Was That The Soybean Bottom?

It was another wild ride on Wall Street yesterday. Stocks stumbled hard out of the gate, following the lead of most global markets. By 11:00 am EST, the DJIA was down more than 500 points, had broken below the October lows, and appeared to be heading toward the next important level on the charts - the February lows.

In fact, the S&P 500 wound up testing the closing lows of early February and April. The financials led the way lower as the action in many of the nation's largest banks was horrid. And the transports were busy exploring new lows for the cycle, causing folks to begin talking about the Dow Theory again.

Then came a small bounce, which was immediately tested with another sell program. For a change, the lows of the day held. After half an hour of sideways action, an actual rally ensued that would wind up erasing the day's losses. And by the time the closing bell rang, the major indices sported small gains. So, as I wrote last week, All's Well That Ends Well, Right?

Why The Turn?

The question of the day, of course, is, why did the market turn? Sure, stocks were very oversold and investor sentiment had become dour as just about everybody on the planet was now calling for another big drop in the stock market. Thus, the table was set for the bulls to get back in the game. But, as is usually the case, a trigger was needed to get things moving the other direction.

In this case, the "trigger" appeared to be several headlines, which when combined were enough for the programs to flip from sell to buy, for the shorts to cover, and for traders to jump in for another "ride the range" opportunity.

Although Theresa May's decision to delay the vote on the EU BREXIT deal was one of the major news stories of the day, there were a couple other items that got traders' attention.

On the positive side, there was the news the Facebook (FB ) was going to buy back $9 billion of their shares. With the stock trading nearly 37% below its July high of $217.50, the social media giant apparently believed their shares were a bargain. After all, the stock was back to where it stood in February 2017.

The point here is that during every negative phase in the stock market, the issue of "value" eventually comes into play. The bottom line is after a good shellacking, stocks tend to present decent value plays for the longer term and actual humans decide to jump in.

The other big news came on the trade front. Bloomberg reported mid-day that China would soon announce the resumption of soybean purchases. As usual, details of the purchase weren't complete. However, the key is that the Chinese were making good on one of the big items that came out of the Trump/Xi dinner during the G20 meeting.

More Good News on Trade

This morning, there is more encouraging news on China/U.S. trade negotiations. First, reports indicate there was a high-level conference call with China overnight with Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer representing the U.S. and China's Vice Premier Liu He. The fact that Mnuchin was on the call is being viewed as a positive since he is seen as a dampener to Lighthizer's overly hawkish stance.

Next up, there is a word that China is considering slashing tariffs on U.S. auto imports from 40% to 15%. Recall that Trump had tweeted about the reduction after the meeting in Buenos Aires, but that China had been silent on the subject. So again, movement on China's part here is a good thing.

In response, the President tweeted this morning, "Very productive conversations going on with China! Watch for some important announcements!" I guess we need to stay tuned.

With that, stocks are set to rally at the open with Dow futures up more than 360 points. But, as we've seen lately, the question is where we close, not where we open. Fingers crossed!

Now let's turn to the weekly review of my favorite indicators and market models...

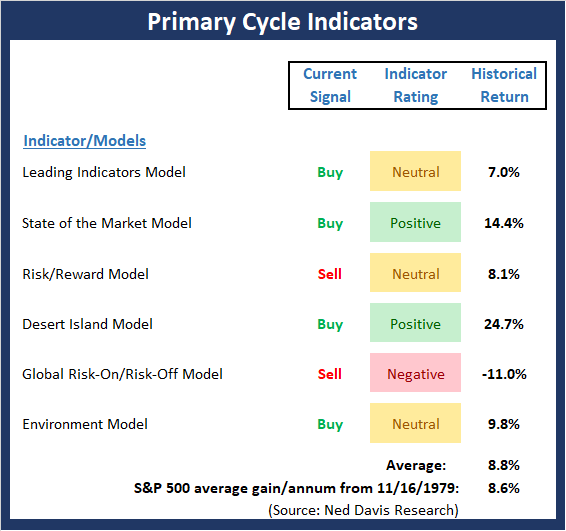

The State of the Big-Picture Market Models

I like to start each week with a review of the state of my favorite big-picture market models, which are designed to help me determine which team is in control of the primary trend.

The Bottom Line:

- There was one minor change to the Primary Cycle board this week. My "Desert Island" model improved a smidge, winding up in the positive zone - by the skinniest of margins. For me, the takeaway here is the historical return is only a bit above the long-term average.

Note: We have added a new model to the Primary Cycle board. Since most big moves in the market tend to be global in scope, we've added a "risk-on/risk-off" model based on global markets. Unfortunately, this indicator remains negative at this time.

This week's mean percentage score of my 6 favorite models declined to 53.6 (from 57.9% - 2 weeks ago: 64.5%) while the median rose to 55% (from 52.5% - 2 weeks ago: 65%).

The State of the Trend

Once I've reviewed the big picture, I then turn to the "state of the trend." These indicators are designed to give us a feel for the overall health of the current short- and intermediate-term trend models.

The Bottom Line:

- Not surprisingly, the Trend board sports a fairly bright shade of red. It is important to note that the Long-Term Trend Model went negative this week. While the model's record as a timing indicator is mixed, the model reading has done a good job in terms of confirming the state of the environment. Finally, from a near-term perspective, there are very important technical levels in play. As such, we need to watch the action very closely here.

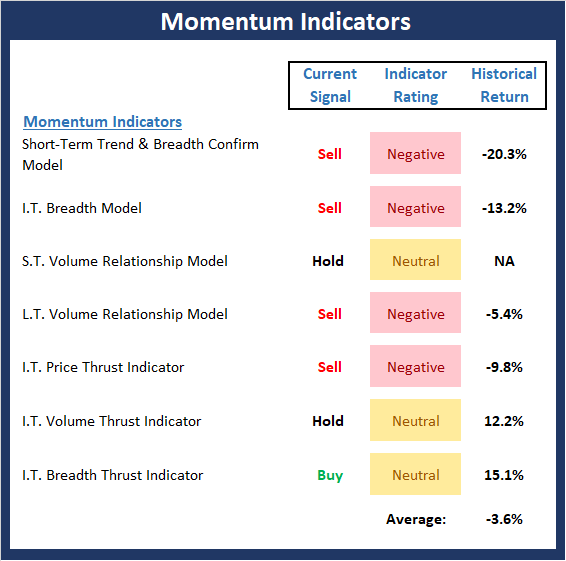

The State of Internal Momentum

Next up are the momentum indicators, which are designed to tell us whether there is any "oomph" behind the current trend.

The Bottom Line:

- After showing some decent improvement in the week prior, the Momentum board went into the tank this week. While the major averages have not broken to new lows for the cycle, this board is clearly flashing a warning that all is not well.

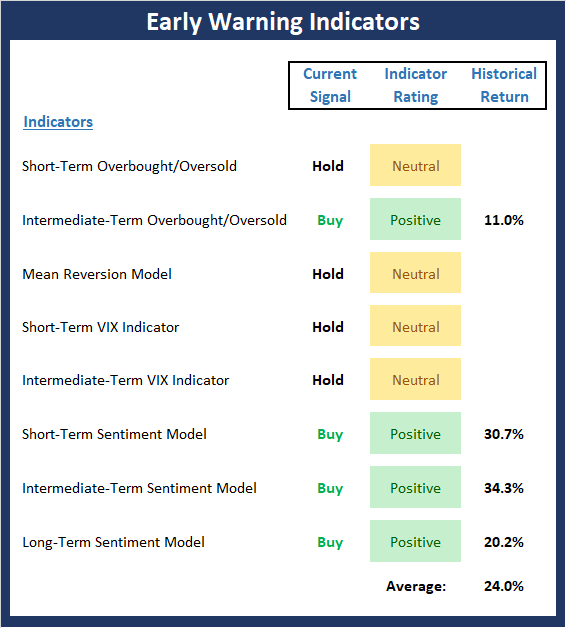

The State of the "Trade"

We also focus each week on the "early warning" board, which is designed to indicate when traders might start to "go the other way" -- for a trade.

The Bottom Line:

- The "Early Warning" board is beginning to sense that the decline is becoming extended. While not flashing a strong buy signal yet, the sentiment indicators are acting like a kid at the back of the class frantically waving his hand that he knows the answer.

The State of the Macro Picture

Now let's move on to the market's "environmental factors" - the indicators designed to tell us the state of the big-picture market drivers including monetary conditions, the economy, inflation, and valuations.

The Bottom Line:

- The External Factors board remains mixed. Monetary and Valuation factors continue to be a problem while the economic and earnings components remain positive. The good news is our inflation model is continuing to move lower, which suggests inflation is not a risk at this time.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more