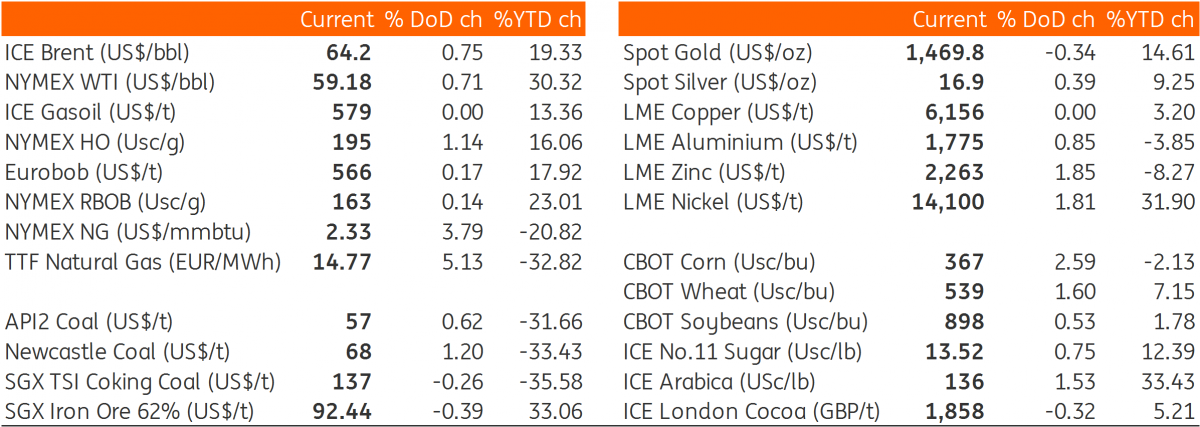

Daily price update

(Click on image to enlarge)

Source: Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more